Uslsai Review: Exploring Legitimacy, Risks, and Key Details

In this Uslsai review, we take a balanced look at uslsai.com, a platform claiming to offer AI-driven crypto trading. Many ask, is uslsai.com legit? We combine insights from multiple sources to cover ownership, compensation plans, and more. This helps investors make wise decisions in 2026. For more scam alerts and investigations, see our Scams Radar.

Table of Contents

Part 1: Understanding USLS AI and Its Core Claims

USLS AI positions itself as an innovative tool in the AI crypto space. The platform, run by LSAI-BOT Capital Group Ltd., promises automated trading bots that use machine learning for high-frequency cryptocurrency trading. Users deposit funds, such as USDT, to let the AI handle trades, aiming for steady gains. Sources describe it as a U.S.-based setup, but details remain thin.

The site hints at effortless earnings through AI robots. It ties into broader trends like blockchain, Ai, and Web3 AI, where tech meets finance. Yet, real-world utility stays unclear without deep docs. For those exploring decentralised AI platforms, USLS AI claims to optimise trades in volatile markets. But lacks evidence of machine-learning blockchain integration or DeFi AI features.

Key promises include passive income via staking or arbitrage. No whitepaper or detailed bios appear on the site. This raises questions for AI enthusiasts checking USLS AI blockchain features or USLSai DeFi integration.

1.1 Ownership Profiles and Backgrounds

Ownership stands out as a major concern in this Uslsai review. The company behind it is Lightning Shark Capital Group Ltd. Public records show it formed in New York in 2025. The listed address is 55 Broad St, a shared office space often used by new firms.

No clear executive profiles exist. Sources note hidden WHOIS data via Domains By Proxy, LLC. This masks names, addresses, and contacts. The domain was registered on August 4, 2025, making uslsai.com’s domain age just months old. No SEC filings or business regs confirm the U.S. base under LSAI-BOT.

Background checks reveal no founder histories or leadership track records. Legit firms share bios to build trust. Here, opacity suggests shell status. For investors seeking USLS AI investor guide info, this lack hinders due diligence. Compared to established players, it falls short in transparency.

One SEC Form D filing ties to Lightning Shark, but it’s basic and recent. No prior ventures or expert credentials link to owners. This fits patterns in AI crypto projects where hidden teams avoid accountability.

Part 2: Breaking Down the Compensation Plan

The compensation plan centers on AI-powered trading with affiliate elements. Users register, deposit crypto, and activate bots for automated earnings. Sources indicate a focus on recruitment, where referrals earn commissions. This creates tiered structures like pyramids.

Specific returns aren’t listed openly, but similar setups promise 1-5% daily. For example, a 2% daily yield compounds fast. Let’s calculate: Start with $1,000. Daily growth at 1.02 factor over 365 days hits about $1.378 million. That’s over 137,000% APY.

Daily Return Example | Initial Investment | After 1 Year (Compounded) | Realistic Comparison |

1% Daily | $1,000 | ~$37,800 | S&P 500: 7-10% |

2% Daily | $1,000 | ~$1.378 million | Bank Savings: 4-5% |

5% Weekly | $1,000 | ~$12,640 | Crypto Staking: 2-8% |

This table shows why high claims worry experts. Real markets can’t sustain such growth without new funds inflows. The plan relies on USDT deposits for bots to “earn.” Withdrawal attempts often incur fees or are blocked.

Affiliate tiers reward bringing in users, boosting pyramid risks. No audited performance backs claims. For USLS AI token incentives, none are detailed focus is on trading gains, not tokens. This differs from best decentralised AI projects with clear utility.

Part 3: Risks and Red Flags in USLS AI

Every Uslsai review must address legitimacy. Third-party tools flag issues:

- Trust scores: Scam Detector at 17.4-20.8/100; Gridinsoft at 39/100; others label “suspicious.”

- Blacklist status: Some security firms block it as risky.

- Traffic: Very low, no organic buzz.

- Public views: No forums or Reddit talks; silence signals newness or avoidance.

Security uses basic SSL from GoDaddy and Cloudflare hosting. No advanced measures like cold wallets or audits. Payments are limited to crypto, no fiat, raising irreversibility concerns.

No KYC or AML details increase laundering risks. Technical glitches, like loading errors, hint at poor upkeep. For uslsai platform security, claims of “industry-leading” lack proof.

Comparisons highlight gaps:

Aspect | USLS AI | Legit Alternatives (e.g., Binance Staking) |

Transparency | Hidden owners, no bios | Public teams, regs |

Returns | Vague high yields | 5-15% APY, audited |

Regulation | None verified | SEC/FINRA compliant |

Withdrawal | Unclear, potential blocks | Clear policies, fast |

These point to Ponzi traits: New money pays old users until inflows stop.

Part 4: Public Perception and Community Aspects

Searches show no endorsements or influencers. No X, Reddit, or Telegram buzz on USLS AI community join. Promoters, if any, use private channels with referral codes or fake profits screenshots.

The latest USLS AI news is absent, with no press or events. This contrasts with uslsai vs centralised AI like established bots on exchanges. For developers, USLS AI for developers offers no clear tools or APIs.

USLS AI scam check reveals patterns matching SEC-cracked schemes. No complaints yet, but newness explains that.

4.1 Mathematical Insights into Sustainability

High returns defy math. A 1% daily promise needs endless growth. Formula: (1 + 0.01)^365 ≈ 37.8x. No AI beats markets consistently at scale. Volatility in crypto averages 200% yearly gains but with crashes.

Graphically, plot growth:

- Line for 1% daily: Steep exponential curve.

- Line for market avg: Gradual rise.

Without a real trading edge, it’s unsustainable. Decentralised machine learning, USLS claims, lacks evidence.

Alternatives and Practical Tips

Consider safer options:

- Banks: 4-5% APY, insured.

- Real estate: 5-10% yields.

- Crypto exchanges: 2-8% staking.

For USLS AI real world utility, test small if curious. Verify withdrawals first. Report issues to SEC or FTC.

Conclusion: Weighing the Evidence in This Uslsai Review

This Uslsai review highlights key concerns for uslsai.com. Hidden ownership, vague plans, and low scores suggest high risks in the AI crypto world. While promising decentralised AI appeal, the lack of proof urges caution. Investors, do thorough checks. Stick to regulated paths for safety. Always research deeply; your funds depend on it.

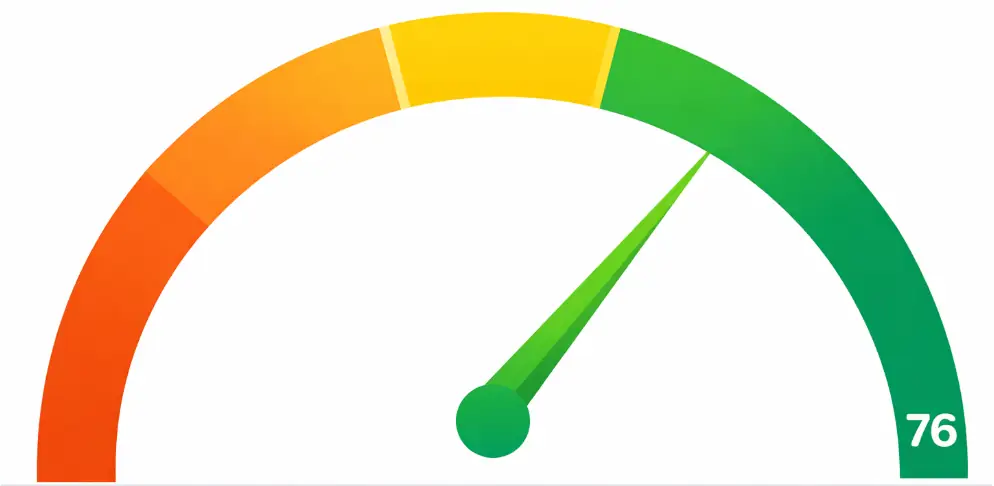

Uslsai Review Score

A website’s trust score is an important indicator of its reliability. Uslsai currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Uslsai or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Uslsai Review

This section answers key questions about Uslsai, clarifies points, addresses concerns, and highlights issues related to the platform’s legitimacy.

A platform offering AI trading bots for crypto.

Evidence shows red flags; verify independently.

No token details available.

No public groups found; proceed carefully.

Current data flags risks over rewards.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.