The Synthelix review examines the platform’s legitimacy, ownership, compensation plan, and risks. DePIN is marketed as an AI-powered network that promises high returns. Transparency issues and unsustainable returns, however, raise concerns. There is a lack of clear information about the platform’s operations and founders. It is important to approach the promise of high returns with caution due to the potential risk to investors.

Synthelix is a platform that supports decentralized infrastructure using AI and Web3. This company offers Syn GPT, Synthelix Pad, and PRISM with an AI companion named Jessie. By using the DePIN ecosystem, users earn tokenized rewards. However, vague metrics and operations in this Synthelix review raise doubts.

There is no clear indication of who owns the property, which raises red flags:

Platform | Registration | WHOIS Visibility |

Synthelix | Unverified | Hidden |

Binance | Verified | Public |

Kraken | Verified | Public |

Conclusion: Anonymous ownership signals high risk for investors.

The platform’s compensation plan includes:

Synthelix suggests up to 40% annual returns, but calculations show issues:

ROI Comparison

Investment Type | Annual ROI | Risk Level |

Synthelix | Up to 40%* | High |

Real Estate | 6–10% | Low |

Bank Deposits | 3–5% | Very Low |

Crypto Staking | 5–15% | Medium |

The information provided in this Synthelix review is for informational purposes only. It is important to understand that cryptocurrency investments are risky. Before making an investment, you should conduct your own research and consult with a professional.

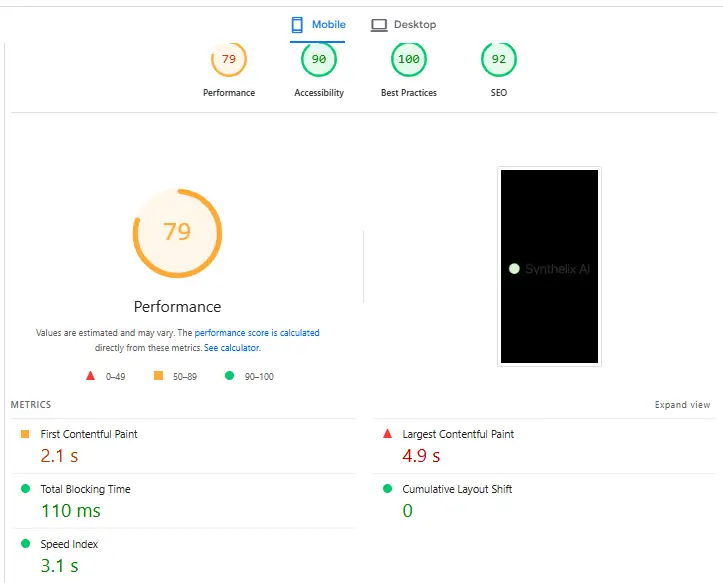

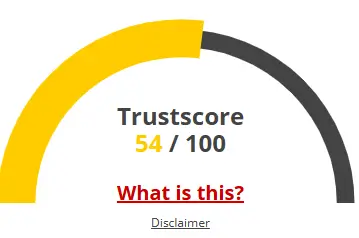

Trust scores are the only factor that determines whether a website is trustworthy or not, so it is likely to be a scam. When using this website, we ask you to exercise caution as much as possible. This Synthelix AI website analyzes ownership, location, popularity, user reviews, bogus items, threats, and phishing attacks.

These are some answers to some of the most frequently asked questions (FAQs) regarding the Synthelix legitimacy report. In order to clarify any concerns you may have, we have compiled a list of questions and answers below:

The Synthelix platform offers tokenized rewards powered by AI. As a result of this analysis, it is flagged as a high-risk entity due to its unknown ownership and unaudited contracts.

The user earns through tasks, node contributions, staking, and airdrops. There are concerns about sustainability, however, due to unclear revenue sources and high fees.

Team details or corporate registration are not provided, and WHOIS data is hidden. There is a potential fraud risk associated with this lack of clarity.

The Synthelix Report reveals no security audits, crypto-only payments, and promoter links to scams, making it a risky investment.

The lack of transparency and verified returns on Synthelix makes it less risk-friendly for investors than audited platforms like Binance.

Title: Synthelix AI

There are no reviews yet. Be the first one to write one.