Decentralized finance (DeFi) platforms promise high returns, but not all are trustworthy. This DefiPro review examines the legitimacy of DefiPro.io, a platform claiming to offer lucrative investment opportunities. Scams Radar analyze its ownership, compensation plan, traffic, security, payment methods, customer support, and ROI claims.

DefiPro.io markets itself as a DeFi platform where users can invest small amounts, like $6, and earn massive returns, such as “unlimited BNB” or “7 crores in 7 months.” However, its promises raise concerns. This DefiPro review investigates whether it’s a genuine opportunity or a potential scam.

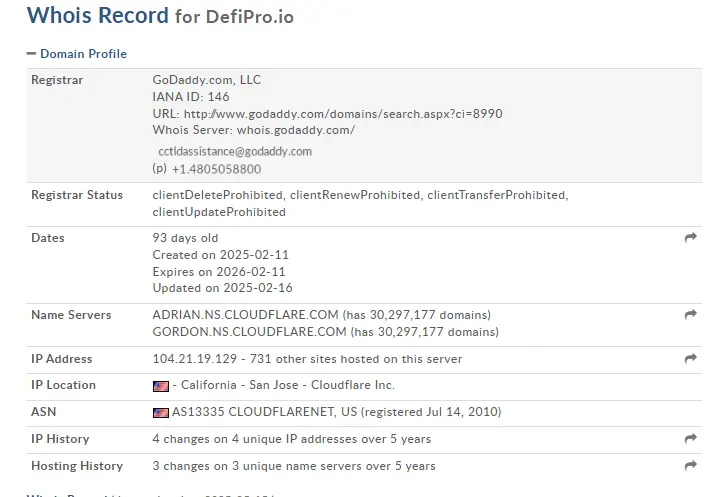

The platform claims to be a “100% decentralized system” with “no owner” or “management control.” No team members, company registration, or legal details are disclosed. A WHOIS lookup shows private domain registration, hiding the owner’s identity. There’s no verifiable link to DeFi Development Corp, a legitimate entity investing in Solana.

Red Flags:

Without clear ownership, investors risk losing funds with no recourse. Legitimate DeFi projects, like Compound, publicly share team details and audits.

DefiPro.io likely uses a multi-level marketing (MLM) structure. Users invest in “liquidity pools” or staking, earning 1-2% daily returns, plus bonuses for recruiting others. Promotional materials promise exponential growth, like turning $6 into $700,000 in seven months.

Let’s break down the math for a 1% daily return:

Formula: Compound interest, ( A = P \cdot (1 + r)^n )

Calculation: ( A = 1000 \cdot 1.01^{365} \approx $37,783 )

Annual Return: 3,678%

For $6 to reach $700,000 in seven months, the monthly return is about 1,166%. This is unsustainable without constant new investor funds, resembling a Ponzi scheme.

Red Flags:

Investment Type | Annual ROI | Risk Level |

DefiPro.io | 365-730% | Extremely High |

Real Estate | 7-10% | Moderate |

Bank Savings | 4-5% | Low |

Crypto Staking | 5-15% | High |

Legitimate DeFi platforms like Aave offer 5-20% APY through lending fees. DefiPro.io’s claims are impossible without a Ponzi structure.

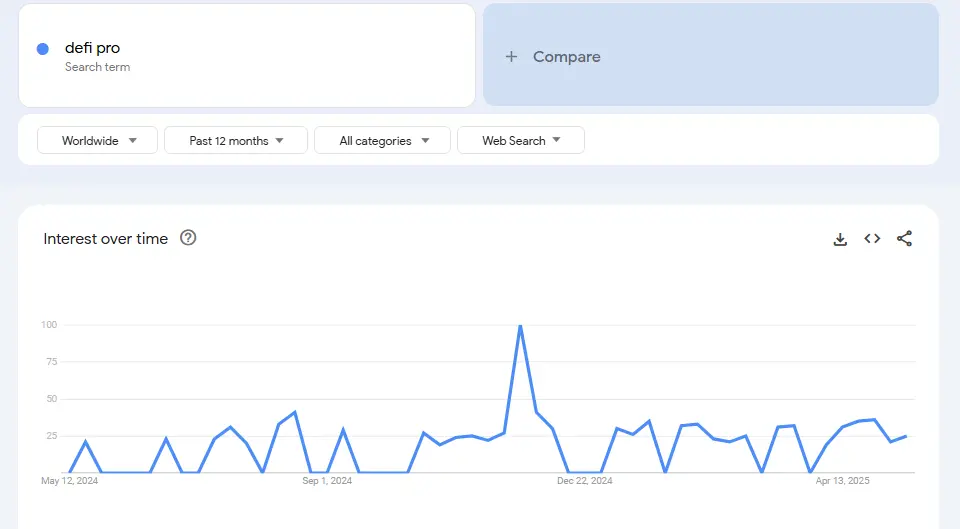

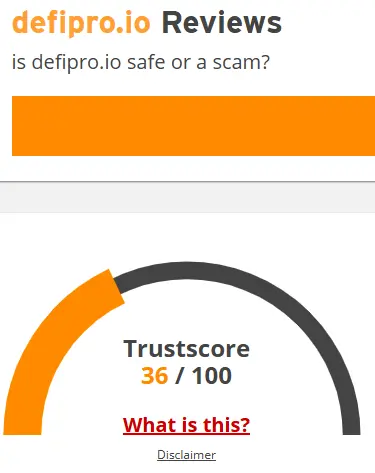

Traffic data from tools like SimilarWeb shows low or inconsistent visits, suggesting limited user interest. Social media hype, often from unverified accounts like @CryptoWealthGuru on X or @DeFiKing2025 on TikTok, drives short-term spikes. ScamAdviser gives it a low trust score, and Reddit discussions warn of DeFi scams.

Red Flags:

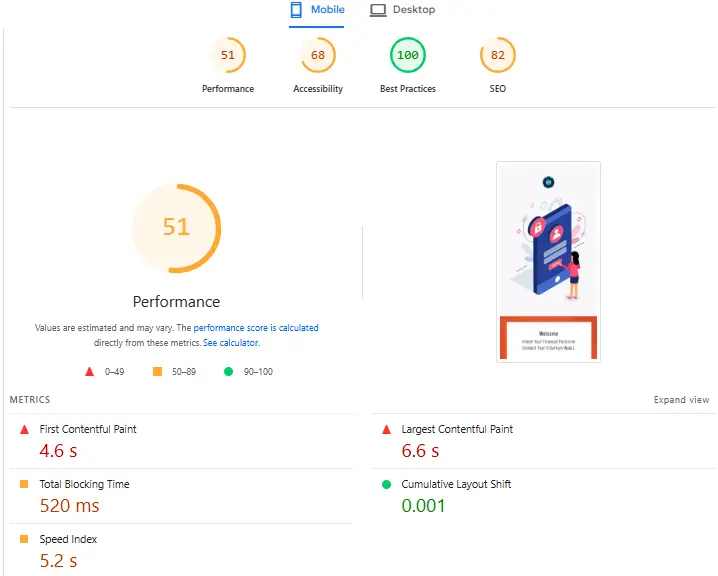

The platform lacks details on security measures like smart contract audits, two-factor authentication, or bug bounties. It uses basic HTTPS but no advanced protocols. Technical performance is poor, with slow load times and no whitepaper or GitHub activity.

Red Flags:

DefiPro.io accepts only cryptocurrencies (e.g., BNB, ETH), with no fiat options or KYC/AML compliance. Customer support is limited to email forms, with no phone or live chat. Users report unresponsive support and withdrawal issues.

Red Flags:

Unverified accounts promote DefiPro.io alongside other dubious platforms like Deffio.com and CryptoPros.io. These accounts use fake engagement, like bot comments, to create hype.

Red Flags:

The absence of reports is concerning. Legitimate platforms are actively audited and tracked.

This DefiPro review reveals serious concerns: hidden ownership, unrealistic 365-730% annual returns, and no audits or security measures. Compared to real estate (7-10%), bank savings (4-5%), or crypto staking (5-15%), its claims are unsustainable, resembling a Ponzi scheme. Investors should avoid it and stick to reputable platforms. Stay vigilant and prioritize safety in DeFi.

Disclaimer: This DefiPro review is for informational purposes only, not financial advice. The DeFi space is risky. Always research using primary sources like whitepapers, audits, and regulatory filings. Consult a financial advisor before investing.

The website being discussed is likely a fake because trust scores are the most crucial metric of a website’s credibility. This website requires extreme caution. This Defi Pro website’s ownership, location, popularity, user reviews, phony items, threats, and phishing attempts are thoroughly investigated.

The answers to frequently asked questions about the validity report of Defi Pro can be found here. To address your concerns, we have provided the following questions and answers:

DefiPro.io raises concerns due to anonymous ownership, lack of smart contract audits, and unrealistic ROI claims (e.g., 365-730% annually). Unlike trusted platforms like Aave, it lacks transparency, suggesting high scam risk. Always research before investing.

Risks include potential fund loss from unaudited smart contracts, withdrawal delays, and a Ponzi-like MLM structure. With no KYC or regulatory compliance, investors have little recourse if issues arise. Stick to regulated platforms for safety.

DefiPro.io claims 1-2% daily returns, equating to 365-730% annually, far exceeding real estate (7-10%), bank savings (4-5%), or crypto staking (5-15%). Such returns are unsustainable, indicating a possible scam.

Public perception is limited, with no coverage from reputable sources like CoinDesk. ScamAdviser gives it a low trust score, and Reddit warns of similar DeFi scams. Unverified social media hype from accounts like @CryptoWealthGuru raises red flags.

Title: Defi Pro

There are no reviews yet. Be the first one to write one.