On August 26, 2025, BitMart restricted APTM token trading in Lithuania following a complaint alleging non-compliance with MiCA (Markets in Crypto-Assets Regulation), as reported by BehindMLM. The Bank of Lithuania investigated and confirmed violations, leading to BitMart’s decision to block access for Lithuanian users, per fiu.gov.lt. APTM, tied to Apertum Foundation and Josip Heit’s DAO1 scheme, is flagged for unregistered securities, per. This move aligns with MiCA’s uniform EU rules requiring authorization for crypto-asset services, per ec.europa.eu. X posts from @CryptoLawyerz highlight BitMart’s compliance to avoid penalties, per.

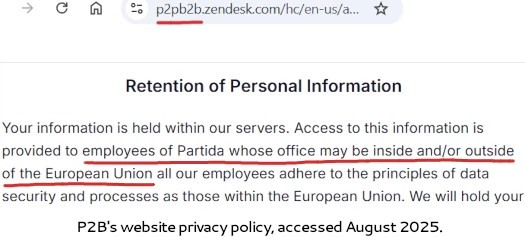

APTM operates as a “crypto-asset” in DAO1’s MLM investment scheme, promising returns through unregistered offerings, violating MiCA’s transparency and authorization requirements, per coinlaw.io. Listed on MEXC, LBank, P2B, and BitMart (dba UAB GBM Global), APTM’s trading volume is dominated by P2B (75.48%), per CoinMarketCap. The Bank of Lithuania confirmed P2B and LBank are not registered VASPs or CASPs, making their operations illegal in Lithuania, per fiu.gov.lt. MEXC faces global fraud warnings, including from Germany’s BaFin, per bafin.de. Historical data shows APTM’s ties to GSPartners’ $1B fraud, per sec.gov.

The restriction could extend across the EEA, as MiCA applies uniformly, potentially impacting APTM’s liquidity on exchanges like P2B (Lithuanian ties via UAB Partida), per. Germany (47% of Apertum traffic) and other EEA countries may follow, given BaFin’s oversight, per bafin.de. XRP ($2.29) and SOL ($184.50) remain stable, per CoinMarketCap, but APTM’s non-compliance risks delistings, eroding investor confidence. SEC parallels in the U.S. underscore global scrutiny on unregistered schemes, per coinlaw.io. X posts from @CryptoScamAlert warn of broader delistings, per.

APTM’s future hinges on MiCA compliance; without authorization, trading bans could spread, collapsing liquidity, per ec.europa.eu. Investors should avoid DAO1 and verify exchanges via fiu.gov.lt or bafin.de. Monitor XRP ETF delays (October 2025) for ripple effects, per. Diversify into USDC or ETH ($4,070) with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. MiCA enforcement could reduce fraud but stifle non-compliant tokens like APTM, per.