Platforms like Defily.ai frequently seem as cutting-edge financial solutions in a time when artificial intelligence (AI) and decentralised finance (DeFi) promise large rewards. Nonetheless, investors must be extremely cautious due to the existence of sophisticated frauds in this field. This research demonstrates that Defily.ai is a risky and perhaps fraudulent investment due to its lack of transparency, unclear ownership, and dubious business plan.

A Questionable Character in Network Marketing: Dr. Parwiz Daud

Dr. Parwiz Daud is among the most well-known individuals associated with Defily.ai. Despite having a medical degree, he moved into network marketing and company development.

Validus’s chief network officer: Prior to this, Dr. Daud was connected to Validus, a network marketing firm with a reputation for unethical tactics.

No Defily.ai Role That Can Be Verified: Although he is frequently associated with Defily.ai on social media, there is no formal record attesting to his ownership or management role inside the business.

Why This Is Doubtful: Reputable businesses reveal transparent leadership hierarchies and credible corporate profiles.

Due to Defily.ai’s concealed WHOIS registration, investors are unable to identify the accountable parties.

Lack of a Clear Explanation of Revenue Streams: One of the biggest red flags in financial platforms is that Defily.ai does not reveal how it makes money.

Most Likely Ponzi Scheme: Numerous websites, such as Defily.ai, function as multilevel marketing (MLM) or pyramid scams in which new investors deposit money and older investors withdraw it. When recruitment slows down, these models will unavoidably fall apart.

🔴 Red Flag: A company is probably a fraud if it is unable to provide a clear explanation of its business model beyond ambiguous assertions.

Low User Engagement & Low Traffic: A genuine financial platform need to feature lively forums, consumer interaction, and conversations. Defily.ai isn’t very active on public forums or investment review websites, though.

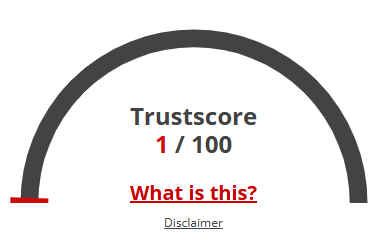

Contradictory Trust Scores: ScamAdviser provides a favourable assessment (maybe as a result of automatic analysis).

Scam Detector warns of possible fraud risks by assigning a low trust score of 4.7 out of 100.

🔴 Red Flag: The absence of genuine user evaluations, conversations, or evidence of payouts points to a phoney marketing campaign rather than an actual community.

13/100 for proximity to suspicious websites indicates a relationship with other sites that pose a significant risk.

Phishing Score: 35 out of 100; there may be a chance of data theft.

Malware Score: 21 out of 100; there may be a chance of fraud.

Additional Website Security Issues: It is unable to analyse the backend security because it depends on JavaScript to operate.

A serious red flag for possible investors is the absence of a verifiable business address or corporate compliance information.

🔴 Red Flag: Defily.ai lacks the complete openness and advanced cybersecurity precautions that legitimate platforms do.

Unknown Methods of Payment: The usage of untraceable cryptocurrency transactions is suggested by the lack of formal disclosure of acceptable payment methods.

No Refund Policy: In order to minimise reimbursements, fraudulent platforms frequently deny refunds or take use of “terms of service” loopholes.

🔴 Red Flag: Investors should avoid a firm if it does not make explicit its refund procedures and financial compliance.

No Listed Contact Information: It is inappropriate for a financial platform that handles customer cash to have no visible support mechanism.

Lack of Proof of Complaint Resolution: Users are unlikely to be able to get their money back in the event of problems if there is no traceable customer service presence.

🔴 Red Flag: No respectable financial institution functions without unambiguous routes of contact and support.

Although ROI rates are not disclosed by Defily.ai, comparable fraudulent schemes offer large profits at no risk.

Mathematical Proof: Without an underlying actual company activity, no DeFi financial model can ensure steady, high-yield passive income.

🔴 Red Flag: Any “investment” that promises risk-free, fixed, high returns is a fraud.

Dr. Parwiz Daud, a former leader of Validus network marketing and key promoter.

Defily.ai is being actively promoted on social media.

No formal claim to ownership—probably a ruse to appear more credible.

Other Unidentified Promoters: Since Defily.ai conceals team members, it’s possible that other people are operating the scam under false pretences.

A popular strategy to evade legal responsibility is the omission of actual team members from advertising films and PDF presentations.

🔴 Red Flag: Reputable businesses openly interact with their audience and proudly name their employees.

Within six to twelve months, the majority of Ponzi-like schemes fall apart when fresh recruits stop coming in.

When withdrawals surpass deposits and the plan is unable to continue operating, investors will probably lose money.

🚨 Extremely high risk 🚨 ❌ Avoid investing in Defily.ai!

Defily is the final verdict.Avoid AI at All Costs: It’s a Scam

Key Findings: ✅ No accountability due to anonymous ownership and hidden WHOIS data.

✅ No explanation of the revenue model—probably a Ponzi scam.

✅ Low Trust Scores and High Security Risks: Possible malware and phishing attacks.

✅ Lack of customer service and refund policies: a set-up for investor losses.

✅ Inauthentic or Unproofed Leadership: Dr. Parwiz Daud’s involvement is dubious.

In summary, Defily.AI is a Risky Ponzi Scheme

🚨 Avoid making an investment in Defily.ai. Investors run the danger of permanently losing their money, and the platform shows all the traditional scam symptoms.

An investment offer is a fraud if it seems too wonderful to be true. Keep yourself informed, be careful, and save your hard-earned cash!

✅ Steer clear of websites with unsubstantiated claims and concealed ownership.

✅ Alert financial authorities and fraud watchdogs about Defily.ai.

✅ Invest only on platforms that are legally compliant and regulated by the SEC.

✅ Alert people about the dangers of making investments on phoney sites.

Given Gimi Profit Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Gimi Profit, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Defily.ai is an AI-powered platform that integrates artificial intelligence with decentralized finance (DeFi) to offer automated trading, staking, and NFT-based business transformation solutions.

Defily.ai provides AI-driven automated trading solutions that analyze market trends and optimize investment strategies for better returns in the crypto market.

The platform offers AI-powered staking options that aim to provide consistent and secure growth for users' crypto assets.

Defily.ai enables businesses to be converted into tradable NFTs on the blockchain, ensuring secure and transferable digital ownership.

Yes, Defily.ai leverages blockchain security measures to protect users' assets and transactions, ensuring a safe and transparent experience.

There are no reviews yet. Be the first one to write one.