Mkt Investing Review 2026: A Detailed Look at This Trading Platform

In 2026, online trading platforms continue to attract attention from people looking to enter the Forex, CFDs, and cryptocurrency markets. Mkt Investing presents itself as a professional broker offering access to thousands of instruments. This Mkt Investing review, published by Scams Radar, examines the available evidence to help readers understand whether the platform is trustworthy or carries serious risks.

Table of Contents

Part 1: Platform Overview and Key Features

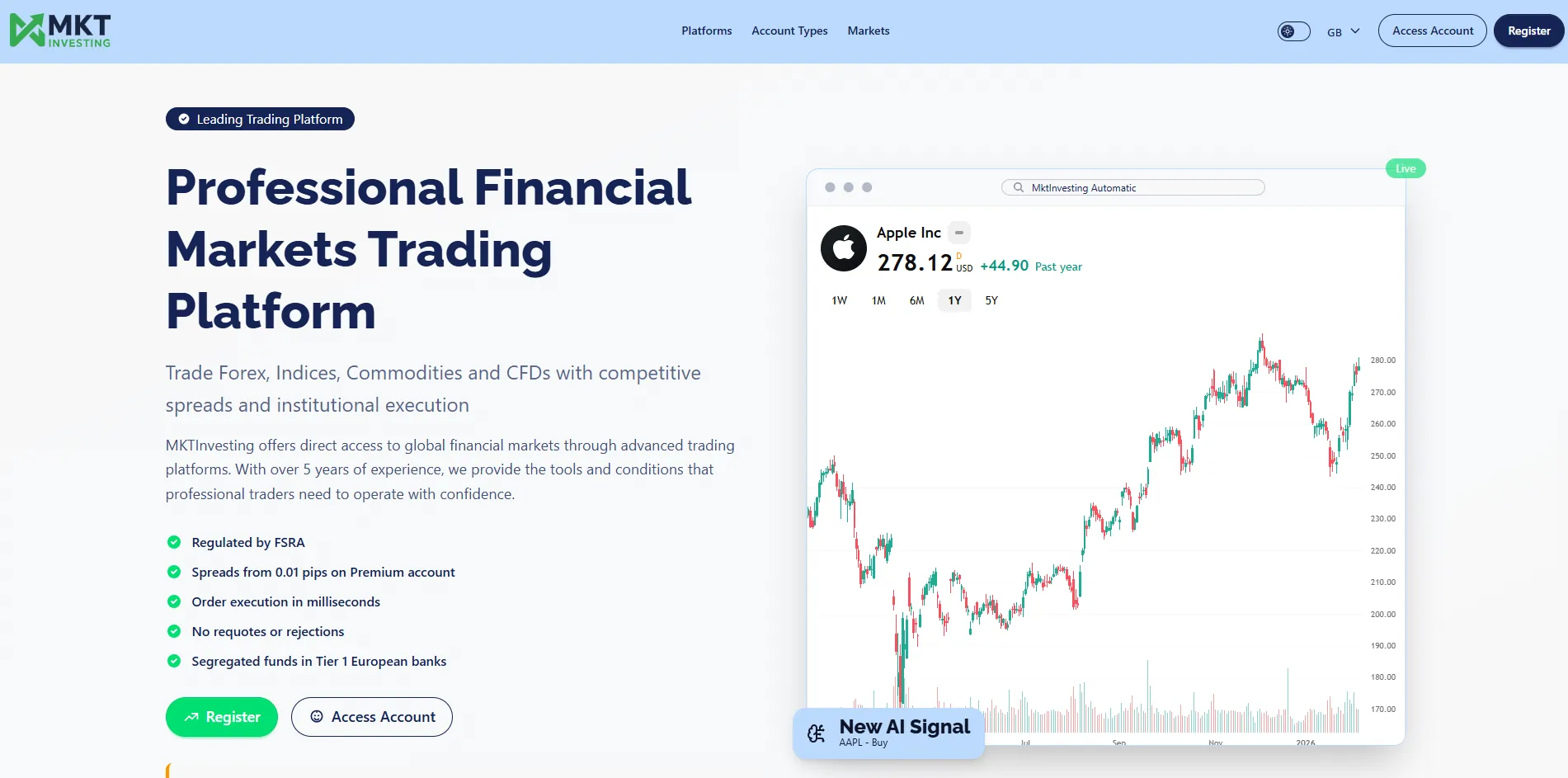

MktInvesting markets itself as an established CFD broker with tools for trading Forex pairs, stock indices, commodities, cryptocurrencies, and shares. The site highlights features such as:

- Over 5,000 trading instruments

- Leverage up to 1:500 on professional accounts

- 24/7 cryptocurrency trading

- AI-based trading signals

- Economic calendar and charting tools

- Multiple account types with minimum deposits starting at €250

The platform uses a white-label trading interface and redirects users to a separate client portal for login and trading. Basic security measures like SSL encryption are in place, and the site mentions segregated client funds and negative balance protection.

However, several basic elements appear incomplete. Statistics on the homepage show “0 Active Clients,” “0 Monthly Volume,” and similar placeholder values. A short-term returns calculator is present but often displays zero results even when users enter values.

1.1 Regulation and Licensing Status

Regulation is the most important factor when choosing a broker. MktInvesting claims regulation by the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market with license number 2025-00161.

Official checks tell a different story:

- The ADGM FSRA issued a public alert in early 2026 stating that the platform is not licensed and has never been licensed by them.

- The license number does not appear in the official FSRA public register.

- Spain’s CNMV listed the domain among unauthorized entities in January 2026.

These direct regulatory warnings are serious red flags. Legitimate brokers hold verifiable licenses from respected authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Part 2: Ownership and Company Background

Transparency about ownership builds trust. Unfortunately, MktInvesting provides almost no clear information in this area.

- Domain registration details are hidden behind privacy protection.

- The domain was registered in August 2025, making it less than a year old at the time of this review.

- One regulatory alert references “Mount Nico Corp Ltd” as the operating entity, but no direct connection to a currently regulated company can be confirmed.

- No names of directors, executives, or founders are listed on the site.

- Contact details are limited to a generic email address with a misspelled domain name.

Established brokers typically disclose their legal entity, registration number, and office address. The lack of this information is a common warning sign.

2.1 Account Types and Trading Conditions

The platform offers tiered accounts with increasing minimum deposits:

Account Type | Minimum Deposit | Key Features Mentioned |

Basic | €250 | Standard tools, lower leverage |

Standard | €2,500 | Improved conditions, more signals |

Premium/Automatic | €10,000 | Highest leverage, automated systems |

Spreads are advertised as very tight (from 0.01 pips in some places), and execution speed is emphasized. However, independent verification of these conditions is difficult without regulation.

2.2 Returns, Risk, and Mathematical Reality

MktInvesting does not promise fixed daily or monthly returns. It operates as a CFD broker, meaning profits or losses come from market movements and leverage.

Still, the presence of a returns calculator that accepts user-input monthly rates (for example, 5%) creates confusion. Here is a simple breakdown of what 5% monthly compounding would produce:

Period | Initial €1,000 Becomes | Total Gain |

1 year | €1,795 | 79.5% |

3 years | €5,750 | 475% |

5 years | €18,679 | 1,768% |

Real-world comparison of sustainable annual returns:

Investment Type | Typical Annual Return | Risk Level |

Bank savings/CDs | 2–5% | Very low |

Global stock index funds | 7–10% | Moderate |

Professional hedge funds | 12–20% | High |

Top historical performers | Up to ~39% | Very high |

Implied 5% monthly calculator | ~80% | Impossible |

No legitimate trading strategy delivers consistent high monthly returns without significant drawdowns. CFD trading statistics show that 70–80% of retail accounts lose money.

Part 3: User Experiences and Complaints

Independent review platforms show limited but consistently negative feedback:

- Reports of delayed or blocked withdrawals

- Requests for additional deposits or fees before releasing funds

- Difficulty reaching responsive support

- Accounts showing profits that cannot be withdrawn

Traffic analysis tools indicate very low visitor numbers, which is unusual for a genuine broker with active clients.

Part 4: Security and Technical Assessment

The site uses standard HTTPS encryption, which is now common even on questionable platforms. Claims of segregated funds in Tier-1 banks and an investor compensation fund up to €20,000 cannot be verified without proper regulation.

No evidence of third-party security audits or insurance documentation is provided.

Red Flags Summary

The site uses standard HTTPS encryption, which is now common even on questionable platforms. Claims of segregated funds in Tier-1 banks and an investor compensation fund up to €20,000 cannot be verified without proper regulation.

No evidence of third-party security audits or insurance documentation is provided.

Alternatives to Consider

Traders seeking reliable platforms should look for brokers regulated by Tier-1 authorities. Well-known options include:

- Interactive Brokers (multi-asset, strong regulation)

- IG Group (established CFD provider)

- Saxo Bank (professional-grade tools)

- Regulated cryptocurrency exchanges like Coinbase or Kraken for direct crypto exposure

These platforms offer verifiable licenses, transparent fees, and established track records.

Conclusion

After examining regulatory records, website details, user reports, and mathematical realities, MktInvesting raises multiple serious concerns. The official warnings from financial authorities, combined with transparency issues and withdrawal complaints, make it a high-risk choice. Potential users are strongly advised to avoid depositing funds and instead select brokers with proven regulation and clear corporate governance.

Always verify licenses directly on official regulator websites and never invest money you cannot afford to lose.

Mkt Investing Review Score

A website’s trust score is an important indicator of its reliability. Mkt Investing currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Mkt Investing or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Mkt Investing Review

This section answers key questions about Mkt Investing, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. The ADGM FSRA has explicitly stated that the platform is not licensed by them.

The basic account starts at €250, with higher tiers requiring €2,500 and €10,000.

Yes, multiple users report delays, additional fee requests, or the inability to withdraw profits.

It is mentioned on the site, but without regulation, the claim cannot be independently confirmed.

Recovery is difficult with unregulated platforms. Contact your bank immediately if payments were made by card or wire.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.