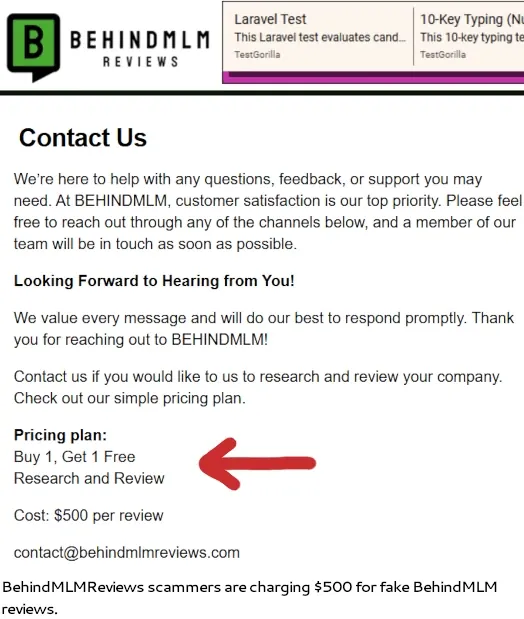

In January 2026, the dormant website behindmlmreviews.com reactivated to publish DAO1 and Apertum marketing spam, impersonating the reputable BehindMLM review platform, per reports. Originally launched in late 2024 as a clone charging $500 for fake reviews, the site went inactive in July 2025 before republishing six articles featuring DAO1 promoters like Holly Hayes, Kelly Nichols, Amanda Flavell, Sarah Percy, Jessica Klinger (J9), Andrew Hawkes (DocDrew), Tony Pipes, and Neil Morrison. This tactic aims to lend credibility to Josip Heit’s schemes by mimicking trusted sources.

DAO1 and Apertum face active fraud warnings from New Zealand’s FMA (January 2025), Australia’s ASIC (February 2025), Germany’s BaFin (October 2025), Latvia, and Lithuania, citing unregistered securities and Ponzi characteristics. Apertum (APTM) serves as a token to launder funds within DAO1, successor to GSPartners’ G999, which collapsed amid $1B+ in alleged losses. Heit, a convicted fraudster hiding in Dubai, settled GSPartners’ claims with U.S. states in 2024, with proceedings ongoing.

Heit’s history includes a Luxembourg conviction, a Croatian money laundering probe, and Forsage ties ($340M losses). DAO1 traffic (July 2025) originates from Germany (45%), the Dominican Republic (27%), the UK (9%), South Africa (5%), and the U.S. (5%), despite U.S. exclusion. DNS records link behindmlmreviews.com to Dmitrijs Babovskis in Latvia, via First Cloud SIA, highlighting coordinated deception.

This impersonation echoes OnPassive’s 2021 fake BehindMLM site, cited in Ash Mufareh’s $32M SEC settlement. Investors should verify sources at behindmlm.com and check regulators like sec.gov, bafin.de, or fma.govt.nz. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, but MLM crypto risks persist. Diversify into USDC with stop-losses below BTC’s $112,000. Follow @TheBlock__ on X for alerts. DAO1’s tactics signal desperation; avoid entirely.