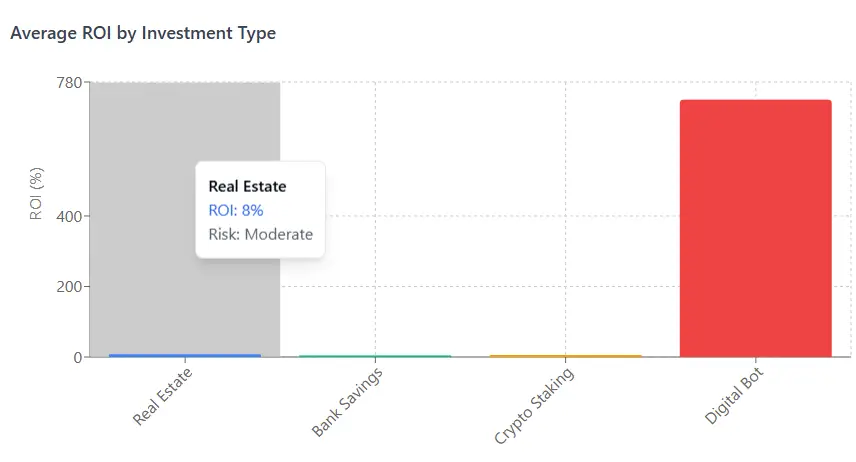

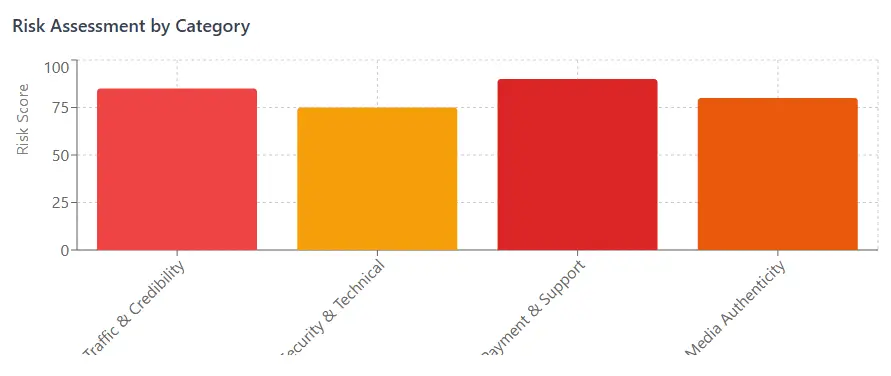

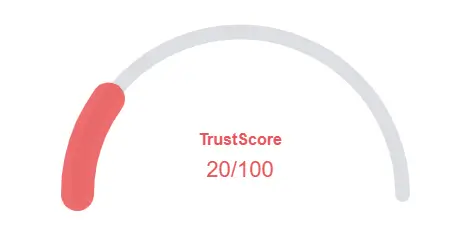

This Digital Bot review concludes that the platform exhibits multiple warning signs, including hidden ownership, an MLM-driven compensation plan, and unsustainable ROI claims. Compared to real estate (6–10% ROI), bank savings (4–5% APY), or crypto staking (4–8% APY), its 365–1,095% annualized returns are implausible. Investors should avoid this platform and prioritize regulated alternatives. Always conduct thorough research before investing.

DYOR Disclaimer: This Digital Bot review is for informational purposes only and not financial advice. Investors must perform their due diligence, consult professionals, and verify platform legitimacy. Cryptocurrency investments carry high risks, and past performance does not guarantee future results.