In the realm of digital investments, platforms like Trade Bit emerge, promising substantial returns which naturally attract investor attention. This Trade Bit Review meticulously analyzes Trade Bit to evaluate its legitimacy and potential risks, guiding potential investors through its business structure, compensation plans, and other pivotal aspects.

The transparency, or lack thereof, concerning Trade Bit’s ownership details is immediately concerning. The official website lists only a generic email and a placeholder phone number under its contact section, a significant red flag. Legitimate platforms typically showcase comprehensive details about their management and headquarters, fostering trust and transparency.

Trade Bit promotes eye-catching returns, asserting a “Guaranteed Minimum 15% Monthly ROI” and peaks up to 20%. To put these figures into perspective, here’s a comparative analysis with conventional investment avenues:

Such disproportionate claims by Trade Bit raise immediate concerns over the feasibility and sustainability of their business model, often characteristic of high-risk schemes or Ponzi structures. A closer mathematical scrutiny reveals the exponential growth potential based on their promises, which starkly contrasts with the returns from traditional investment vehicles, further emphasizing the risks involved.

The absence of verifiable traffic data and user feedback for Trade Bit complicates the assessment of its market reception. Established platforms generally have accessible metrics and reviews, which are notably missing here, hinting at possible obscurity or inauthenticity.

Trade Bit’s vague statements regarding data security, without specific details on encryption or compliance standards, do not instill confidence. This lack of clarity about protective measures is another troubling indicator of the platform’s reliability.

The presence of generic content and placeholder texts across Trade Bit’s website underlines a lack of professionalism. Such issues, coupled with the confusion arising from similarly named entities like tradebit.com and tradebit.io, potentially mislead and exploit user trust.

The ambiguity continues with unspecified payment methods and unreliable customer support, evidenced by a non-functional contact number. Transparent and responsive support systems are crucial for legitimate operations, which seems compromised here.

Despite having a social media presence, notably on Instagram, Trade Bit fails to show significant engagement or endorsements from recognized financial authorities, which is atypical for a credible financial platform.

Illustrative graphs and charts comparing Trade Bit’s promised returns against traditional investments highlight the impracticality of their claims. For instance, a visual compounding interest graph showcasing the growth of a $1,000 investment at 15% monthly paints a clear picture of the unrealistic financial trajectory proposed by Trade Bit.

Given these factors, potential investors are advised to approach Trade Bit with caution. Engaging with this platform bears considerable risk, as highlighted through analytical deductions and comparative assessments.

This review serves informational purposes and should not be construed as financial advice. Investors are encouraged to conduct thorough due diligence and consult with professional advisors before committing to any investment decisions.

Trade Bit presents multiple red flags typical of investment scams, characterized by unrealistic returns, opacity in operational details, and inadequate security measures. Based on the analysis, potential investors should remain vigilant and preferably explore more transparent and reliable investment avenues.

This Trade Bit Review is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

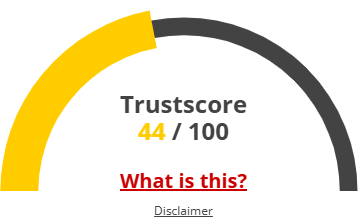

Given Trade Bit Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Trade Bit, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the Trade Bit Review article. These questions and answers are designed to address common concerns and provide additional clarity for readers:

Trade Bit Review highlights several risks including unrealistic ROI claims, lack of transparency regarding ownership and operations, insufficient security details, and poor customer support, which are typical indicators of high-risk or fraudulent investment platforms.

Trade Bit promises a minimum of 15% monthly ROI, significantly higher than traditional investments like real estate, high-yield savings accounts, and cryptocurrencies, which typically offer much lower and more sustainable returns.

Available information and user feedback are limited, making it difficult to verify the reliability of Trade Bit. The absence of substantial user reviews and transparent traffic data raises concerns about its legitimacy.

Investors should verify the platform’s regulatory compliance, transparency in ownership and operation details, security measures, and real user reviews. Consulting with financial advisors and conducting thorough research are also recommended.

The high ROI claims made by Trade Bit are highly unlikely to be sustainable long-term. Such claims often signal the potential for Ponzi schemes where returns are paid from new investors' funds rather than legitimate business profits.

Title: Trade Bit

https://scamsradar.com/agi-ai-net-review-critical-facts-every-investor-needs/

https://scamsradar.com/talkfusion-review-2025-scam-or-real-deal-exposed/

https://scamsradar.com/airobot000-vip-review-truth-revealed-explosive-guidelines-2025/

https://scamsradar.com/tetherbot-io-review-shocking-truth-investors-must-know/

https://scamsradar.com/tetherbot-io-review-shocking-truth-investors-must-know/

There are no reviews yet. Be the first one to write one.