On November 22, 2025, Luiz Goes, former CEO of LyoPay and a key figure in WeWe Global, emailed a site requesting the removal of his name and photo from articles linking him to the WeWe Global Ponzi scheme, per the user’s query. Goes claimed he was a contracted technical employee at VAI Marketing Management in Dubai, unaware of fraudulent activities among clients like WeWe Global, Xera Pro, and Homnifi, per. He denied involvement in pyramid schemes, asserting he focused solely on fintech and blockchain development, and cited a decripto.com removal as precedent. In follow-up emails, Goes reiterated the “I knew nothing” defense, blaming Alessio Vinassa and Diego as the true operators.

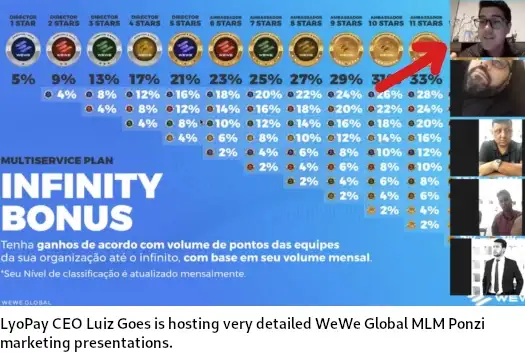

WeWe Global emerged in 2021 as a Dubai-based MLM crypto Ponzi, promising returns via WEWEX points, collapsing in early 2022, per. Rebooted with LyoFI and LyoPay, it introduced Ponzi tokens under Goes’ public-facing role as CEO, featuring in marketing webinars, per. The scheme collapsed thrice more, with the third in August 2023, per. Goes fronted the fourth reboot as The Blockchain Era in September 2023, collapsing in January 2024, and a fifth as Xera in 2024, per. New Zealand’s FMA issued fraud warnings in February 2023.

Goes accuses Alessio Vinassa, majority shareholder of VAI Marketing Management, of owning and running WeWe Global, per. Vinassa, an Italian crypto promoter based in Dubai, is linked to Inti Gold Global and Dianesis Consulting Limited, per. Post-WeWe, Vinassa founded BlockTech Group, a vague blockchain-AI firm with no verifiable operations, per. Goes claims Vinassa and Diego (likely Diego Endrizzi, head of global sales) remain wealthy while he faces reputational damage, per. This shifts blame, but Goes’s fronting of reboots implicates him in conspiracy to commit wire fraud and securities fraud.

Goes’ defense lacks credibility, as FMA warnings predated his involvement, per. His role in marketing and reboots suggests liability, similar to Nestor Nunez (Forcount), extradited and sentenced to four years in 2024 for conspiracy. SEC and DOJ probes into similar schemes could extend to WeWe, per. X posts from @CryptoLawyerz urge reporting to the FBI, SEC, and CONSOB, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, per CoinMarketCap, but WeWe’s fallout erodes MLM crypto trust.

Promoters should review contracts for payout rights and consult lawyers on withheld earnings, per. Verify schemes via sec.gov or fma.govt.nz. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. We’s pattern may lead to arrests by 2026, but Goes’ claims highlight internal rifts in Ponzi networks.