Any platform investment necessitates careful due diligence to guarantee the venture’s legality and safety. It’s critical to distinguish between legitimate investment possibilities and possible scams in light of the increase in fraudulent internet schemes. Among these platforms, OzoFund (www.ozofund.com) raises a lot of concerns. A thorough analysis that explains why this platform is risky for investors can be found below.

People like Robin and Ayush Gupta have left testimonials on OzoFund. Verifiable information like complete identities, transaction histories, or outside verification are absent from these endorsements, nevertheless. Scam sites frequently utilize fake testimonials to trick prospective investors.

Patterns seen in previous scams suggest that OzoFund would probably disappear once it is unable to continue paying out, leaving investors with large losses.

OzoFund demonstrates every characteristic of a high-risk fraud. It is clearly a hazardous platform for investors based on its lack of transparency, inflated ROI promises, sparse online presence, and uninspired content.

Make Smart Investments and Remain Alert. Keep Your Hard-Won Cash Safe.

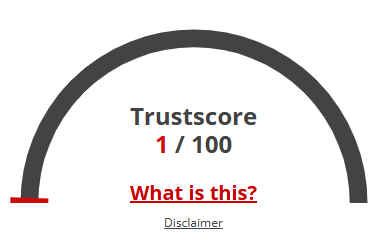

Given Gimi Profit Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Gimi Profit, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

OZO Fund provides a range of investment services, including:

Investment Advisory: Tailored advice for individuals, corporations, and institutional investors.

Financial Planning: Personalized guidance on investments, retirement planning, education funding, and risk management.

Portfolio Management: Professional management of investment portfolios to balance risk and return according to client objectives.

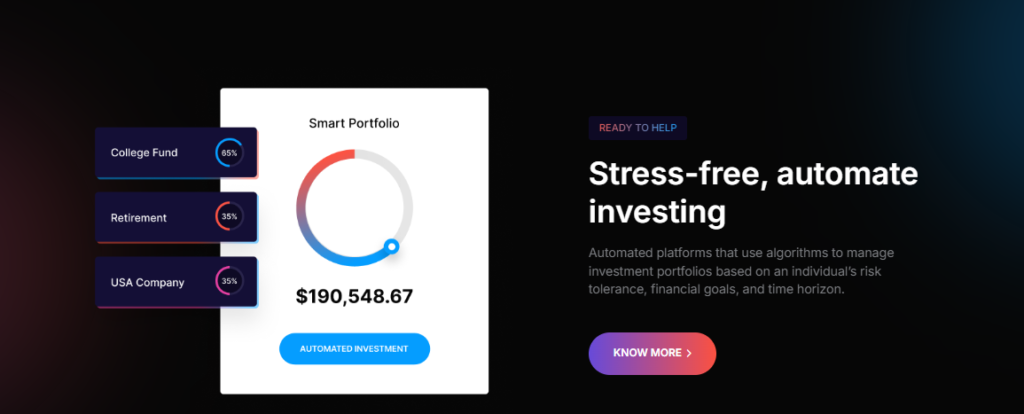

OZO Fund utilizes automated platforms that employ algorithms to manage investment portfolios based on an individual's risk tolerance, financial goals, and time horizon, aiming to simplify the investment process for clients.

While OZO Fund offers diversification and professional management, investors may encounter management fees and have less control over individual investment decisions.

You can contact OZO Fund via email at [email protected] or by phone at (510) 652-7401. Their office is located at 5095 Telegraph Ave, Oakland, California-94609, USA.

According to a review by Scamadviser, ozofund.com has a high trust rating, indicating that it is likely a legitimate and reliable platform.

There are no reviews yet. Be the first one to write one.