Germany’s Federal Financial Supervisory Authority (BaFin) issued a securities fraud warning against WeFi on February 3, 2026, targeting the website wefi.co for offering unauthorized banking and cryptocurrency services. BaFin highlighted DeFi staking and other financial products provided without required licenses, noting promotional events in Germany, per. The warning names entities Wefi Payments Limited (Canada), SRL (Costa Rica), Nordpal Holding Limited, and Quantum Capital Holdings Limited (Hong Kong). This aligns with BaFin’s ongoing crackdown on unlicensed crypto platforms, similar to recent alerts against Cryptex and Avlitex.

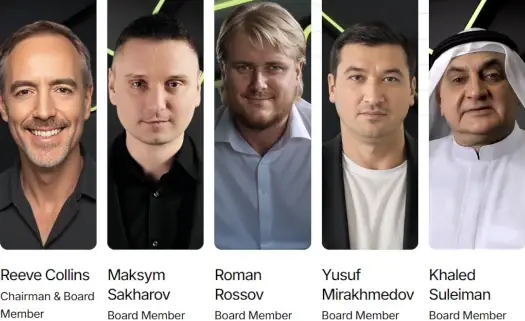

WeFi, an unregistered MLM crypto investment scheme, operates primarily from Dubai but routes through Costa Rica and Hong Kong shell companies to obscure origins. Fronted by Reeve Collins, former Tether CEO, the scheme involves Maksym Sakharov and Roman Rossov (Ukrainian promoters), Khaled Suleiman (financier), and Yusuf Mirakhmedov (fugitive), per. WeFi’s model relies on recruitment-driven returns, typical of Ponzi schemes, per. As of December 2025, SimilarWeb tracked 407,000 monthly visits, with top traffic from France (28%), the U.S. (23%), Italy (19%), Japan (9%), and Germany (5%).

BaFin’s action reflects increasing scrutiny on MLM crypto schemes, following Austria’s Cryptex warning and Texas’s GSPartners negotiations, per. WeFi’s unauthorized offerings violate the German Securities Trading Act, risking investor losses, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, per CoinMarketCap, but WeFi’s exposure could erode DeFi trust, per. Investors should verify platforms via bafin.de or sec.gov, per. BaFin’s database confirms that WeFi lacks authorization.

WeFi’s warning underscores MLM and crypto fraud risks, per. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for regulatory updates. BaFin’s proactive stance may inspire EU-wide measures, reducing fraud but highlighting the need for licensed platforms.