DesAlpes Review: This thorough examination assesses the reliability of DesAlpes.world, a website that offers cashback and high-yield real estate prospects. We seek to provide prospective investors with straightforward, understandable insights by analysing its ownership information, compensation plan, and major risks. To identify its warning signs and make wise choices, read the Scams Radar study.

DesAlpes World (https://desalpes.world/login) presents itself as a cutting-edge marketplace that offers substantial profits on real estate investments and a cashback-based purchasing strategy. But its lack of openness calls into question its validity. With an emphasis on its ownership history and pay structure, this DesAlpes evaluation compiles important information from several sources to evaluate its reliability.

There is no clear information regarding the company’s founders, leadership group, or registration on the platform. One significant issue is the lack of a credible corporate profile or “About Us” website. Although the website is hosted by Edificom SA in Switzerland and the WHOIS information for the domain is concealed, this does not substantiate its legitimacy.

Reputable investment platforms register with financial regulators such as the FCA or SEC and reveal ownership. Investors have no recourse in issues without these. The absence of a physical address and concealed registrant information further undermine trust and suggest possible deliberate obfuscation.

The platform advertises a 2×20 forced matrix pay model in which each member expands across 20 levels by recruiting two more. According to promotional promises, hiring just two employees may result in a monthly income of nearly $9,751. The website does not, however, provide precise information regarding investment tiers, payout timelines, or percentage returns.

The matrix requires over 2 million members to fill 20 levels, an exponential growth model typical of pyramid schemes. For instance:

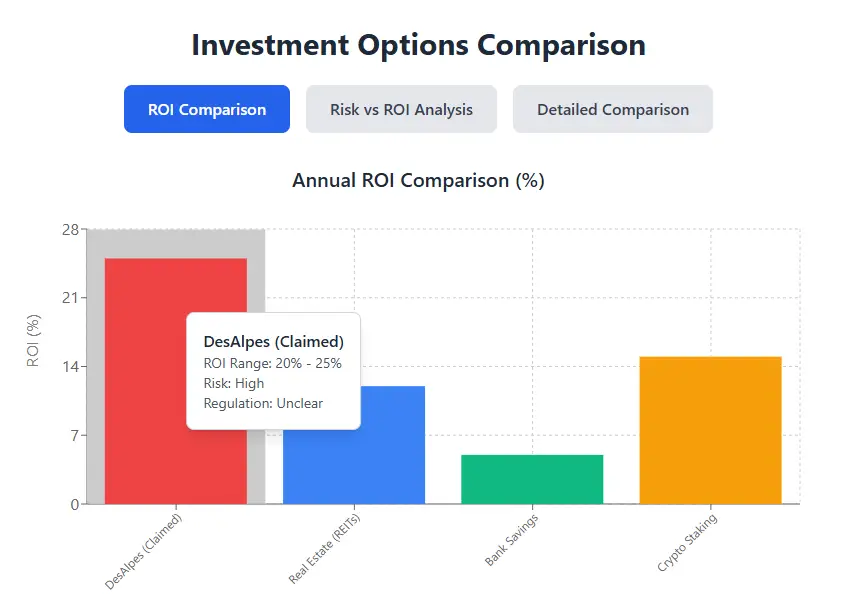

Such growth is mathematically unsustainable, as it relies on constant recruitment rather than genuine profits. Compared to traditional investments:

A hypothetical 20% annual ROI, often implied by such platforms, is unrealistic. Using the compound interest formula for a $10,000 investment over 5 years at 20%:

The gap highlights the improbability of sustained high returns without transparent financials, suggesting a Ponzi-like structure.

Investment Type | Annual ROI (%) | Risk Level | Regulation |

|---|---|---|---|

DesAlpes (Claimed) | 20+ | High | Unclear |

Real Estate (REITs) | 6-12 | Moderate | High |

Bank Savings | 3-5 | Low | High |

4-15 | High | Moderate |

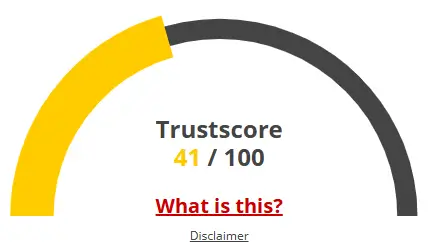

Analysis of traffic using technologies such as SimilarWeb reveals very little information about visitors, which may indicate a fresh launch or poor public recognition. There are no noteworthy evaluations on sites such as Trustpilot or Reddit, and there are no social media references of X. Because of its short domain lifespan and unfavourable customer reviews, Scamdoc gives the website a 1% trust grade.

Despite using HTTPS, the website is devoid of information about more sophisticated security features like GDPR compliance and two-factor authentication. The technical performance is inadequate, the content is general and poorly optimised for mobile devices, and there are no credible testimonials or specific project information.

There is no mention of bank transfers or cryptocurrencies, making the payment options unclear. Insufficient for a financial platform, customer service is restricted to a basic contact form with no phone or live chat options.

Significant dangers are highlighted in this DesAlpes evaluation, such as an unsustainable remuneration scheme, a lack of openness about ownership, and a negative public image. The platform’s high-yield claims are unsupported by reliable evidence, which is a feature of fraudulent schemes. To safeguard their money, investors should give careful study and regulated options first priority. Before making an investment, always get advice from experts.

Disclaimer: Please note that this review of DesAlpes is purely informative. Investors need to check claims, consult experts, and do their own research. Report suspected fraud to authorities such as the FBI IC3 or the SEC, and only invest money you can afford to lose.

These are responses to frequently asked questions about the DesAlpes Networks study’s dependability. To ease any concerns, we’ve included the following questions and answers:

High-yield real estate and cashback opportunities are purportedly available on DesAlpes. Its unsustainable remuneration plan and lack of ownership transparency, however, cast serious doubt on its legality. Before making an investment, do extensive study.

The 2x20 forced matrix used by the platform necessitates exponential recruiting in order to achieve substantial profits, such as $9,751 each month. These models frequently lack explicit payout information, are unsustainable, and resemble pyramid schemes.

An investor red flag is the platform's failure to reveal its founders or company registration. Reputable platforms usually offer clear ownership information to foster confidence and guarantee responsibility.

Red flags, including low trust scores, ambiguous ROI claims, and inadequate openness, are brought to light by a thorough DesAlpes study. It is constantly rated as high-risk in reviews from resources like Scamdoc and Scamadviser.

In contrast to DesAlpes, regulated alternatives such as REITs (6–12% ROI), high-yield savings accounts (3–5% APY), or well-known cryptocurrency exchanges (4–15% APY) provide greater transparency and reduced risk.

Title: Sign In | Des Alpes

There are no reviews yet. Be the first one to write one.