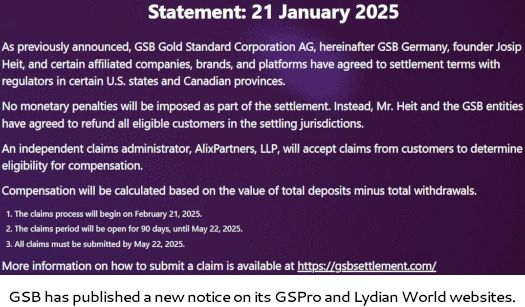

On January 21, a fresh notification went online on the GSB websites for Lydian World and GSPro.

The document states that on February 21st, the GSB victim claims procedure will start.

Until May 22nd, victims of GSPartners will be able to file claims for money they lost to any GSB investment plan. This deadline is challenging.

Although GSB provided this information, the dates have not been verified by AlixPartners, the third-party responsible for managing the GSB victim claims procedure.Thirty-five jurisdictions are involved in the GSB settlement as of this writing:

Until May 22nd, victims of GSPartners will be able to file claims for money they lost to any GSB investment plan. This deadline is challenging.

Although GSB provided this information, the dates have not been verified by AlixPartners, the third-party responsible for managing the GSB victim claims procedure.

Thirty-five jurisdictions are involved in the GSB settlement as of this writing:

Customers in the US and Canada are unable to keep their certificates and get incentives like interest.

Don’t trust anybody who tells you differently.

Customers in the US and Canada are likewise unable to switch to a new product. Residents of the US and Canada will not be able to purchase products from GSPro+ and DAO1.

Once again, don’t trust anybody who tells you differently.

This platform will only be accessible to users outside of Canada and the United States.

The fraudulent investment plan of GSPartners is being carried on by GSPro+ and DAO1.

Even though GSPartners (Australia, South Africa, the Bahamas, and New Zealand) have been the subject of worldwide regulatory fraud alerts, GSB seems determined to go on defrauding customers outside of North America.

Additionally, the GSB released a statement that contradicts official NA regulator communications:

The GSB entities and Mr. Heit will agree to stop providing or selling unregistered securities in the settling countries when the settlement is finalised, without acknowledging or disputing any legal infractions or the fact that any product the GSB businesses provide is a security.

Neither Mr. Heit nor the GSB businesses are required to make any factual or legal admissions under the terms of the settlement.

TSSB has already confirmed that when the settlement’s reimbursement component is finished,

GSB Group and Mr. Heit will agree to the entry of an enforcement order that finds the respondents unlawfully marketed and/or sold securities that were not registered in accordance with state law, provided that they are able to restore deposits to customers as required under the term sheet.

We’ll keep you informed if there are any new developments.

The claims date of February 21st has been validated by the British Columbia Securities Commission and the Arizona Corporation Commission.

from the AZCC

Through a claims procedure run by a third-party administrator, AlixPartners, LLP, qualified clients may be able to recover the value of their deposits with GS Partners minus the value of any withdrawals.

Mr. Heit and the Respondent businesses will file a consent order stating that they offered and/or sold securities that were not registered under state law when the money have been successfully restored to qualified clients.

A secure platform for submitting claims will be accessible starting February 21, 2025.

The GSB Settlement webpage has not been updated as of this update.

The same “21 January 2025” notification has been posted by Josip Heit on his own website:

The claim dates of February 21 and May 22 have also been certified by the Securities Commissions of Alberta and Alabama.

Investors in GSB and GSPartners have been instructed to “check your emails” by Joe Rotunda, Enforcement Director of the Texas State Securities Board:

The GSB Settlement webpage has not been updated as of this update.

There are no reviews yet. Be the first one to write one.