10fifteen Review: Is This Investment Platform Legit or a Risky Scam?

This 10fifteen review on Scams Radar examines the legitimacy of 10fifteen.com, a high-yield investment platform claiming 3–10% daily returns through AI-driven crypto trading. Launched in 2025, the platform raises concerns due to unrealistic ROI promises, opaque ownership, and potential security risks. Our analysis covers ownership, compensation plans, traffic trends, public perception, security, payment methods, and overall sustainability. Using clear data, charts, and simple language, we provide actionable insights for potential investors seeking transparency and safety. Always conduct your own research (DYOR) before investing.

Table of Contents

Ownership and Background

The platform operates under Ten Fifteen Solutions LTD, registered in the UK (company number 16491960) on June 3, 2025. Its address is 39-41 New Bedford Road, Luton, England, LU1 1SE. However, the registration is recent, and the address appears to be a virtual office. No team members or directors are listed, and WHOIS data shows privacy protection via WhoisGuard. The Terms page references “Dutch law,” conflicting with UK incorporation. Legitimate platforms like Coinbase disclose leadership and regulatory details.

- Red Flags:

- Anonymous ownership with no verifiable team.

- Recent registration (less than 6 months old).

- Inconsistent legal jurisdiction claims.

- Anonymous ownership with no verifiable team.

Compensation Plan Details

The 10fifteen platform offers multiple investment plans:

- Plan 1: 10% daily for 15 business days (150% total, 50% net profit, principal included).

- Plan 2: 3–7% daily for 25 business days (125% total, principal included).

- Plan 3: 1.25% daily for 16 business days (120% total, principal returned).

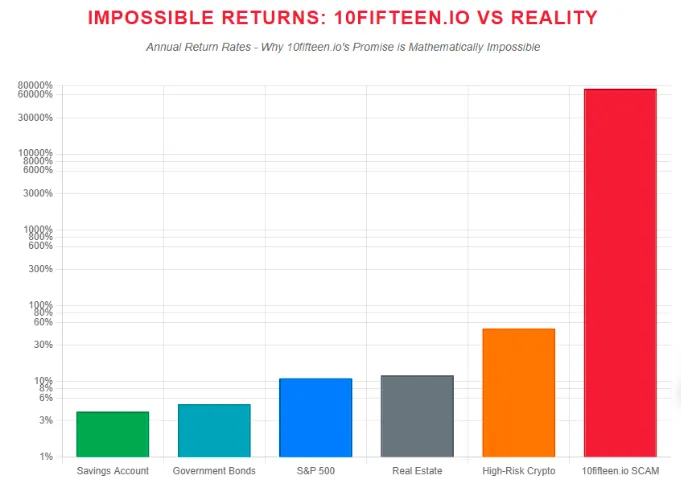

Investment Type | Annual ROI | 15-Day ROI | Risk Level |

10fifteen | ~199,000% | 50–150% | Extreme |

Real Estate | 7–10% | 0.3–0.5% | Low–Medium |

Bank Savings | 4–6% | 0.2–0.3% | Very Low |

Crypto Staking | 3–20% | 0.1–0.8% | Medium–High |

Security and Technical Performance

The platform uses basic HTTPS with a Let’s Encrypt SSL certificate. It lacks two-factor authentication (2FA), KYC, or cold storage details. The Terms admit blockchain vulnerabilities and irreversible transactions. Hosting is on your-server.de (Hetzner, EU), but no uptime or performance data is available. Legitimate platforms like Binance offer robust security and transparency.

- Red Flags:

- Basic security with no advanced protections.

- No regulatory compliance (e.g., FCA authorization).

- Potential for withdrawal delays (manual, within 48 hours).

- Basic security with no advanced protections.

Payment Methods and Support

Deposits and withdrawals use BTC, LTC, and TRX, with a $15 minimum deposit, $5 minimum withdrawal, and 1.99% withdrawal fee. No fiat or KYC is mentioned, raising fraud risks. Support is limited to email (support@10fifteen.io) and a Telegram channel (@tenfifteenio, ~734 subscribers). Legitimate platforms offer diverse payments and responsive support.

- Red Flags:

- Crypto-only payments enable anonymity.

- Limited support channels reduce accountability.

- Crypto-only payments enable anonymity.

Public Perception and Promotions

HYIP monitors like Invest-Tracing.org list 10fifteen as “paying” but report delays (last payout 8 days ago). Scamdoc (25% trust score) and Gridinsoft flag it as suspicious. No mainstream reviews exist on Trustpilot or Reddit. Promoters like @allmonitors24_ on X and Telemetr’s “IncomeGrowth” channel also push other HYIPs (e.g., Qubex, AITIMART), suggesting a pattern of short-lived schemes.

- Red Flags:

- Reliance on HYIP monitors, not organic reviews.

- Promoters linked to other risky platforms.

- Reliance on HYIP monitors, not organic reviews.

Risk Assessment

The platform’s 10% daily returns are mathematically unsustainable, requiring exponential new deposits. Its short history (launched May–June 2025), anonymous ownership, and lack of regulation mirror Ponzi schemes. Early payouts may occur, but collapse is likely within 3–6 months.

![HYIP Lifecycle Graph] Line graph showing typical HYIP phases: Hype (1–3 months), Delays (3–6 months), Collapse (6+ months)

Recommendations

- Avoid Investment: The 10fifteen investment platform carries extreme risks due to unrealistic returns and no regulation.

- Withdraw Early: If invested, attempt small withdrawals and document transactions.

- Choose Regulated Options: Use platforms like Coinbase or Vanguard for safer investments.

- Verify with Tools: Check ScamAdviser, WHOIS, and FCA registers before investing.

- Report Issues: Contact authorities if you suspect fraud.

DYOR Disclaimer

This 10fifteen review is for informational purposes only, not financial advice. Always verify platform legitimacy with regulators like the FCA and use tools like Scamdoc. Investments carry risks, and high returns often signal fraud. Consult a financial advisor before investing.

10fifteen Review Conclusion

This 10fifteen review highlights critical risks in the 10fifteen investment platform. Its 3–10% daily returns, anonymous ownership, and lack of regulation suggest a Ponzi-like scheme. Compared to real estate, bank savings, or crypto staking, its ROI is unsustainable. Investors should avoid this platform and prioritize regulated, transparent options to protect their funds.

For further insights into similar high-risk platforms, check out our detailed ESVCAP Review, which also exposes unrealistic ROI promises and lack of transparency.

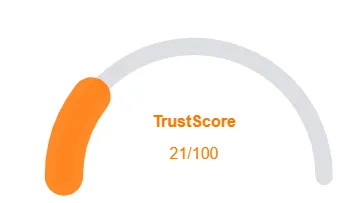

10fifteen Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 10fifteen currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with 10fifteen similar platforms.

Positive Highlights

- Content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS

Frequently Asked Questions About 10fifteen Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

10fifteen is a high-yield investment platform claiming 3–10% daily returns via AI-driven crypto trading. Our review examines if these promises are real or risky.

While 10fifteen promises big profits, our analysis highlights ownership opacity, security concerns, and unsustainable ROI, signaling caution.

10fifteen says it uses AI-powered crypto trading strategies. Our review investigates whether these high returns are mathematically feasible or a potential scam.

Risks include unrealistic daily profits, hidden ownership, limited transparency, and potential exposure to HYIP-related fraud.

Our 10fifteen Review recommends caution. Verify claims, conduct your own research, and consider safer investment alternatives before engaging with 10fifteen.com.

Other Infromation:

Website: 10fifteen.io

Reviews:

There are no reviews yet. Be the first one to write one.