Platforms such as TradeHouseBot assert that they provide up-to-date technology and profitable investment opportunities in the quickly changing realm of cryptocurrencies and automated trading. But not every platform is made equally. This thorough analysis uses technological, ethical, mathematical, and factual reasoning to examine TradeHouseBot’s operations, hazards, and warning signs.

TradeHouseBot does not offer easily accessible customer service channels, such live chat, phone numbers, or email addresses. A serious warning sign for any service-oriented platform is the absence of support infrastructure, which keeps users from asking for help or fixing problems.

The average loading time for the website is 884 milliseconds. Technical stability is dubious, though. Scamadviser reports indicate server dependability difficulties by marking the website as intermittently unavailable (error 503).

TradeHouseBot asserts that it can automate trading in bitcoin, FX, and other financial markets using AI-powered algorithms. It does not, however, offer specific ROI numbers. Lack of clear ROI forecasts frequently indicates a dependence on Ponzi-style schemes, in which new investors finance early returns instead of actual trading gains.

TradeHouseBot has traits with previous HYIP frauds, which usually run for three to six months before taking investor money and disappearing. TradeHouseBot could exhibit this behaviour given its low traffic and trust score.

Numerous warning signs are revealed by the study, such as a lack of transparency, technological difficulties, and a significant probability of Ponzi-like activities. Investors must to proceed with utmost caution and take into account the following suggestions:

Due diligence is crucial in the field of automated trading. TradeHouseBot displays a number of red flags that correspond with well-known fraud trends. Investors should put their security first and refrain from using the platform until its authenticity has been established beyond a reasonable doubt. Keep in mind that if anything seems too good to be true, it most often is.

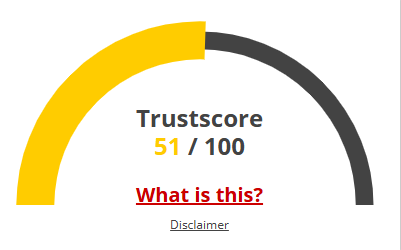

Given Tradee House BOT Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Tradee House BOT, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

There are no reviews yet. Be the first one to write one.