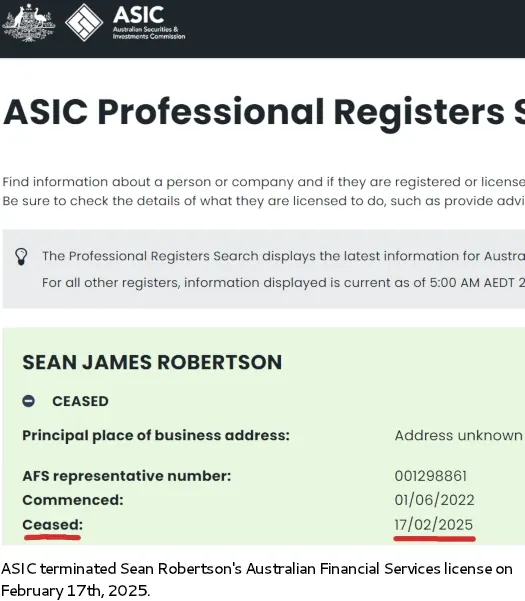

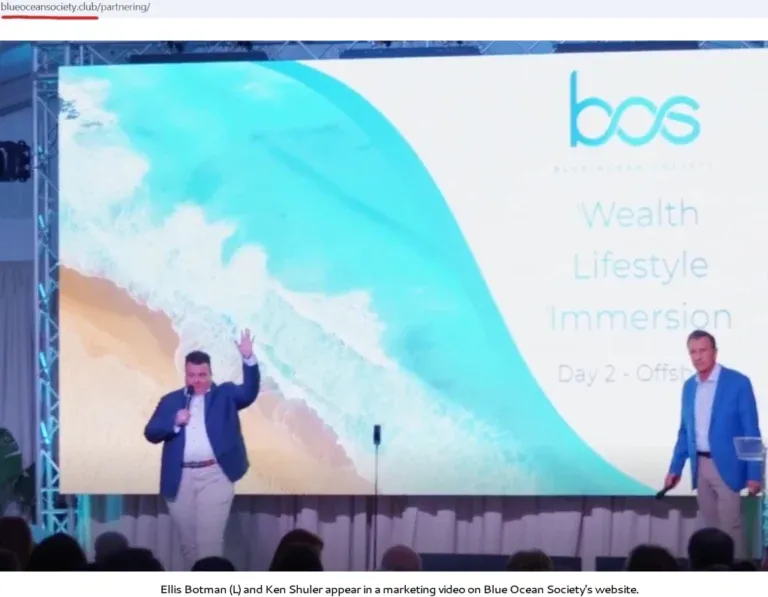

On August 8, 2025, Sean Robertson (also known as Sean James Robertson), a purported trader associated with Blue Ocean Society (BOS), filed a Statement of Claim in the Adelaide registry of the Federal Circuit and Family Court of Australia, suing BOS co-owners Ellis Botman and Kenneth Shuler for losses and damages stemming from their alleged operation of unlawful investment schemes, per court filings and. Robertson lists himself as the applicant, with Botman and Shuler as respondents, claiming he was unaware of the fraud until February 2025, despite his involvement since August 2022, per. The lawsuit alleges securities fraud under Chapter 5C of the Corporations Act 2001, seeking compensation for lost profits and security costs.

Robertson’s claim accuses BOS, described as an “exclusive, invitation-only private wealth club,” of running multiple unregistered managed investment schemes without required ASIC registration, constitutions, compliance plans, or product disclosure statements. These include:

Robertson claims he conducted “Trading Activities” for BOS since 2022, but only discovered the illegality in February 2025, triggered by frozen bank accounts, broker closures, investor complaints, and threats requiring a security detail. He alleges lost profits from restricted trading and security costs, seeking an unspecified amount to be assessed.

BOS’s January 2023 statement referenced an “unnamed partner” (Robertson) responsible for “Trading Islands,” blaming him for withdrawal delays since mid-2024. Robertson, experienced in trading commodities and securities, ran schemes like Gold Harbor but claims ignorance until personal fallout, per. ASIC issued a securities fraud warning against BOS on August 18, 2025, for operating without registration. BOS’s website traffic plummeted to ~7,300 monthly visits by September 2025, mainly from the U.S. (55%), Australia (32%), and Canada (13%), indicating a collapse.

BOS, led by serial fraudsters Botman and Shuler, is accused of a Ponzi scheme defrauding investors through high-yield promises, with losses potentially exceeding $100M, per. Robertson’s lawsuit, filed amid ASIC scrutiny, may seek to distance himself, but his three-year involvement raises questions about complicity. Investors should file claims via ASIC at asic.gov.au and avoid unregistered schemes. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain unaffected, per CoinMarketCap, but BOS’s fallout highlights crypto fraud risks. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. A ruling could prompt ASIC or DOJ actions, potentially recovering funds by 2026.