MintStakeShare (MSS) bills itself as a cutting-edge cryptocurrency staking platform that gives investors 2% daily profits. Even while these claims might be alluring, a careful examination of the platform’s history, functionality, and reliability raises a number of issues that prospective investors should take into account.

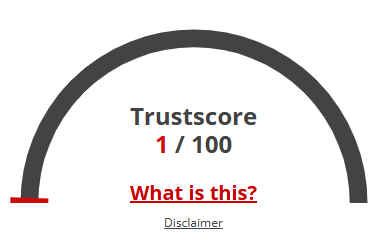

The public does not have access to specific visitor statistics for mintstakeshare.com. It is worrying that the platform has a bad reputation among web analytics platforms. Mintstakeshare.com has a very low trust score from Scamadviser, indicating possible hazards for users.

Red flags about MSS are raised by feedback from several platforms. Scamadviser points out that the site has a very low trust score, which suggests possible fraudulent activity. Additionally, Gridinsoft warns consumers about dishonest actions by flagging mintstakeshare.com as a financial hoax. Furthermore, user comments have pointed to the platform’s connection to high-yield promises that resemble Ponzi schemes.

Because SSL encryption is used on the website, user-to-site data transmissions are kept private. But there are issues with the website’s owner’s identity. A paid privacy service is used to hide the domain registration data, which may raise suspicions about the platform’s validity.

High profits with little risk are emphasized in the platform’s material, which is a feature of many questionable investment plans. Its legitimacy is further damaged by the lack of crucial company information, like physical addresses, thorough staff profiles, and regulatory compliance certifications. Although the information on the website seems unique, there is a serious problem with the lack of openness.

The official website does not specifically include the platform’s payment options. The platform’s dedication to investor security and adherence to accepted financial procedures is called into doubt by the opaqueness of its financial conduits and unclear refund policies.

Direct customer service contact details, including phone numbers and email addresses, are not offered on the website. For people looking for help or a solution to problems, the lack of easily available support channels might be troublesome.

Although the website seems to be operational, little is known about its technological stability, uptime, or loading speed. Because technical performance data are opaque, it is difficult to completely evaluate the platform’s dependability.

Making a set 2% daily return promise is quite high and very different from what the market would normally expect. Similar to Ponzi schemes, these returns are frequently linked to high-risk schemes that depend on ongoing fresh investments to maintain payouts.

In light of these elements, the platform displays a number of traits that are frequently linked to fraudulent operations. Similar platforms sometimes have brief lifespans and shut down as soon as fresh funding stops coming in.

MintStakeShare should be used with utmost caution by prospective investors. Significant red flags include anonymous ownership, unsustainable ROI claims, unfavorable reviews, and a lack of transparency. To make safe and well-informed investment selections, it is essential to carry out in-depth study before contemplating any investment, look for platforms with validated credentials, and speak with financial experts.

Given MintStakeShare Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated MintStakeShare, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

MintStakeShare (MSS) is an innovative decentralized finance (DeFi) platform operating on the Binance Smart Chain (BSC) and Base Chain. It offers users the opportunity to mint, stake, and share MSS tokens, aiming to provide financial growth through a fair token distribution model and daily staking rewards.

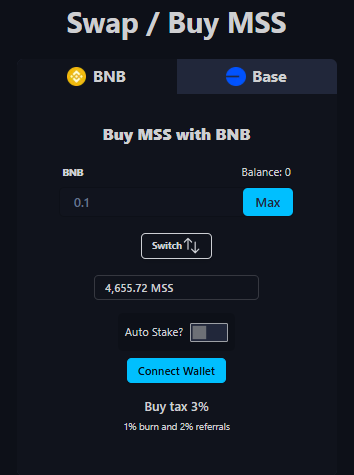

To acquire MSS tokens:

Minting: Visit the MintStakeShare website and use BNB or ETH to mint MSS tokens directly.

Swapping: Utilize decentralized exchanges like PancakeSwap (for BSC) or Uniswap V2 (for Base Chain) to swap other cryptocurrencies for MSS.

MintStakeShare provides a staking program where users can earn 2% daily returns on their staked MSS tokens. These rewards can be compounded to maximize earnings over time.

Yes, MintStakeShare features a referral program that rewards users with a 5% commission on all minting referrals, stakes, and compounds made by their referrals.

MintStakeShare offers a native bridge to facilitate the transfer of MSS tokens between the Binance Smart Chain and Base Chain. This allows users to manage their assets seamlessly across both networks.

There are no reviews yet. Be the first one to write one.