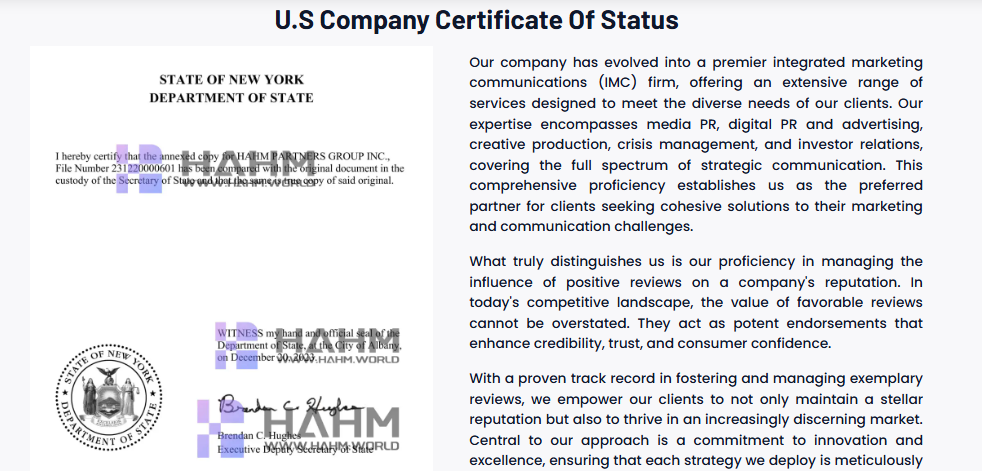

Both honest companies and dishonest schemes have benefited from the growth of online investing platforms. We thoroughly examine *Hahm.world* in this blog article to ascertain its credibility and any dangers to investors. Our goal is to give a clear picture of whether this platform has signs of a fraud by examining its ownership, traffic, public perception, security, validity of its content, financial transparency, and more.

According to the results, Hahm.world demonstrates a number of traits of a scam, such as low trust ratings, inflated ROI promises, and a lack of transparency. Although there isn’t any concrete evidence of fraud, the many warning signs indicate that investors should proceed with utmost caution.

Practical Suggestions:

In conclusion, there are serious doubts regarding the validity of Hahm.world. Investors should put safety first and steer clear of platforms that don’t adhere to fundamental accountability and transparency requirements.

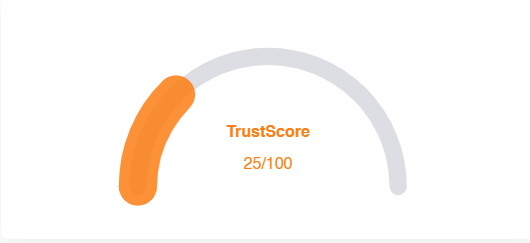

Given Hahm World Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Hahm World, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

There are no reviews yet. Be the first one to write one.