Conectiv Review: A Clear and Honest Breakdown of Membership, Compensation Plan, and Ownership

If you are searching for a detailed Conectiv Review, this guide will help you understand how Conectiv Global works, who owns it, how its compensation plan is structured, and the risks and benefits. This review explains everything in plain language so beginners can understand it easily. For more platform investigations and risk-based breakdowns, you can also explore related reports on Scams Radar.

Conectiv is promoted as a financial education and trading membership platform that combines crypto trading tools, stock alerts, access to a wellness community, and lifestyle perks. But how does the model really work? Let’s break it down step by step.

Table of Contents

Part 1: Conectiv Review: Company Background and Ownership Structure

Conectiv Global operates through Conectiv LLC, which publicly states that it is owned by Investview, Inc. (OTCQB: INVU).

Parent Company: Investview, Inc.

Investview is a publicly traded company. Its listed executives include:

- Víctor M. Oviedo – CEO

- James R. Bell – President & COO

- Ralph R. Valvano – CFO

- Jayme McWidener – CAO

This gives Conectiv a visible corporate parent. However, Conectiv itself does not publish a detailed leadership page for its daily operations team.

1.1 What Conectiv Actually Sells

Conectiv positions itself as a publisher of financial education, not as an investment advisor or broker. It states it does not take custody of funds.

However, marketing references include:

- Crypto strategy managed through Blue Square (3Commas infrastructure)

- Trading scanners

- Stock alerts

- Gold trading insights

- Beginner trading guides

- Financial literacy education

- Debt elimination education

- Personal development tools

This mix creates an image that is both educational and trading-focused.

Part 2: Conectiv Membership Pricing (Clear Table)

Understanding the compensation plan is essential for evaluating sustainability.

Tier | One-Time Fee | Monthly Fee | Key Features |

Basic | $199 | $99 | Entry-level financial education, limited market access |

Core | $299 | $179 | Expanded trading alerts, market calendars |

Plus | $599 | $179 | Crypto scanner access, multi-market tools |

Pro | $1,499 | $179 | Full scanner suite, all markets |

2.1 Important Notes:

- Memberships auto-renew monthly.

- Cancellation must be done before renewal.

- Refunds are limited after renewal.

- Affiliate bonuses may apply depending on rank.

Many people searching for Conectiv membership pricing or Conectiv Pro plan review focus on whether the high upfront cost is justified.

Part 3: Understanding the Conectiv Compensation Plan

Conectiv uses an affiliate-driven structure. While the full compensation PDF is not prominently displayed, third-party reviews and distributor materials suggest the following model.

Likely Structure (Based on Public Promoter Materials)

Component | Description |

Direct Commissions | Earned on personally referred memberships |

Binary Structure | Two-leg team system (left and right) |

Rank Bonuses | Based on team volume requirements |

Fast Start Bonuses | Incentives for early recruitment |

Monthly Renewal Bonus | Ongoing commission from active members |

This resembles a binary compensation model, common in network marketing.

Part 4: Crypto Trading Claims and Sustainability Questions

Conectiv promotes tools such as:

- Conectiv crypto scanner

- Conectiv stock market tools

- Conectiv trading alerts

- Conectiv Gold Trading Insights

However:

- No audited third-party trading performance is published.

- No segregated custody statements are displayed.

No regulator registration for investment advisory is shown.

4.1 Simple Return Comparison Chart

Investment Type | Typical Annual Return |

Bank Savings | 1–5% |

Real Estate | 5–12% |

Crypto Staking | 5–20% |

High-Risk Trading | Highly Variable |

If any promoter suggests very high guaranteed returns, independent verification is essential.

Public Perception and Regulatory Context

Some investigative reports connect Conectiv Global to previous Investview brands that faced regulatory scrutiny.

Documented Regulatory History (Parent Ecosystem)

- SEC settlement involving the Apex program

- CFTC enforcement tied to prior forex programs

- International regulatory decisions linked to related brands

Important clarification:

There is no current public ruling declaring Conectiv a Ponzi scheme.

However, historical regulatory actions within the parent ecosystem increase the need for careful due diligence.

Risk Indicators vs Neutral Indicators

Neutral Indicators

- Publicly traded parent company

- Clear membership pricing

- Compliance page available

- Subscription-based revenue model

Risk Indicators

- Heavy reliance on affiliate bonuses

- Binary compensation balancing rules

- No audited trading performance

- Marketing references to managed crypto strategy

- Limited refund flexibility

Conectiv mentorship complaints found online

Final Verdict: Conectiv Review Summary

This Conectiv Review shows that Conectiv Global is a subscription-based financial education and trading membership platform owned by Investview, Inc.

It offers:

- Financial literacy education

- Crypto trading tools

- Stock alerts

- Lifestyle perks

- Wellness community access

- Affiliate income opportunity

However, potential members should carefully review:

- Compensation structure

- Auto-renew policy

- Refund limitations

- Regulatory history of the parent ecosystem

- Lack of audited performance reports

If you are considering joining Conectiv membership, treat it as an educational subscription, not as a guaranteed income system. Ask for documentation. Compare alternatives. Make informed decisions.

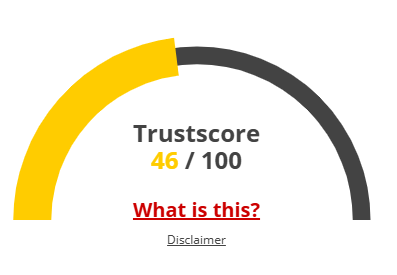

Conectiv Review Score

A website’s trust score is an important indicator of its reliability. Conectiv currently has a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Conectiv or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Conectiv Review

This section answers key questions about Conectiv, clarifies points, addresses concerns, and highlights issues related to the platform’s legitimacy.

Conectiv operates legally as a subscription-based financial education platform. However, due diligence is essential given the parent company's affiliate-driven growth and regulatory history.

It depends on your goal. If you value structured financial education and community, it may offer benefits. If you expect guaranteed trading profits, you should reconsider.

Pricing ranges from $199 to $1,499 upfront, plus monthly fees of $99 to $179.

Refunds are limited, especially after renewals. Always review the Conectiv refund policy before subscribing.

The compliance page says it is a publisher. Marketing mentions strategy infrastructure. Independent verification is recommended.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.