BG Wealth Review: Uncovering the Facts Behind BGWSig

In this BG Wealth review, we explore BG Wealth Sharing Investment Group at bgwsig.com. Many seek details on its crypto trading signals, wealth-sharing model, and investment risks. We combine key insights from various analyses to provide a clear picture. This includes ownership transparency, compensation plan, ROI claims, and more. Our goal is to help you decide if BGWSig is legit or a potential scam. For more in-depth scam investigations and platform reviews, you can also visit Scams Radar for additional insights and updates.https://www.bgwsig.com/

Table of Contents

Part 1: Understanding BG Wealth Sharing: What It Offers

BG Wealth Sharing presents itself as an investment group focused on crypto trading. Users join for daily sessions using signals from the BonChat app and DSJEX exchange. The platform promises easy profits without prior experience. It emphasises a minimum deposit of $500 to start. Trading occurs in two sessions per day, aiming for a 60-65% ROI per session. This sounds appealing to those looking for quick gains in crypto.

The site claims funds stay in personal accounts for security. It also talks about building a US headquarters by May 2026. Marketing uses leaderboards that show the top earners with large USDT balances. These features aim to create excitement and trust. However, deeper checks reveal concerns about sustainability and legitimacy.

1.1 Ownership Profiles and Backgrounds: Who Runs BGWSig?

Ownership at BGWSig lacks clear details. The domain bgwsig.com was registered on January 11, 2025, via GoDaddy. WHOIS data hides the registrant’s name, address, and contacts. This is common in high-risk sites. The hosting comes from Weebly, a basic builder, not advanced financial tech.

No verifiable executives appear on the site. Some materials mention “Professor Stephen Beard” in promotions, but searches show no real background or credentials. LinkedIn profiles linked to promotions, such as Fabian Warislohner’s, use spiritual language like “Frequency of the Radiant Ones” and “Cosmic Code.” This promoter posts about crypto consciousness and modern prophecy. Their history is often tied to similar high-yield schemes, though specific past sites aren’t listed.

Without named owners or corporate filings, accountability drops. No FCA or SEC registration exists. This opacity raises red flags, as legit platforms share leadership bios and comply with rules. For example, regulated exchanges like Binance list executives openly. Here, the setup mirrors anonymous operations that vanish when issues arise.

Part 2: The Complete Compensation Plan: How Earnings Work

BGWSig’s compensation blends trading and recruitment. It’s a hybrid model that rewards both personal trades and team building. Let’s break it down simply.

- Trading Component: Deposit at least $500. Use signals from BonChat app on DSJEX exchange. Two daily sessions promise 60-65% ROI each. No experience needed; just copy trades. Returns compound quickly, but math shows issues (more below).

- Recruitment and Bonuses: Become a team leader or agent. Earn from downline referrals. This includes overrides on team volume, rank bonuses, and exponential rewards. It’s like a unilevel structure with up to 7 levels. Unlock higher payouts via active legs and subscriptions.

- Additional Incentives: Leaderboards highlight top earners. Trial accounts with $2,000 are promoted in videos. Affiliates push via YouTube and Telegram. Earnings tie to network activity, not just trades.

This plan focuses on wealth sharing through referrals. Revenue comes from new deposits, not external sales. No retail products exist; it’s a membership-driven model. Critics call it pyramid-like, as payouts rely on constant inflows.

To clarify, here’s a responsive table outlining the plan:

Component | Description | Requirements | Potential Earnings |

Trading Signals | Copy daily signals via BonChat on DSJEX | $500 min deposit, two sessions/day | 60-65% ROI per session |

Referral Commissions | Earn from recruits’ deposits and activity | Build downline, active referrals | Overrides on 7 levels, team volume bonuses |

Rank Bonuses | Milestone rewards for team growth | Meet volume thresholds | Exponential bonuses, weekly residuals |

Trial Offers | Free or low-entry trials promoted | Sign up via affiliates | Quick wins to hook users |

This structure encourages recruitment over trading. Without audits, it’s hard to verify real profits.

Part 3: ROI Claims and Mathematical Proof: Why It May Not Last

BGWSig promises high returns, like 60% per session or 2.6% daily in some claims. These sound great, but math proves they’re unsustainable.

Consider 60% monthly growth. Using the compound formula A = P(1 + r)^n:

- P = initial amount ($1,000)

- r = 0.60 (60%)

- n = 12 months

A = 1000 * (1.60)^12 ≈ 1000 * 281.5 = $281,500

That’s over 28,000% yearly. No legit market sustains this.

For daily 2.6% (r=0.026):

(1.026)^365 ≈ e^(365 * ln(1.026)) ≈ e^8.77 ≈ 6,400x growth, or 640,000% APY.

Real markets can’t deliver this without risks. Liquidity dries up, and payouts need new money – a Ponzi sign.

3.1 Public Perception, Security, and Red Flags

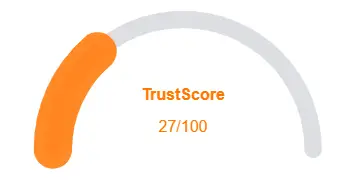

Online views are negative. Scamadviser gives low trust scores, warning of high-risk crypto services. Gridinsoft rates 14/100, citing deceptive practices. Forums like Reddit flag it as a Ponzi, with withdrawal issues and extra fees.

Security: Basic SSL from Let’s Encrypt. No third-party audits or regulated custody. Funds use crypto, which is irreversible and risky to recover.

Red flags include:

- New domain and hidden ownership.

- Unrealistic ROI without proof.

- Recruitment focus over real trading.

- Fake testimonials and leaderboards.

- No FCA/SEC regulation.

- Aggressive promotions on YouTube/Telegram.

Traffic is low, driven by affiliates rather than organic growth. Support via email/phone lacks real help.

Part 4: Social Media Promoters and Their Histories

Promoters like Fabian Warislohner on LinkedIn use hype. Channels like BG Wealth Sharing Investors Group on YouTube push trials and 99.6% accuracy. These often promote multiple schemes, shifting when one fails. Check histories for patterns in high-risk apps.

Future Outlook and Alternatives

By mid-2026, BGWSig may face shutdowns if inflows slow. Regulators could act, freezing assets. Predictions: Delays in withdrawals, then an exit scam.

Choose alternatives, such as regulated exchanges, for trading signals. Binance offers audited staking at 2-15%. Diversify into REITs for 8-12% returns.

Conclusion: Proceed with Caution in Your BG Wealth Review

This BG Wealth review highlights risks in BGWSig’s model. Hidden owners, unsustainable compensation, and scam warnings suggest high caution. Always DYOR, check regulators, and avoid funds you can’t lose. For legit crypto trading, stick to proven platforms. This keeps your investments safe in 2026 and beyond.

BG Wealth Review Score

A website’s trust score is an important indicator of its reliability. BG Wealth currently has a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with BG Wealth or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions BG Wealth Review

This section answers key questions about BG Wealth, clarifies points, addresses concerns, and highlights issues related to the platform’s legitimacy.

It's an investment group offering crypto trading signals via BonChat and DSJEX.

Many reviews flag it as suspicious due to red flags like hidden ownership.

Users copy daily signals in sessions on the DSJEX exchange.

Yes, $500 to start trading and access rewards.

Mentioned in promotions, but no verifiable background found.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.