In this Alniri review, we examine whether Alniri.com is legit, offering daily returns of 0.5% to 2% over 14-day cycles. A minimum deposit of $10 is required to get started. But its high-yield investment program (HYIP) model raises concerns. The detailed analysis includes ownership, compensation plans, security, payment methods, customer support, public perception, and ROI claims.

There are no clear ownership details on Alniri.com, a major red flag. NameSilo, LLC (recently in 2024) registered the domain using privacy protection. The SEC, FCA, and Isle of Man authorities cannot verify company registrations and licensing. There is a Dubai address on the site, but this is often used by fraudulent schemes. Binance discloses its legal entity and leadership profile, but Alniri does not.

Red Flag: The presence of hidden ownership and the lack of verification of regulatory claims indicate possible fraud.

There are two main components that make up the compensation plan for the Alniri website:

Investment Returns:

Referral Program: If you recruit others, you can earn bonuses, which will increase the higher the investment and the higher the rewards. Cash bonuses are unlocked at the top tiers of the program.

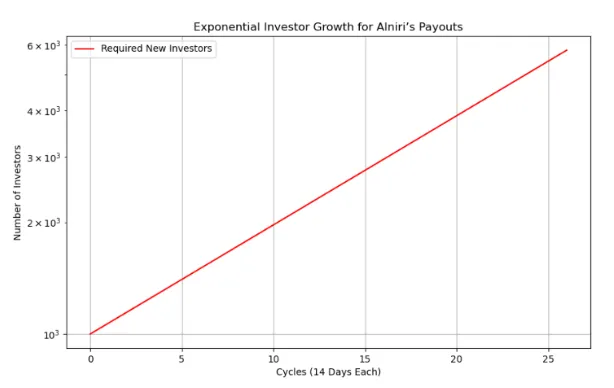

Red Flag:It is necessary to recruit in an unsustainable way in order to achieve high returns and referral incentives.

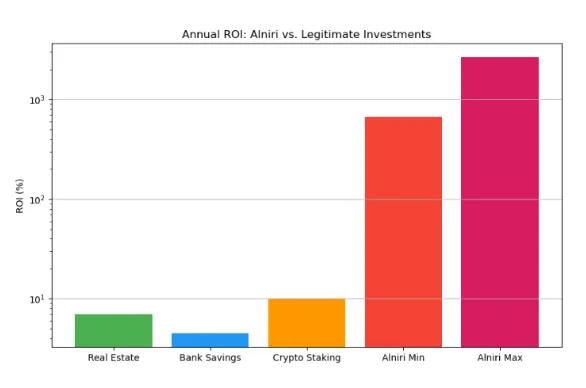

HYIP and MLM structures rely on new investor funds to pay returns, a classic Ponzi scheme trait. Below is a chart comparing Alniri’s returns.

According to Alniri, daily returns range from 0.5% to 2%, so on a 14-day cycle, this translates to 7% to 28% of returns. Let’s calculate:

Investment Example: $1,000 at 2% daily.

Ponzi Dynamics: To pay $318 profit, Alniri needs new deposits, requiring exponential growth (e.g., 318 new $1,000 investors after one year for 1,000 initial investors).

Red Flag: Returns exceed legitimate benchmarks (e.g., 7%–10% for real estate, 4%–5% for banks, 5%–15% for crypto staking).

There is a very low internet traffic to the Alniri website (about 10,000 visits per month), mainly coming from regions where there are lax regulations (e.g., India, Nigeria). The use of social media to promote products is limited to hidden accounts:

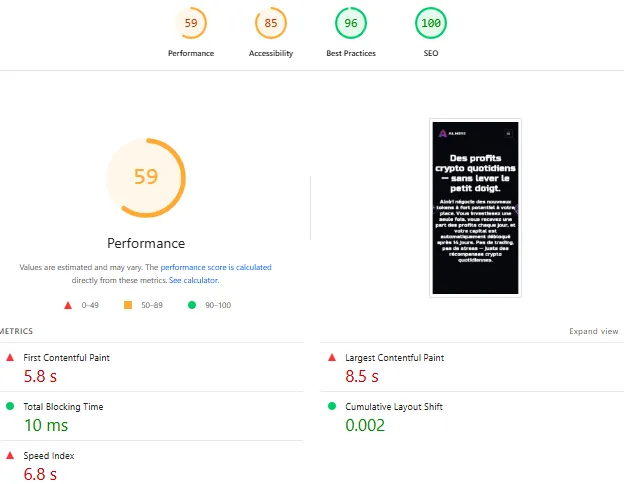

As a free SSL certificate, Alniri uses Let’s Encrypt for basic encryption, but it does not have the following features:

Red Flag: In the event that your company such as Alniri’s security is weak, it may be vulnerable to hacks or exit scams.

There are only cryptocurrencies that are accepted by Alniri (e.g., Bitcoin: 0.0015 BTC minimum, Ethereum: 0.02 ETH minimum, Tether: 5 USDT minimum). There are no fiat options (e.g., bank transfers), enabling anonymity but complicating fund recovery. There have been reports of withdrawals being delayed or canceled by users.

Red Flag: The use of crypto-only payments in scams and problems with withdrawals are common.

The support is limited to an email contact form that can be used to contact the company. A live chat or phone support option is not available, and users report that withdrawal requests are being dealt with slowly or not at all.

Red Flag: The lack of support suggests that the project may have been terminated.

Public feedback is scarce:

The Alniri company review confirms that Alniri.com exhibits the characteristics of Ponzi schemes: hidden ownership, unsustainable returns, and a weak security system. As a result, investors are advised to avoid it and to prioritize alternatives that are regulated instead. Do not hesitate to report suspicious activities and stay vigilant at all times.

Disclaimer: The purpose of this Alniri review is only to provide you with information. A significant amount of risk is involved in investing in HYIPs. Before investing in the stock market, you should conduct your own research and consult a financial advisor.

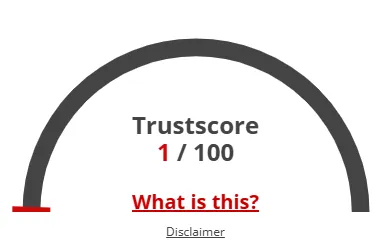

It may be possible that the website is a fake if the trust score is the only factor considered. Please use caution when using this website.

Alniri was analyzed based on ownership, location, popularity, reviews, phony items, threats, and phishing. The trust calculation is based on all of the available data.

Below are some frequently asked questions (FAQs) about Alniri company Review. Listed below are questions and answers designed to clarify common concerns:

Alniri.com raises concerns due to hidden ownership, unrealistic returns, and lack of regulation. It resembles a Ponzi scheme, so investors should avoid it.

Risks include total loss of funds, withdrawal delays, and potential fraud. Its high-yield model relies on new investor deposits, which is unsustainable.

Alniri offers 0.5%–2% daily returns for 14 days and referral bonuses. This multi-level structure depends on recruitment, a red flag for scams.

An Alniri review reveals critical red flags like lack of transparency and unsustainable returns, helping you make informed decisions and avoid scams

Opt for regulated platforms like Binance for crypto staking (5%–15% APY) or banks for savings (4%–5% APY) to ensure security and reliability.

Title: Alniri