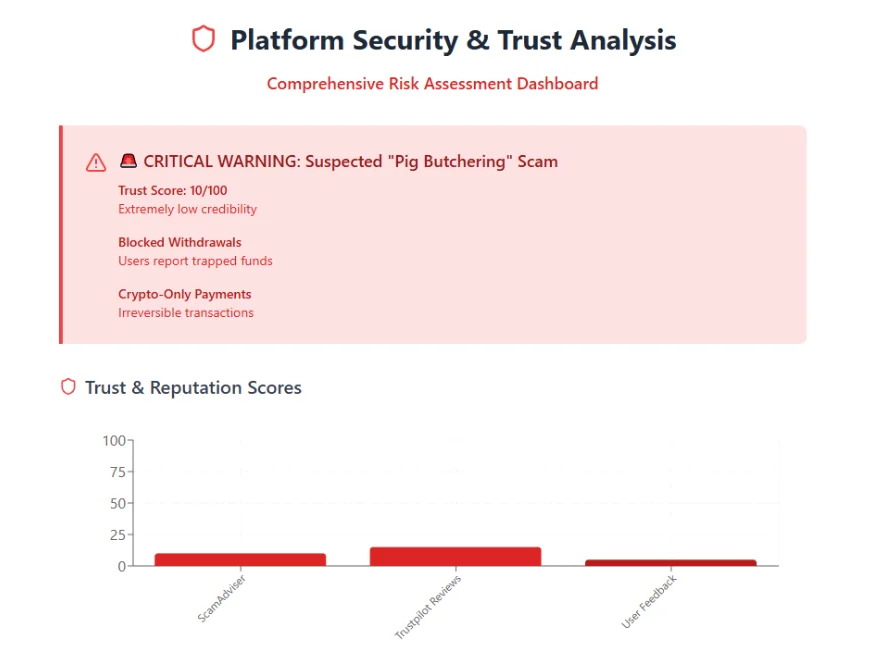

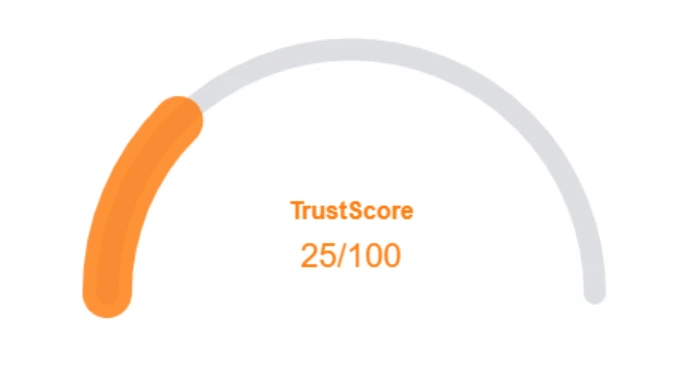

A website’s trust score plays a critical role in determining its credibility. AlphaBlock has raised red flags due to its alarmingly low score, urging users to proceed with extreme caution.

Key issues include low traffic, negative user feedback, signs of phishing behavior, unclear ownership, vague hosting information, and weak SSL security.

Such a low trust score increases the chances of scams, data breaches, or other suspicious activities. It’s essential to thoroughly evaluate these factors before engaging with the AlphaBlock platform or similar services.