In recent times, numerous online investment platforms have emerged, promising attractive financial returns. One such platform, Vextor.trade, claims to offer lucrative daily profits through cryptocurrency trading. However, potential investors must carefully assess such opportunities to avoid fraudulent schemes. This detailed Vextor.trade review evaluates Vextor.trade’s legitimacy by examining critical aspects such as ownership, compensation plan, sustainability, security, public perception, and investment risk, presented clearly and understandably for everyday investors.

Transparency in ownership is essential for trustworthiness.

Domain Registration:

Owner Profiles:

Red Flag: Concealed ownership details suggest a high risk of accountability avoidance.

Vextor.trade claims extraordinarily high daily returns, commonly seen in risky investment programs.

Hypothetical Compensation Plan:

Referral bonuses offered, likely to incentivize new investor recruitment.

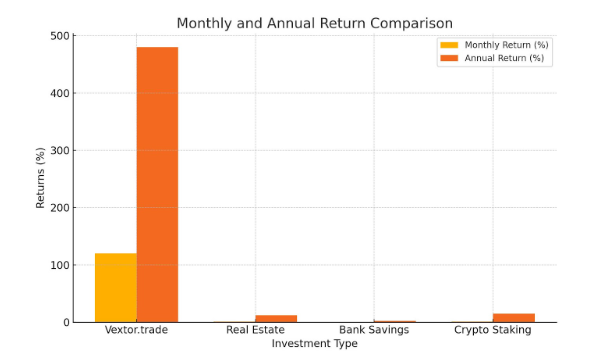

Investment Type | Monthly Return | Annual Return |

Vextor.trade | 120% | 480%+ |

Real Estate | 0.67% – 1% | 8% – 12% |

Bank Savings | 0.04% – 0.17% | 0.5% – 2% |

Crypto Staking (Legitimate) | 0.42% – 1.25% | 5% – 15% |

This table clearly illustrates the unrealistic returns promised by Vextor.trade.

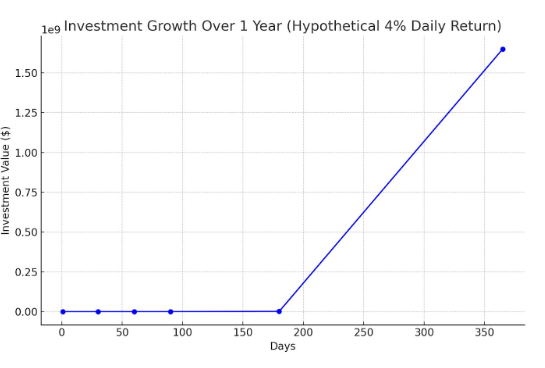

Mathematical Unsustainability

To demonstrate why Vextor.trade’s returns are unrealistic:

To provide context, consider traditional investments and credible crypto platforms:

Investment Type | Annual Return |

Real Estate | 8-12% |

Bank Savings Account | 0.5-2% |

Reputable Crypto APY | 5-10% |

TetherBot.io (promised) | ~3,650% |

Reliable investment platforms usually grow organically.

A legitimate financial website prioritizes robust security.

Hosted by providers associated with known fraudulent activities.

Transparent, reversible payment methods indicate legitimacy.

Social media analysis reveals concerning promotional patterns:

Given the evidence, potential investors should:

The analysis strongly suggests Vextor.trade operates similarly to known fraudulent schemes, marked by significant red flags. Investors should prioritize financial safety and steer clear of such platforms to protect their capital.

DYOR Disclaimer

This review is informational and educational. Always conduct your own research and seek advice from qualified financial advisors before investing. All investment decisions carry risks; past performance does not guarantee future results.

This Vextor.trade Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

Given vextor.trade Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated vextor.trade, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the Vextor.trade Review article. These questions and answers are designed to address common concerns and provide additional clarity for readers:

No. The Vextor.trade Review indicates significant red flags, including hidden ownership, unrealistic ROI, and negative public feedback, suggesting it’s not legitimate.

Vextor.trade promises daily returns around 4%, equating to unrealistic annual returns exceeding 480%, which is financially unsustainable.

The compensation plan relies on constant new investor recruitment, resembling Ponzi schemes, making it highly risky and unsustainable long-term.

Vextor.trade has minimal security measures with only basic SSL encryption and no two-factor authentication, posing high risks to user funds.

Safer alternatives include regulated cryptocurrency exchanges (e.g., Binance), stock brokerages (e.g., Fidelity), or traditional investment options like real estate and bank deposits.

Title: vextor.trade

https://scamsradar.com/tetherbot-io-review-shocking-truth-investors-must-know/

https://scamsradar.com/prime-bridge-review-shocking-truth-revealed/

https://scamsradar.com/salus-global-review-2025-avoid-this-investment-trap/

https://scamsradar.com/betxgain-world-review-should-you-invest-rare-report-2025/

https://scamsradar.com/xtorontorobo-live-review-2025-shocking-truth-exposed/

There are no reviews yet. Be the first one to write one.