MultiX1 Review: Legitimate Platform or Risky Investment?

In this MultiX1 review, Scams Radar examines the platform’s claims and real-world risks. MultiX1 promises easy earnings through mining and holding coins. But questions arise about its setup and sustainability. We cover ownership, compensation plan, features like MultiX1 multiple accounts, and more. This helps users decide if it’s worth trying.

Table of Contents

Part 1: Understanding MultiX1: What It Offers

MultiX1 calls itself an AI, blockchain, and data intelligence platform. It focuses on intelligent data mining and earning with the X1 Network. The site at multix1.com shows sign-up prompts and referral links. Users see promises of 24-hour mining and play-to-earn options.

The Android app, MultiX1 Android app, sits on Google Play. Titled “Multi X1 – X1 Network,” it has low downloads, around 10+. Last update was October 27, 2025. It lets users hold X1 coins in a wallet for profit. This setup draws people seeking passive income.

One key aspect is the MultiX1 app features. It supports MultiX1 multiple accounts. This means running parallel sessions. Think of it as a MultiX1 app cloning tool. Users can manage separate profiles for gaming or social media. For example, MultiX1 gaming account management helps with multiple logins. This ties into earning by handling various tasks at once.

But the core pitch is earning. Promos talk about daily profits from 0.05% to 1.5%. Social posts push “earn anywhere” ideas. Targets include Pakistan and India. Referral codes like ?ref=MX007041 show affiliate focus.

1.1 Ownership Details and Background Check

Ownership links to TRANGO DREAMS LLC. This comes from the Google Play listing. The address is 850 Euclid Ave, Ste 819, Cleveland, OH 44114. It’s a shared mailbox suite. Many small firms use it. This raises questions about real operations.

We searched for TRANGO DREAMS LLC owners background. Public records show little. The Ohio business search yields no deep details. No filing dates or agents listed publicly. It seems like a new LLC with no history. No LinkedIn profiles for owners. No past projects tied to them.

This lack of transparency worries investors. Real companies share team info. Here, it’s hidden. Domain privacy on multix1.com hides more. No WHOIS data helps. For a platform handling money, this is a big issue.

Compare to known firms. They list founders with experience. MultiX1 does not. This suggests a shell entity. Users should check registries like the Ohio Secretary of State themselves.

Part 2: Breaking Down the MultiX1 Compensation Plan

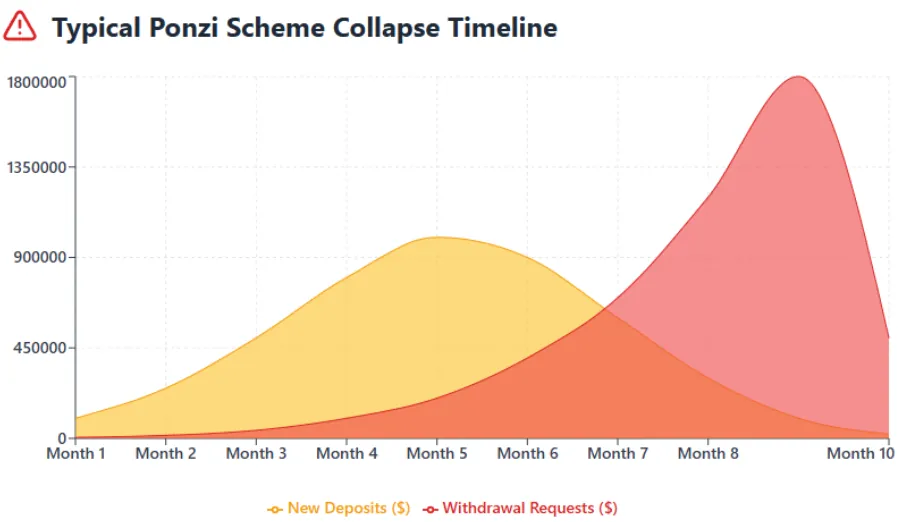

The compensation plan drives user interest. It’s built on referrals, mining, and holding. No exact ROI on the site. But promos imply high yields.

Referrals form the base. Users get codes to recruit others. This creates a multi-level structure. You earn from recruits’ activities. It’s like MLM. Growth depends on bringing in more people.

Mining and holding add layers. “24-hour mining” promises ongoing rewards. Hold X1 coins for profit. Social posts claim 0.05% to 1.5% daily. This sounds good. But details are lacking.

How to clone apps using MultiX1 fits here. The app acts as a MultiX1 dual-space app. It lets you run multiple accounts. This helps in managing social media accounts with MultiX1. Or running multiple WhatsApp accounts with MultiX1. For earnings, it means handling more tasks. Like in play-to-earn games.

But no clear revenue source. No audited contracts. No on-chain proofs. Payouts seem custodial. The team controls funds.

MultiX1 premium/VIP features explained in promos. Higher tiers offer better returns. But this locks the money longer. Auto-reinvest often appears. Users report issues turning it off.

MultiX1 data separation between cloned apps is key. Each account stays independent. This aids privacy. But for investments, it doesn’t fix core problems.

2.1 Why the Promised Returns Don't Add Up: Math Proof

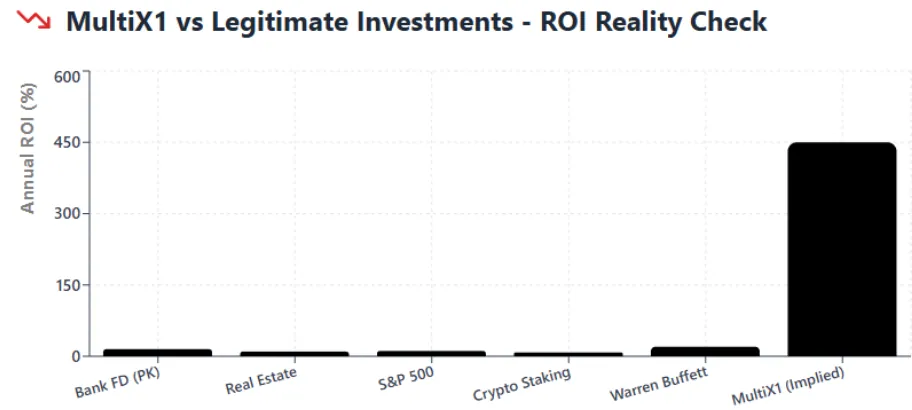

High returns sound tempting. Let’s use math to check. Assume 1% daily, a common claim.

Start with $100. Formula: Final = Principal × (1 + rate)^days.

After 365 days: $100 × (1.01)^365 ≈ $3,778.

That’s over 37 times growth. No real business sustains this.

At 0.5% daily: $100 × (1.005)^365 ≈ $598.

Still too high. At 1.5%: $100 × (1.015)^365 ≈ $22,914.

These need endless new money. It’s Ponzi-like. Payouts come from deposits, not profits.

Real mining costs energy. Yields vary. Small users often lose.

Daily Rate | 1-Year Growth on $100 | Annual Equivalent |

0.05% | $120 | 20% |

0.5% | $598 | 498% |

1% | $3,778 | 3,678% |

1.5% | $22,914 | 22,814% |

2.2 Comparing MultiX1 to Safer Options

MultiX1 vs other app cloning apps comparison matters. For cloning, apps like Multi-Parallel exist. They focus on accounts, not earnings.

For ROI, compare to banks. Pakistan banks offer 8-10% yearly. Safe and regulated.

Real estate: 4-7% from rents. Backed by assets.

Crypto staking: 3-10% on exchanges like Binance. Verifiable.

MultiX1 outliers scream risk. Legit options disclose dangers.

Part 3: Traffic Trends and Public Views

Traffic is low. No SimilarWeb data. Domain is new, few backlinks.

Public perception: No Trustpilot for MultiX1. But MintX1, similarly, has complaints. Blocked withdrawals are common.

Social promoters: Facebook pages like “Multi X1 Official.” Instagram reels push joins. Accounts are new, low engagement.

Other sites promoted: Some push color trading or forex. Patterns match HYIPs.

MultiX1 app reviews from users: Scarce. Promos dominate.

3.1 Security, Privacy, and User Experience

storage for funds.

MultiX1 user privacy policy explained on the S3 bucket. It’s basic. No GDPR notes.

MultiX1 app permissions and security analysis: It needs access for cloning. But for money, this risks data.

MultiX1 user experience varies. App crashes? Troubleshooting MultiX1 login issues helps. But no widespread reviews.

MultiX1 app size and battery usage review: Lightweight. But earning claims overshadow.

Is MultiX1 safe for gaming account management? For cloning, maybe. For investing, no.

Red Flags and DYOR Tools

Key red flags:

- Vague earnings model.

- Referral-heavy.

- No licenses.

- Shell ownership.

- Unsustainable math.

- MintX1 parallels.

Online tools:

- ScamAdviser: Average-good for hygiene.

- Trustpilot: None for MultiX1.

- WHOIS: Private.

- Google Play: Low downloads.

MultiX1 updates and new features timeline: Recent, but no roadmap.

Alternatives to MultiX1 for app cloning: Multi Parallel, Clone App.

Recommendations for Users

Test small. Disable auto-reinvest. Withdraw early.

How to install MultiX1 safely: From the Play Store.

How to back up MultiX1 app data: Use the built-in if available.

MultiX1 compatibility with the latest Android versions: Seems fine.

MultiX1 multi-device support: Unknown.

For investments, avoid. Seek regulated options.

Future: Likely short-lived. Complaints may rise by 2026.

Conclusion

This MultiX1 review highlights risks. Ownership lacks depth. Compensation relies on referrals and shaky returns. Features like cloning add value, but earnings claims fail math tests. Do your own research. Consult experts. Stay safe in 2025 investments.

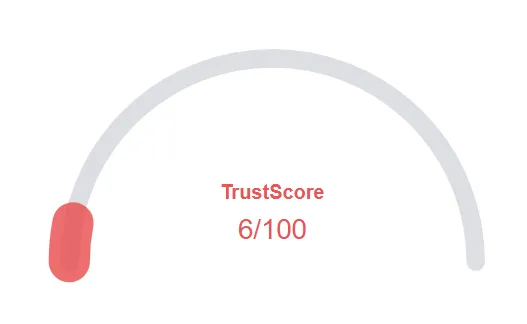

MultiX1 ReviewTrust Score

A website’s trust score is an important indicator of its reliability. MultiX1 currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the MultiX1 or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About MultiX1 Review

This section answers key questions about the MultiX1, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

MultiX1 shows hidden ownership and unrealistic ROI, suggesting it’s a high-risk, referral-based scheme.

It depends on recruiting users, with payouts from deposits rather than real trading or mining.

No verified mining proof exists; claimed returns are mathematically unsustainable.

Use regulated investments like banks, crypto staking, or licensed brokers instead.

Both platforms rely on MLM-style referrals and lack verified revenue sources.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.