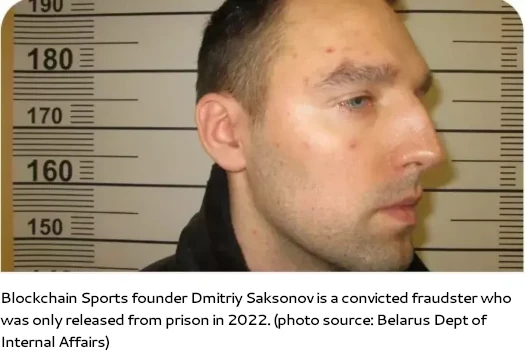

Blockchain Sports, launched in mid-2023 as a crypto Ponzi by Dmitry Saksonov (aka Dima Saksonov), an Eastern European convicted fraudster hiding in Dubai, has evolved into a multi-layered scam, per CoinDesk. Initially marketed as a “football academy” generating revenue, it collapsed through failed tokens SPORTS and FTBLL, per. Partnering with Jeremy Roma, a U.S. national linked to the $1B Daisy Global Ponzi, they rebooted as Limitless in 2024, selling NFT “node positions” up to 100,000 USDT, paying in ATLA tokens, per. X posts from @CryptoScamAlert reveal Saksonov’s team, including Artem Karapetyan (COO) and others, targeted Daisy victims for recovery, per.

Blockchain Sports shifted to “drift pack” investments up to 115,000 USDT, tied to “AI racing” baloney, which flopped amid scrutiny in Belarus, per The Block. ATLA staking promised higher returns but locked tokens for 12 months, releasing monthly over 48 months, preventing cashouts, per. The OTC Platform allowed bag offloading but with similar locks, per. Roma’s August 13 webinar emphasized creating MEXC volume through trading, even junk coins, to manipulate value, per. This setup funnels USDT from investors to insiders like Roma and Saksonov, per.

ATLA launched on MEXC August 17, 2025, peaking at $28M daily volume but showing bot-driven manipulation, with periods of $0 volume when bots were off, per CoinMarketCap. Only 0.12% of ATLA supply is public, leaving 99.88% with insiders for dumping, per. MEXC, with fraud warnings from Japan, Ontario, Malaysia, Spain, Hong Kong, Quebec, British Columbia, Austria, UK, and Germany, enables the exit-scam, per BaFin. Roma called MEXC his “favorite exchange” for laundering, per. X posts from @ScamDetector warn of insider pumps before retail dumps, per.

Blockchain Sports‘ low traffic (~2,900 monthly visits, mostly Belarus, U.S., Germany) indicates waning interest, per SimilarWeb. Tied to Daisy’s collapse, it’s flagged as a Ponzi by regulators, per SEC filings on similar schemes. Investors face locked funds and manipulated values, with no real revenue beyond new investments, per. Outlook: ATLA could crash post-dump, mirroring Forsage’s $340M loss, per DOJ. Avoid; report to sec.gov or local authorities. Diversify into USDC or ETH ($4,448) with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates.