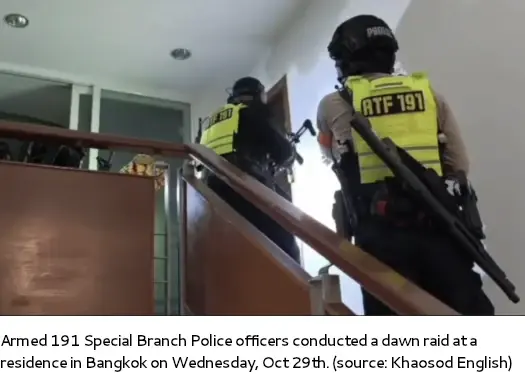

On October 29, 2025, Liang Ai-Bing, a key administrator of the Fintoch Ponzi scheme, was arrested in Bangkok, Thailand, at a luxury home office in Wang Thonglang district, where he had been living alone since December 2024, per Khaosod English. Thai police discovered him at a workstation surrounded by electronic devices; he surrendered without resistance. Authorities seized an unlicensed Beretta pistol and 20 rounds of ammunition, leading to charges of illegal possession and illegal entry as a foreign national, per Thai Examiner. This arrest followed an international warrant from Chinese authorities, who had previously detained another Fintoch admin in China, per. X posts from @CryptoLawyerz note the coordination as a “major win for cross-border fraud enforcement,” per [post:0].

Fintoch, launched in 2022, was an MLM crypto Ponzi scheme fronted by U.S. nationals Mike Provenzano and Joel Fry, but operated by Chinese scammers Al Qing-Hua, Wu Jiang-Yan, Tang Zhen-Que, and Zuo Lai-Jun, believed to run from Southeast Asia, per. The scheme promised high returns on “crypto investments” but collapsed in May 2023, locking out users. Chinese investigations, triggered by local victim reports, revealed $14 million in losses from 100 victims in China alone, per. Three admins fled China after learning of the probe, with Zuo Lai-Jun arrested there; the others are at large, possibly in Southeast Asia or Dubai, per. Global losses from Fintoch and its SCF Finance reboot (collapsed October 2023) are estimated at $100M+, per. Regulatory warnings came from Singapore, Malaysia, Canada, and California, per.

Thai authorities are coordinating with China for Liang Ai-Bing’s extradition, per Khaosod English, potentially uncovering more about the network’s operations. This follows a pattern of international pursuits, similar to Forsage admins’ arrests in 2023, per. Fintoch primarily targeted non-Chinese users but locked out Chinese investors first, then global ones 24 hours later, per. The arrests signal escalating global enforcement against MLM Ponzi schemes, with SEC and DOJ investigations into similar U.S.-fronted operations, per. Bitcoin (BTC) ($102K) and Ethereum (ETH) ($3,200) remain stable, but the crackdown could deter DeFi participation in emerging markets, per CoinMarketCap. X sentiment from @CryptoPatel warns “more arrests coming—stay away from MLM crypto,” per [post:1].

Investors should verify platforms via sec.gov or FATF databases and avoid MLM schemes promising high returns. Fintoch’s collapse highlights risks in unregulated crypto staking and yield farming, per. Diversify into USDC or ETH with stop-losses below BTC’s $98K, per TradingView. Track extradition updates on thaiembassy.org and follow @TheBlock__ on X for crypto fraud news. Global losses from such schemes exceed $1B annually, per Chainalysis, underscoring the need for regulatory vigilance in 2025, per.