On November 6, 2025, iGenius, a subsidiary of Investview, Inc., announced its latest CoinPro iteration, partnering with Blue Square Wealth to provide Cforce automated trading strategies executed via 3Commas per. This marks the third evolution of CoinPro, launched in mid-2024 with CoinRule (UK firm), then 3Commas (Estonian/BVI entity) in July 2025, per. CoinPro requires a $1,599.99 entry fee plus $224.99 monthly, promising passive returns through crypto trading, but neither iGenius, Investview, 3Commas, nor Blue Square Wealth is registered with the SEC or CFTC for such offerings, per SEC and CFTC databases.

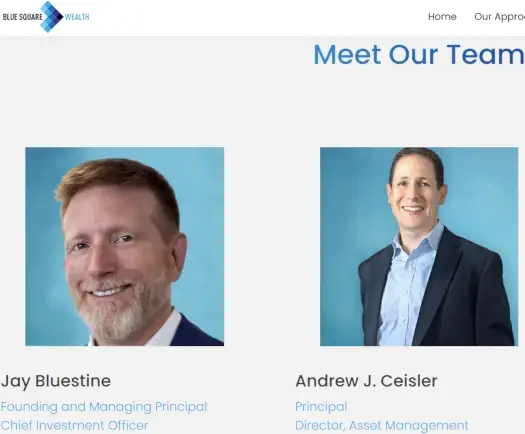

Blue Square Wealth, a New York-based firm led by Jay Bluestine, is affiliated with Blue Square Asset Management, an SEC-registered investment adviser, but its registration does not cover providing crypto trading strategies or signals for automated platforms like 3Commas Under the Investment Advisers Act of 1940, advising on securities requires specific registration, and crypto trading falls under this if deemed securities, per. Bluestine‘s CFTC registration is as an investment adviser, not a broker, and his history includes a 2018 termination from Raymond James for unauthorized client introductions and a 2020 $5,000 fine/suspension for undisclosed loans, per the NFA BASIC database. 3Commas, operated through 3C Trade Tech Ltd (BVI), lacks SEC or Estonian FI registration.

Investview’s SEC filings (last 10-Q on August 13, 2025) omit CoinPro partnerships, violating disclosure rules. Offering passive returns via automated crypto trading requires CFTC registration as a Commodity Trading Advisor (CTA) or broker, which Investview, iGenius, Blue Square, and 3Commas lack. CoinPro’s disclaimer, “Cforce is managed by Blue Square Wealth, executed via 3Commas, independent third-parties, “does not absolve affiliation, as they are integral to the unregistered scheme. Investview settled the Apex fraud with the SEC in January 2025 and the Kuvera Global fraud with the CFTC in 2018, yet continues unregistered trading.

CoinPro targets global affiliates, excluding Canadians due to August 2025 settlements with Ontario and Quebec, evidencing awareness of illegality, per. 3Commas’ direct consumer access and Blue Square’s strategies form a fraud triangle: unregistered securities (SEC) and commodities (CFTC), per. Investor losses could mirror Forsage’s $340M, per. BTC ($113,234) and ETH ($4,070) remain stable, but CoinPro erodes trust in DeFi, per CoinMarketCap. Victims should report to the SEC (sec.gov) or CFTC (cftc.gov).

Verify firms via SEC EDGAR and NFA BASIC, avoiding unregistered trading, per. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. iGenius may face SEC/CFTC enforcement, potentially yielding refunds, but innovation suffers from such schemes.