Dollar Defai Review: A Close Look at This DeFi Platform in 2026

In this Dollar Defai review, we explore the platform’s key features, including its compensation plan and owner details. Launched on the Binance Smart Chain, Dollar Defai offers USDT yield through daily ROI and smart contracts. We aim to provide clear insights for those considering DeFi options, such as this BSC DeFi setup.

For more in-depth investigations and transparency reports on similar platforms, visit Scams Radar for additional resources and internal analysis.

Table of Contents

Understanding Dollar Defi as a DeFi Platform

Dollar Defai positions itself as a decentralised finance option focused on passive income. Users connect via MetaMask or similar wallets to deposit USDT on the BEP-20 network. The site ties its earnings to PancakeSwap LP activity, claiming to deliver real yields from high trading volumes. Minimum entry is 10 USDT, with options for compound earnings and referral programs.

The platform runs on immutable contracts, meaning once deployed, changes are limited. This appeals to those seeking secure, automated setups. However, transparency remains key in any Dollar Defai review, especially for new users who are asking whether Dollar Defai is a scam or legit.

Core to its appeal is the promise of steady gains. Daily returns range from 2.7% to 3.1%, spread over 50 days. This includes a mix of capital return and profit. For example, lower tiers offer about 2% capital plus a 0.7%-1.1% daily ROI. Higher investment slabs unlock slight boosts, up to 3.1% total.

To join Dollar Defai BSC, users follow a simple process: connect a wallet, select a slab, and deposit. The site provides a Dollar Defai MetaMask tutorial in its guides, making it accessible for beginners.

Owners' Profiles and Backgrounds

Details on ownership form a critical part of any Dollar Defai review. The platform lacks named founders or executives. No public profiles appear on the site or linked channels. Domain records show registration in January 2026, with privacy protection obscuring the registrant’s information. This setup, common in DeFi, uses services like Namecheap for hosting.

Background checks reveal no LinkedIn ties or company registrations. The team remains anonymous, a choice some projects make for decentralisation. However, this raises questions about accountability. Third-party scans note the site’s youth and hidden WHOIS as factors in low trust scores, around 25-27/100 from tools like Scamdoc and GridinSoft.

In comparison, established DeFi platforms often list teams with crypto experience. Here, the focus shifts to community channels, such as the Dollar Defai Telegram group, for updates. Support comes via @DollerDeFAI_Support and announcement feeds, filling the gap left by absent profiles.

Breaking Down the Compensation Plan

The compensation plan drives much of the interest in Dollar Defai. It blends direct investment returns with network building. Let’s examine it step by step.

Investment Slabs and Daily ROI

Users choose from seven slabs based on deposit size. This tiered system affects Dollar Defai daily returns.

- Slab 1 (under 2,501 USDT): 2.0% capital return + 1.0% ROI = 3.0% total daily.

- Slab 2 (2,501-10,000 USDT): Slight increase to 3.05% total.

- Up to Slab 7 (over 1,000,000 USDT): Peaks at 3.1% total daily.

Over 50 days, this could yield 150% total return on principal. For a 1,000 USDT deposit in Slab 1, expect about 30 USDT daily, totalling 2,500 USDT payout.

The plan includes Dollar Defai onboarding rewards for new users, like instant bonuses on first deposits. This encourages quick starts.

Referral Program and Leadership Bonuses

A standout feature is the multi-level referral program. It spans up to 25 levels and offers commissions on team deposits.

- Direct referrals: Higher commissions, often 5-10% on level 1.

- Deeper levels: Smaller percentages, down to fractions on level 25.

- Leadership bonuses: Extra rewards for team growth, like volume milestones.

This unilevel structure allows unlimited width, unlike binary or matrix plans. No leg balancing is required, making it straightforward. Users earn Dollar Defai referral commissions by sharing links and building networks for passive income.

Compound Earnings and Regrow Options

The regrow profits Dollar Defai feature lets users reinvest earnings. Instead of withdrawing, compound to boost slabs. This amplifies growth but locks funds longer.

Withdrawals occur daily in USDT, with no Dollar Defai withdrawal fees noted in the core docs. However, network gas applies to BSC.

To visualise sustainability, consider this table comparing ROIs:

Investment Type | Annual ROI (Approx.) | Risk Level |

Bank Savings | 4-5% | Low |

Real Estate | 7-10% | Medium |

Ethereum Staking | 3-6% | Medium-High |

PancakeSwap LP | 20-60% | High |

Dollar Defai | 1,095% (at 3%) | Very High |

This highlights how Dollar Defi ROI slabs exceed typical best DeFi USDT platforms 2026 yields.

Security and Audits

Security relies on audits from HazeCrypto and SolidityScan. These checks for code issues, such as vulnerabilities. Reports are linked on the site to verify the smart contract.

Positive notes include valid SSL and on-chain transparency. Yet, audits focus on tech, not economics. Users should check the Dollar Defai smart contract address independently.

Public Perception and Traffic

Early feedback is limited due to the site’s age. No major reviews on Trustpilot or Sitejabber yet. Traffic appears low per scans, but promotions on YouTube and Telegram are building buzz.

Questions like “Is Dollar Defai safe?” or “earn 3% daily Dollar Defai” dominate searches. High-yield DeFi BSC USDT appeals, but caution is advised.

How to Invest in Dollar Defai

For those interested, investing in Dollar Defai starts with a USDT deposit. Connect the wallet, pick the slab, and approve the transaction. Use Dollar Defi USDT deposit guides for steps.

Join Dollar Defai BSC communities for tips. Always start small to test.

Future Outlook

Predictions suggest short-term growth via referrals, but long-term growth depends on inflows. If yields hold, it could attract more. Yet math shows the challenges of sustaining high ROIs without real revenue.

Conclusion: Weighing the Pros and Cons

This Dollar Defai review highlights a platform with appealing features such as daily ROI, referral programs, and compound earnings. Tied to PancakeSwap yield, it offers passive income paths. However, anonymous ownership and high returns raise points worth considering. For USDT yield seekers, verify all via BSCScan. Approach with care, as DeFi carries risks. Research fully before committing.

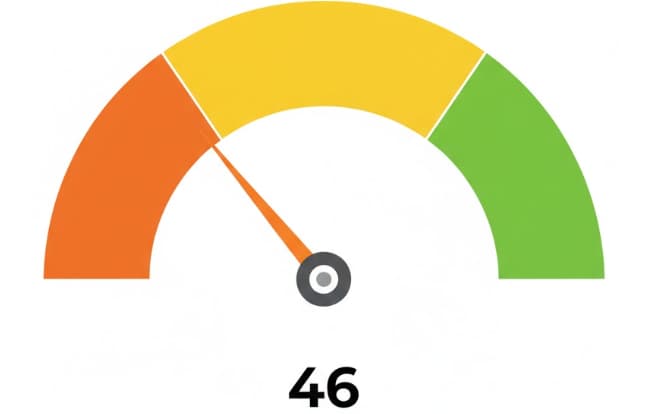

Dollar Defai Review Score

A website’s trust score is an important indicator of its reliability. Dollar Defai currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Dollar Defai or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Dollar Defai Review

This section answers key questions about Dollar Defai, clarifies points, addresses concerns, and highlights issues related to the platform’s legitimacy.

Based on the available data, it shows DeFi traits but lacks transparency into ownership. Check on-chain for yourself.

They range from 2.7% to 3.1% total, including capital and profit over 50 days.

Earn via 25 levels, with bonuses for team building.

These reward growth milestones in your network.

No platform fees noted, but BSC gas applies.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.