BitradeX Review 2026: Evaluating This AI Crypto Trading Platform

People often look for smart ways to trade digital assets, especially as AI-powered tools promise easier profits in volatile markets. This BitradeX review examines the platform closely, covering its features, leadership, returns, and potential risks. The analysis is based on publicly available information and insights commonly referenced on Scams Radar, helping readers make more informed decisions before investing.

Table of Contents

Part 1: Ownership and Company Background

Clear leadership builds trust in any crypto exchange. BitradeX mentions a CEO named Nikolai Bonello Jenkins in promotional interviews. He appears in videos as a marketing expert with past roles in finance teams.

A UK company called BITRADEX FINTECH LIMITED was registered in March 2025. It shares a similar name, but no direct proof links it to the trading site. Some materials claim operation by BitradeX SG Pte. Ltd. in Singapore.

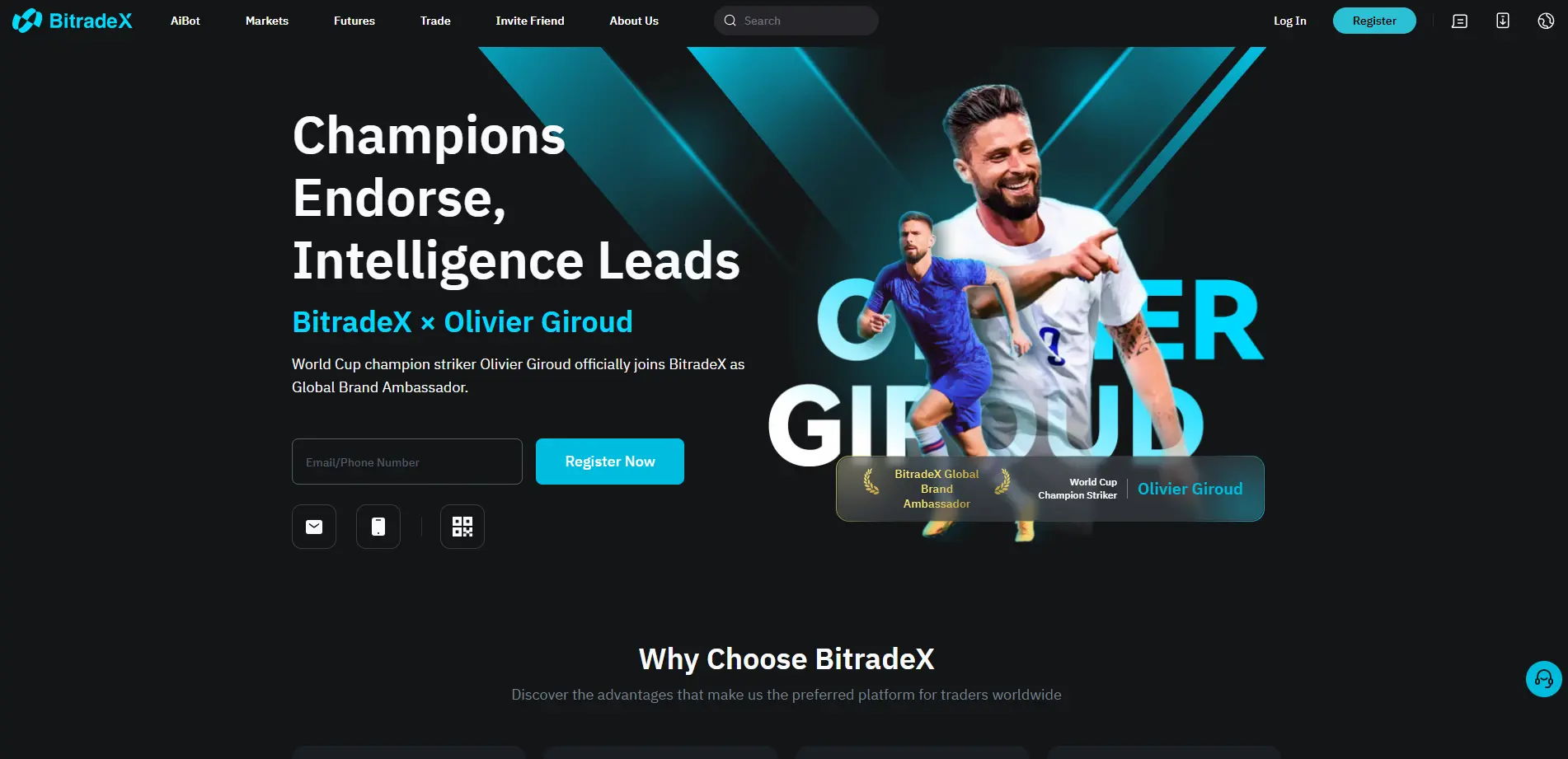

French footballer Olivier Giroud serves as a brand ambassador. This is a paid promotion, not ownership. WHOIS records hide domain owners. No full team bios or verified histories appear on the site.

1.1 Key Features and AI Trading Tools

BitradeX positions itself as a global digital asset platform. It offers spot trading, futures, and an AI Bot for automated strategies.

The AI Bot uses quantitative models with risk controls. Examples show potential annual returns around 178%, but disclaimers stress these are not guarantees.

Other tools include a BTX Card for spending and a claimed Protection Pool to cover shortfalls. Deposits and withdrawals work with major cryptos. Reported daily volume reaches billions, suggesting active use.

Part 2: Compensation Plan and Referral Structure

Many users join for passive income options. BitradeX combines trading with a multi-level referral system.

Direct referrals earn 10% of downline AI Bot profits. Indirect ones pay 5%. VIP levels go up to VIP6, offering higher commissions based on team size and investment volume.

Level | Commission Type | Rate Example | Qualification Needs |

Direct | From immediate referrals | 10% of earnings | Basic signup |

Indirect | Second level | 5% of earnings | Active direct line |

VIP Ranks | Differential bonuses | Up to 60% total | Team investment volume (e.g., millions for top ranks) |

Internal units like USDN peg to USDT but route through BTX tokens before full withdrawal.

2.1 Return Claims and Realistic Math

Promoted yields range from 0.25% to 0.5% daily on AI Bot plans. Short terms offer lower rates; longer lockups promise higher.

A 0.4% daily rate compounds to over 300% annualized. Adding referral payouts increases the platform’s performance.

Asset Type | Typical Annual Return | Risk Notes |

Bank savings/CDs | 4-5% | Low, insured |

Stock market average | 7-10% | Moderate volatility |

Real estate | 5-12% | Illiquid, market dependent |

Crypto staking | 5-20% | High, variable |

BitradeX examples far exceed these without matching risk disclosures.

2.2 Regulation, Security, and User Feedback

Claims include US MSB registration and UK ties. MSB covers money transmission, not investment guarantees. No confirmed FCA authorization for yield products.

Security scans rate it positively. No major hacks reported. Traffic appears solid.

Safer Alternatives for Crypto Trading

Established exchanges like Binance or Bybit offer AI tools with clearer regulation. For passive options, consider licensed staking on Coinbase.

Always start small and test withdrawals.

Final Assessment

BitradeX provides modern AI crypto trading features and reported volume. However, opaque ownership, high-yield promises, and referral-driven growth raise caution flags.

Research thoroughly. Choose platforms with strong transparency and realistic expectations. Crypto involves risks; never invest more than you can lose.

BitradeX Review Score

A website’s trust score is an important indicator of its reliability. BitradeX currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the BitradeX or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions BitradeX Review

This section answers key questions about the BitradeX, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

It shows security features but lacks full regulatory clarity for high-yield products.

Some users report delays; test small amounts first.

Details vary by feature; check current terms.

Yes, regulated exchanges and licensed brokers offer safer options.

Yes, try regulated options like Binance for AI-powered crypto exchange needs.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.