Solar Chain Review: Is This Blockchain Solar Energy Platform Legit?

Investing in renewable energy is gaining traction, and the Solar Chain blockchain platform (solarchain.energy) promises to blend solar energy with decentralized technology. This Solar Chain review examines its legitimacy, ownership, compensation plan, risks, and potential benefits. We analyze its transparency, ROI claims, security, and public perception to help you decide if this platform is a safe investment in 2025. For more insights into high-risk or emerging blockchain projects, visit Scams Radar.

Table of Contents

What Is the Solar Chain Blockchain Platform?

The Solar Chain platform, operating as a Web3 startup, aims to promote solar photovoltaic (PV) systems in Africa. It claims to offer rent-to-own solar systems and token rewards for energy generation. By integrating blockchain, it seeks to enable peer-to-peer energy trading and provide clean energy solutions for households and SMEs. However, limited transparency raises questions about its credibility.

Ownership and Transparency Concerns

The platform is linked to SolarChain Labs, reportedly founded in 2022 and based in Sangotedo, South Africa, with five employees and a minority stake from MZ Web3 Fund. However, WHOIS data shows the domain uses a privacy service, hiding registrant details. No executive team or verifiable credentials are listed, a stark contrast to transparent projects like Power Ledger, which disclose leadership and registrations. This anonymity is a red flag, as legitimate platforms prioritize openness to build trust.

Compensation Plan and ROI Sustainability

The Solar Chain investment model includes:

- Rent-to-Own Solar Systems: Users pay monthly to own solar equipment.

- Token Rewards: Earn tokens based on energy generation.

- Referral Bonuses: 5–15% for recruiting new users, resembling multi-level marketing (MLM).

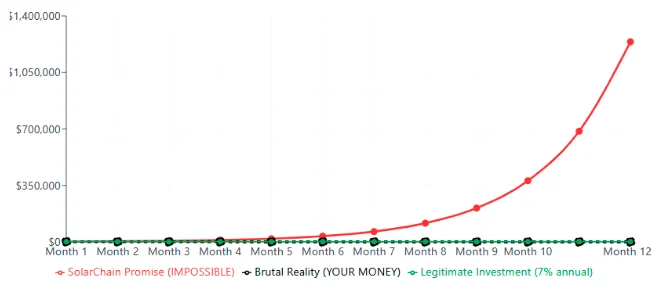

The platform vaguely claims “up to 3% daily” ROI through “solar mining rewards,” equating to 90% monthly or 1,080% annually. Let’s break it down mathematically:

- Assumed 2% Daily ROI:

Using the compound interest formula ( A = P \times (1 + r)^n ), where ( P = $1,000 ), ( r = 0.02 ), ( n = 365 ):

( A = 1000 \times (1.02)^{365} \approx $1,370,000 ) (137,000% annual return).

This requires exponential new deposits, a hallmark of Ponzi schemes. - Sustainability Test:

For 100 investors depositing $1,000 each ($100,000 total), a 2% daily payout equals $2,000/day or $60,000/month. By month six, new deposits must exceed $1.2 million monthly to sustain payouts—an impossible growth rate.

Comparison to Legitimate Investments:

Investment Type | Annual ROI | Risk Level |

Solar Chain (Claimed) | 1,080% | Extreme |

Real Estate (Pakistan) | 8–12% | Moderate |

Bank Fixed Deposit | 6–9% | Low |

Binance Staking (SOL) | 5–12% | High |

The Solar Chain ROI is unsustainable, as no revenue model (e.g., energy trading profits) supports such returns.

Traffic Trends and Public Perception

Traffic data from SimilarWeb shows low visibility (~8,000 visits/month, mostly paid ads), with high bounce rates (~80%) from India, Indonesia, and Nigeria. No credible reviews exist on Trustpilot or SiteJabber, and ScamAdviser rates a related domain (solarchain.io) at 0/100 due to missing SSL and hidden ownership. Social media accounts (@solarchainofficial on TikTok, Instagram, X) lack engagement, and promotions by MLM influencers like “Mr Expert Sid” on Telegram raise suspicions, as they previously shilled defunct scams like SunContract.

Security and Technical Performance

The platform uses basic SSL (Let’s Encrypt) and Cloudflare hosting but lacks advanced security like 2FA, smart contract audits, or penetration testing. No blockchain explorer or GitHub repository verifies its decentralized platform claims. This opacity increases risks of data breaches or fund loss, unlike audited projects like WePower.

Payment Methods and Customer Support

Solar Chain accepts only crypto (BTC, ETH, USDT, SOL), with no fiat options or refund mechanisms. Users report “KYC delays” and high minimum withdrawal thresholds, common in scams. Customer support is limited to WhatsApp, Telegram, and Gmail, with no professional ticketing system, hindering issue resolution.

Content Authenticity and Risks

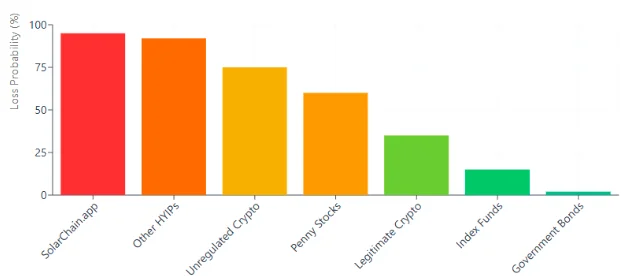

The platform’s claims of distributed solar energy and token rewards lack a whitepaper or audited tokenomics. No proof of solar installations or energy generation exists, and vague marketing resembles HYIP tactics. Key risks include:

- Capital Loss: High probability due to unsustainable payouts.

- No Recourse: Crypto-only payments prevent chargebacks.

- Identity Theft: Unverified platforms may misuse personal data.

DYOR Tool Reports

- ScamAdviser: Flags low trust due to hidden ownership and low traffic.

- WHOIS: Privacy-protected domain, no registrant details.

- VirusTotal: No malware reports, but clean scans are common in early scams.

- Trustpilot: No user reviews, indicating low engagement.

Social Media and Promoter Patterns

Promoters like @CryptoGreenGuru (X) and @SolarCryptoMaster (Telegram) push MLM-style recruitment, previously linked to scams like SolarFarm. Their focus on urgency and unverified testimonials mirrors Ponzi tactics.

Visualizing the Risks

Investment | ROI (%) |

Solar Chain | 1,080 |

Real Estate | 8–12 |

Bank Deposit | 6–9 |

Binance Staking | 5–12 |

Note: Solar Chain’s claimed ROI is 100–200 times higher than legitimate options, signaling unsustainability.

Future Outlook

Without transparency or audited operations, Solar Chain risks collapse within 6–18 months, following the typical HYIP lifecycle: aggressive recruitment, initial payouts, withdrawal delays, and shutdown. Regulatory scrutiny, like that faced by OneCoin, is likely if it grows.

Recommendations for Investors

- Avoid Investment: Lack of transparency and unsustainable ROI make Solar Chain high-risk.

- Use Regulated Platforms: Choose Binance, Coinbase, or Power Ledger for safer crypto/energy investments.

- Enable Security: Use 2FA and secure wallets if engaging with unverified platforms.

- Report Issues: Contact SEC (sec.gov) or FTC (ftc.gov) for suspicious activity.

- Verify Claims: Use ScamAdviser, WHOIS, and SimilarWeb to check legitimacy.

Solar Chain Review Conclusion

This Solar Chain review highlights significant risks in its blockchain solar energy platform. Anonymous ownership, unsustainable ROI, and lack of transparency suggest a potential Ponzi scheme. Investors should prioritize regulated, transparent alternatives and conduct thorough research. The platform’s promises of high returns and green energy innovation are appealing but lack verifiable evidence, making it an unsafe choice for 2025. For a deeper comparison, check out our TARGlobal Review which exposes similar warning signs.

DYOR Disclaimer: This Solar Chain review is for informational purposes only and not financial advice. Always do your own research (DYOR) before investing. Verify ownership, regulatory compliance, and user reviews, and consult licensed financial advisors to ensure safe decisions.

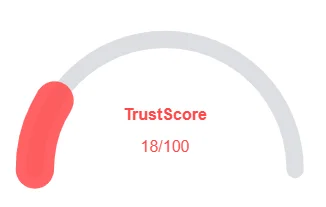

Solar Chain Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Solar Chain shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Solar Chain or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website is fully accessible

- Content is grammatically correct and error-free

Negative Highlights

- AI-generated review score is low

- WHOIS information is not publicly available

Frequently Asked Questions About Solar Chain Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Solar Chain (solarchain.energy) claims to integrate blockchain with solar energy by tokenizing renewable energy production and offering potential investment rewards.

Solar Chain raises questions about its legitimacy due to vague ownership details, lack of regulatory filings, and unverified ROI claims.

Solar Chain implies high returns through its energy-token model, but it provides no audited proof of profitability, making the ROI claims risky.

Currently, there are no credible third-party reviews on platforms like Trustpilot or Reddit, which limits public insight into real user experiences.

Solar Chain is listed on Scams Radar due to its unverified ROI promises, hidden business structure, and potential red flags tied to high-risk blockchain investments.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.