On January 25, 2026, Vyb promoters were informed that the company was merging into Connective, the rebooted version of iGenius, effectively collapsing Vyb’s operations, per industry reports. Launched in early 2025 by Aundray Russell and Ragan and Megan Lynch as a pump-and-dump pyramid scheme, Vyb relaunched in May with a revised compensation plan but failed to generate meaningful retail revenue, per. By December 2025, Vyb’s website traffic plummeted to ~6,100 monthly visits, signalling a collapse, according to SimilarWeb data. The merger positions David Imonitie as a key figure, leveraging his Investview ties, per webinar recordings.

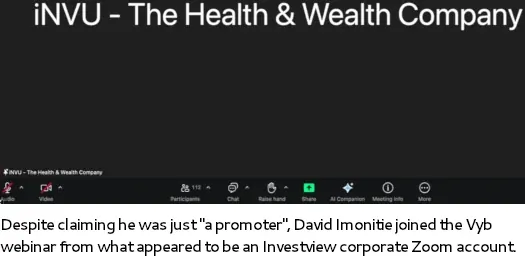

During the January 25 webinar, Imonitie, appearing under an Investview Zoom account, pitched Connective to Vyb promoters, emphasising Organo Gold and iMarketsLive success without mentioning the FTC’s $1.2B fraud lawsuit against iMarketsLive owners in May 2025, per. Imonitie focused on acquiring Investview shares, targeting 50M shares for personal gain, while promising promoters $8–10K/month through recruitment-focused strategies, per. No mention of retail customers or commissions underscored pyramid scheme concerns, mirroring iGenius’ recent $4M pyramid fraud fine in Poland.

Connective represents iGenius’ pivot to diamonds and health supplements, following Investview’s acquisition of Imonitie’s Nvisionu in December 2025, per. Ragan and Megan Lynch appear to have secured positions under Imonitie, while Aundray Russell has shifted to promoting Akashx, per social media. iGenius’ transition, announced amid the Poland fine, has drawn promoter backlash, per. X posts from @MLMTruth highlight Connective as a continuation of pyramid tactics, per. Investview (INVU) shares remain volatile, with no significant uplift from the merger, according to Yahoo Finance.

Vyb’s collapse into Connective exemplifies MLM pyramid risks, with no retail focus driving sustainability, per. Investors should avoid recruitment-heavy schemes and verify opportunities via sec.gov or bcsc.bc.ca, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain unaffected, per CoinMarketCap, but MLM fraud erodes trust in crypto-adjacent models, per. Diversify into regulated assets like BTC or USDC with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. Connective may face SEC scrutiny similar to GSPartners or Forsage, per, urging caution in 2026.