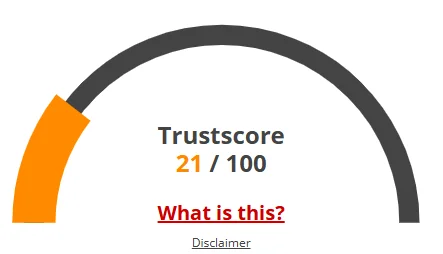

A website’s trust score is a crucial indicator of its dependability. HitzCash’s extremely poor rating raises serious doubts about its legitimacy. When utilising this service, users are recommended to use extreme caution.

The following are important red flags: low website traffic, bad user reviews, possible phishing dangers, ambiguous hosting information, undisclosed ownership, and inadequate SSL protection.

There is a far higher chance of fraud, data breaches, or other questionable activity when the trust score is so low. These elements must be carefully checked before implementing HitzCash or any other platform.