Rox Protocol Review: Exploring Legitimacy and Investor Risks

In this Rox Protocol review, Scams Radar dives into the platform’s features, ownership transparency, compensation plan, and potential risks for investors. Rox Protocol positions itself as a decentralized platform built on blockchain technology, emphasizing asset tokenization, smart contracts, and scalability. However, a close look reveals concerns about sustainability and red flags that every investor should consider. We combine insights from multiple analyses to provide a clear picture, using simple language to help you understand the basics.

Table of Contents

Part 1: What Is Rox Protocol? Key Features and Claims

Rox Protocol operates as a DeFi protocol with a dual-token system: ROX as the native token and BIN as a supporting asset. It enables asset tokenization, allowing users to stake USDT in fixed terms of 1, 15, or 30 days. The system auto-buys ROX and BIN to create liquidity pools locked in a “black-hole” address for security. This setup promotes interoperability with other chains like Ethereum and Polkadot, while focusing on scalability through a rate-limiter that caps inflows to build buy pressure.

The platform highlights smart contract capabilities for automated market-making, low transaction fees, and governance mechanisms where holders can vote on updates. Rox Protocol also offers developer tools, including an open-source repository for building decentralized applications. Its token economics model includes staking advantages for the native token, with use cases in finance and supply chain management. Partnerships and collaborations remain unverified, but the roadmap promises future development plans like enhanced regulatory compliance and real-world asset tokenization examples.

Despite these claims, public verification falls short. No audited smart contracts or confirmed exchange listings tie directly to https://roxprotocol.org. Token name collisions with unrelated ROX projects add confusion, risking investor mix-ups.

1.1 Ownership Transparency and Team Backgrounds

Ownership details for Rox Protocol remain unclear. Standard WHOIS lookups for https://roxprotocol.org yield no public registrant names or organizations. This lack of transparency raises questions about accountability in a decentralized platform.

No team members are publicly identified, with zero LinkedIn profiles or backgrounds disclosed. Legitimate blockchain projects often feature doxxed developers with experience in governance and security features. Here, the anonymous setup mirrors patterns in high-risk schemes, where founders avoid scrutiny. Without clear legal entity registration or licensing, regulatory compliance stays uncertain. Investors should demand more on team credentials to assess expertise in interoperability, scalability, and asset tokenization.

Part 2: Detailed Compensation Plan Explained

The compensation plan drives much of Rox Protocol’s appeal but also its risks. Users stake a minimum of 200 USDT to unlock features like referrals and FOMO pools. Here’s a breakdown:

- Staking Options:

- 1-day term: 0.3% daily return (no compounding).

- 15-day term: 0.9% daily, compounding to about 14.38%.

- 30-day term: 1.5% daily, compounding to roughly 56.31%.

- Referral Structure: Direct referrals earn 5%, with team rewards up to 30% across seven tiers (R1 to R7). This multi-level setup encourages recruitment, similar to MLM models.

- FOMO Pools: 10% of system earnings flow into four pools (Level, Weekly Ranking, Influence, Monthly Ranking), rewarding top performers and creating urgency.

- Taxes and Fees: A 25% profit tax on sellers, plus 3.5% buy/sell taxes redistributed to nodes, liquidity pools, governance, and holders. A rate-limiter starts at 300 USDT per minute, increasing daily to 3,000 USDT, capping per-account stakes at 10,000 USDT.

This plan relies on continuous inflows and internal recycling, not external revenue from transaction fees or staking advantages. It prioritizes growth over stable value creation, a common issue in yield-focused platforms.

Tier | Reward Percentage | Requirements |

R1 | 5% | Direct referrals |

R2-R7 | Up to 30% total | Team building and performance |

2.1 ROI Claims: Why They May Not Hold Up

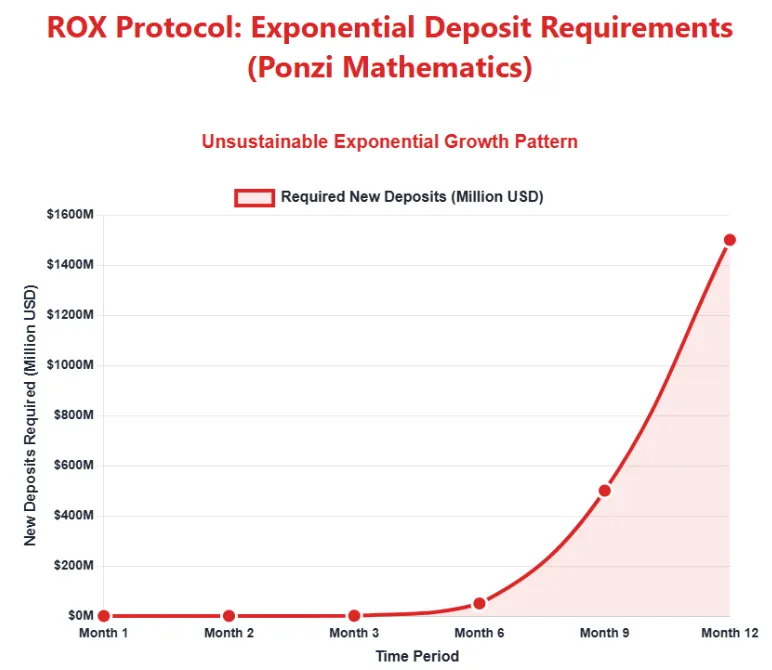

Rox Protocol promises high returns, like 1.5% daily compounding to 56.31% over 30 days. Repeating this monthly could yield over 21,000% annually, a $10,000 stake growing to about $2.11 million in a year.

To check sustainability, consider the math:

- Monthly growth factor: (1 + 0.015)^30 ≈ 1.5631 (56.31% gain).

- Annual multiplier: 1.5631^12 ≈ 211 times the initial investment.

This requires exponential inflows, as shown in the table below:

Month | Starting Capital ($100k Example) | End Balance | New Funds Needed for Payouts |

1 | $100,000 | $156,310 | $56,310 |

3 | $244,341 | $381,958 | $281,958 |

6 | $1.48M | $2.31M | $2.21M |

12 | $211M | $329M | $329M |

Comparison to Realistic Benchmarks

Rox Protocol’s claims far exceed standard returns:

- Bank ROI: 3-5% annual (e.g., high-yield savings at 5%).

- Real Estate ROI: 6-12% annual, backed by tangible assets.

- Crypto APY: 3-10% on platforms like Lido or Aave, from network fees.

A simple bar chart illustrates the gap (annual returns in %):

Investment Type | Annual Return (%) |

Bank | 5 |

Real Estate | 8 |

Crypto Staking | 10 |

Rox Protocol Claim | 21,100 |

Part 3: Public Perception and Technical Performance

Feedback is limited and mixed, with promotional posts on X and Binance AMA replays. Engagement stays low, signaling hype over adoption. The site shows poor load performance, with no dashboards for treasury transparency. Security features like auditing processes remain unproven, heightening risks in a volatile market.

Red Flags and Risk Assessment

Several issues stand out:

- Anonymity: No team details or audits for smart contracts.

- Unsustainable Yields: Math shows reliance on new deposits.

- MLM Focus: Heavy emphasis on referrals and FOMO pools.

- Low Visibility: Minimal traffic, no DYOR tool reports (e.g., Trustpilot shows zero reviews).

- Name Collisions: Confusable with other ROX tokens.

- Promotion Patterns: Mainly via @RoxProtocol on X, with past unrelated promotions by similar accounts.

Social media analysis: The official X handle promotes DeFi growth but lacks technical depth. No major partnerships or ecosystem collaborators confirmed.

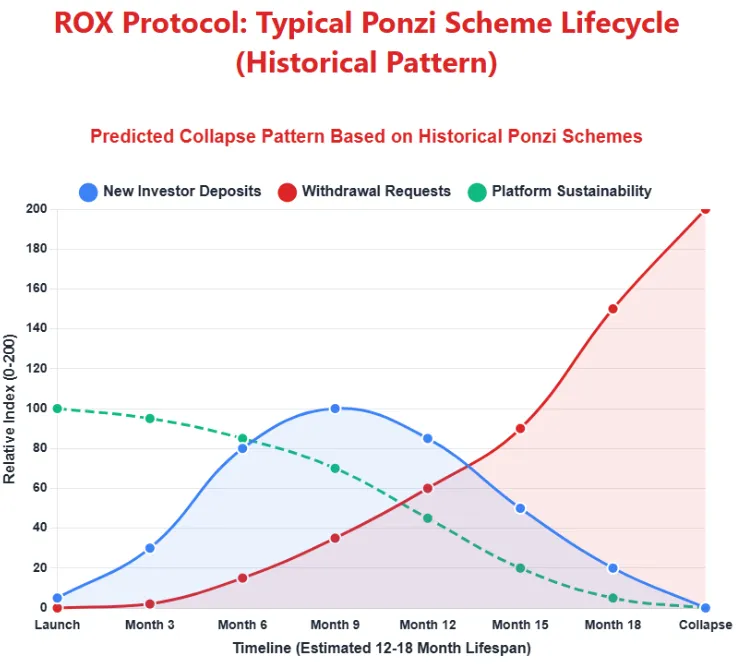

Future Predictions and Investor Guide

Short-term hype may drive inflows, but without external revenue, a collapse within 12-24 months seems likely based on similar schemes like BitConnect. Rox Protocol’s interoperability and developer onboarding could improve if audits emerge, but current indicators point to high risk.

For participation: Follow the investor guide, verify contracts, check nodes and validators, and understand token economics. Compare with other platforms for transaction speed and cost.

Conclusion: Proceed with Caution in Your Rox Protocol Journey

This Rox Protocol review highlights innovative features like blockchain interoperability and tokenization, but underscores risks from opacity and unrealistic yields. For a platform aiming at scalability and governance, transparency is key. Weigh comparisons carefully and verify claims. Always invest wisely; cryptocurrency carries high volatility.

DYOR Disclaimer:

This is informational only, not advice. Conduct your own research and consult professionals. Risks include total loss.

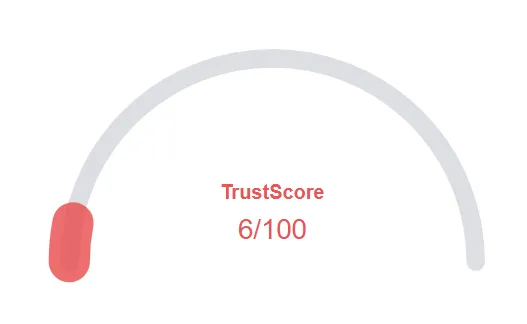

Rox Protocol ReviewTrust Score

A website’s trust score is an important indicator of its reliability. Rox Protocol currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Rox Protocol or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About Rox Protocol Review

This section answers key questions about the Rox Protocol, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Not confirmed. The platform has anonymous founders and no verified audits, which makes it high-risk.

Its returns rely mostly on new user deposits, not external revenue, which raises Ponzi-like concerns.

Anonymous team, unrealistic daily ROI, heavy referral structure, no real partnerships, and no proven utility.

Users earn commissions for recruiting others, structured across multiple team levels similar to MLM models.

Like the Everstead Review, it shows high ROI claims with unclear backing, requiring strong DYOR before investing.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.