ProBotX Review: Clear and Detailed Insight Into the AI Trading Platform

This ProBotX Review provides a fact-based, simple breakdown of how the platform works, its compensation structure, ownership background, and real-world risk signals. If you are researching automated trading or considering using this trading bot, this guide will help you understand the full picture in plain language. For more detailed investigations and platform risk analysis, you can also explore related reports on Scams Radar.

Table of Contents

Part 1: ProBotX Review: Platform Overview and Core Offering

ProBotX presents itself as an AI and automated trading platform designed for Forex, indices, and commodities trading.

- KRYSOS strategy – Focused on Forex bot execution

- MORPHEUS strategy – Designed for indices trading, including S&P 500 trading

- GEMS strategy – Applied to commodities trading, such as gold commodities

The platform claims that users can earn through a hands-free trading model powered by algorithms. It promotes accessibility for beginners and markets itself as a simplified solution for those without trading experience.

Key Services Promoted

- AI-driven automated Forex trading

- AI crypto bot features

- Multi-asset trading exposure

- Dashboard-based account tracking

- Subscription-based access

The tone of the platform marketing emphasises simplicity, automation, and the potential for daily profit.

1.1 Ownership Profile and Corporate Transparency

A critical part of any ProBotX review is understanding who runs the company.

Domain and Registration Details

- Domain registered: May 29, 2022

- WHOIS data: Privacy protected

- Registrar: NameCheap

- Hosting: Cloudflare (United States servers)

The domain uses privacy shielding, meaning public ownership details are hidden. While privacy protection is common, financial platforms typically disclose corporate registration data clearly.

Legal and Jurisdiction Signals

The platform’s terms state that disputes are governed by United Arab Emirates law. However, the website does not prominently display:

- Corporate registration number

- Named directors or executives

- Verified office address

- Regulator license number

No evidence of registration with financial regulators such as SEBI, FCA, ASIC, or SEC is publicly visible.

This absence increases due diligence requirements for potential users.

Part 2: Compensation Plan and Subscription Structure

Understanding the compensation plan is essential for evaluating sustainability.

2.1 Subscription Pricing

Plan | Price | Description |

Trial | $0 | Limited access |

Starter | $99 | Entry-level automation |

Advance | $499 | Expanded features |

The ProBotX minimum deposit beyond subscription is not clearly disclosed on public pages.

2.2 Implied Return Model

Promotional materials often suggest daily returns. Let us illustrate sustainability with a simplified example.

If a user invests $1,000 and receives 1% daily return:

Daily Return = 1% of $1,000 = $10

Annual Compounded Return ≈ 3,780%

Annual Growth Visualisation (1% Daily)

Month 1: $1,350

Month 3: $2,459

Month 6: $6,022

Month 12: $37,800

This exponential curve requires consistent performance without losses. In real markets, even professional hedge funds rarely achieve triple-digit annual returns consistently.

Part 3: Referral Program and Multi-Level Incentives

Public promotional videos mention a ProBotX referral program. This includes:

- Recruitment bonuses

- Tier-based commissions

- Ambassador rewards

Structural Flow Chart

New Investor Funds

Subscription + Deposit

Commission Paid to Referrer

Trading Account Allocation

When platforms rely heavily on recruitment rewards, sustainability depends on continuous new member inflows.

3.1 Trading Dashboard and User Interface

The ProBotX trading dashboard reportedly includes:

- Real-time profit display

- Strategy selection (KRYSOS, MORPHEUS, GEMS)

- Withdrawal request feature

- Referral tracking

However, no independently audited performance reports or broker-linked verification statements are publicly available.

3.2 Traffic and Public Perception

Estimated global traffic rank: ~384,950

3.3 Public Trust Indicators

Factor | Observation |

SSL Certificate | Present (basic validation) |

Independent Reviews | Limited volume |

Trust Score Tools | Medium-risk rating (~67/100) |

User Reviews 2026 | Mixed, low volume |

Reported concerns include:

- Delayed withdrawal processing

- Limited customer support response

- Lack of verified trading proof

Part 4: Payment Methods and Fund Flow

The platform terms mention:

- Online banking

- Crypto transactions

- Mcoin

- Cash options

Crypto and cash channels can complicate dispute recovery. There is no clear disclosure of regulated third-party custodians or segregated accounts.

Risk Management and Sustainability Analysis

Simplified Sustainability Formula

If:

Daily Payout = r × Total Funds

Required New Inflow ≥ Daily Payout

Example:

- Total funds = $1,000,000

- Daily return = 2%

- Required new inflow daily = $20,000

If inflow slows, payouts become difficult.

ProBotX Strategies Explained

ProBotX KRYSOS Forex

Marketed for automated Forex trading across currency pairs.

ProBotX MORPHEUS Indices

Focuses on S&P 500 trading and global indices.

ProBotX GEMS Commodities

Targets gold commodities and commodity contracts.

No third-party audit reports confirm strategy backtesting or verified brokerage accounts.

Is ProBotX Safe for Beginners?

While the system is marketed as beginner-friendly, automated trading carries inherent risks:

- Market volatility

- Slippage

- Liquidity gaps

- Execution delays

Without regulatory oversight, the mechanisms for investor protection are unclear.

Key Red Flags and Considerations

- Limited ownership transparency

- No visible regulator license

- High profit claims

- Referral-driven expansion

- Mixed ProBotX user reviews 2026

Balanced Assessment

ProBotX positions itself as a modern AI crypto bot and automated Forex trading system. The structured strategies, subscription plans, and referral incentives create a professional appearance.

However, for investors evaluating automated trading platforms, the absence of verifiable trading audits, named executive leadership, and regulatory clarity increases financial risk.

Careful verification is essential before committing funds.

Conclusion: Final ProBotX Review Verdict

This ProBotX Review highlights both the platform’s structured AI trading approach and the areas that require deeper scrutiny. While the marketing promotes automation and accessibility, investors must evaluate transparency, regulatory compliance, and sustainability carefully.

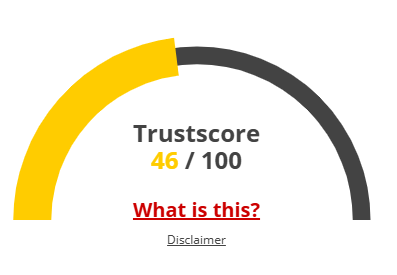

ProBotX Review Score

A website’s trust score is an important indicator of its reliability. ProBotX currently has a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with ProBotX or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions ProBotX Review

This section answers key questions about ProBotX, clarifies points, addresses concerns, and highlights issues related to the platform’s legitimacy.

No regulatory registration is visible. Investors should conduct independent verification before participating.

The site lists subscription pricing but does not clearly state trading deposit requirements.

Yes, a $0 trial plan is displayed.

Some online reports mention delays, though individual experiences vary.

No public regulatory license is prominently displayed.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.