All inX Review: Uncovering the Risks and Realities of This Trading Platform

In this All inX review, Scams Radar examines the platform’s claims around tokenized assets, real-world assets trading, and more. Launched in 2025, it promises features like spot trading, staking, and a crypto card. But concerns about legitimacy arise from hidden ownership and high commissions. We combine insights from multiple sources to help you decide if it’s safe.

Table of Contents

Part 1: Ownership Details in All inX Review

Public records provide limited information on who operates the organization. The site lacks clear details on executives or team members. This raises questions about accountability in all InX trading platform activities.

1.1 Profiles of Key Figures

UK records list Jianfeng Zhao as a person with significant control. Born in October 1983, he is Chinese and linked to an address in Fengqiu County, China. He served as director briefly but stepped down in September 2025. No public background in finance or crypto appears for him. Searches yield unrelated individuals in fields such as geospatial consulting or academia.

Dongsu Park is noted as the director, a South Korean national with a Hong Kong address. Again, no financial history surfaces. The matches point to a bone regeneration researcher at Baylor College of Medicine, likely not the same person. This opacity in All inX UK registration and All inX FinCEN-registered claims suggests foreign control without transparent ties.

Without verifiable bios, trust erodes. Legit platforms share leader profiles to build confidence.

Part 2: Compensation Plan Breakdown

The All inX Partner Program draws scrutiny for its structure. It offers up to 86% commissions, marketed on social media. This multi-level setup rewards recruitment over trading.

From reports, it breaks down like this:

- Level 1 (direct recruits): 85% commission

- Level 2: 7%

- Level 3: 3%

- Level 4: 5%

Total payouts can hit 100% of investments, implying reliance on new funds. How to trade on All inX platform ties into this, as fees fund rewards. But with typical exchange fees at 0.1%, keeping just 14% after 86% payouts leaves slim margins.

Level | Commission Rate | Based On |

1 | 85% | Direct referrals’ deposits |

2 | 7% | Second-line activity |

3 | 3% | Third-line |

4 | 5% | Fourth-line |

This table shows the tiered payouts. Benefits of trading tokenized real-world assets on All inX seem secondary to recruiting. All inX liquidity providers and market makers aren’t detailed, adding to concerns.

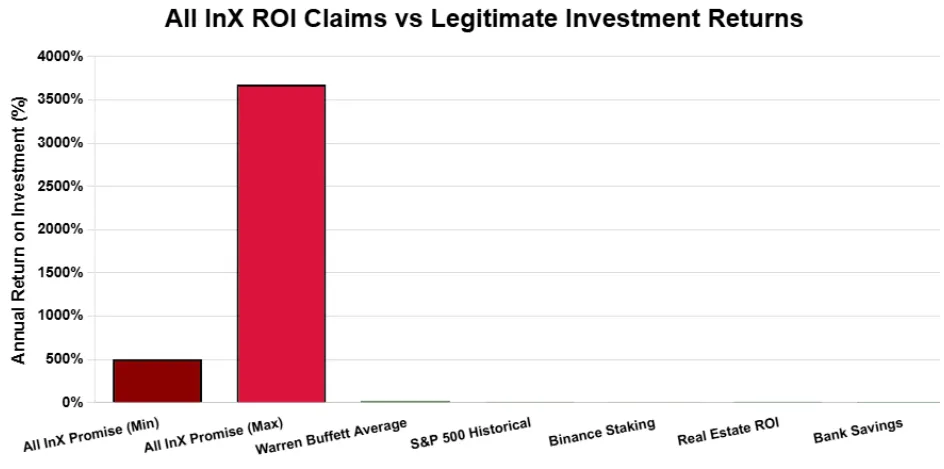

2.1 ROI Claims and Why They're Risky

Promises include 0.2%-1% daily returns, or 73%-365% yearly without compounding. With bonuses for lock-ups of up to 540 days, APY could reach 505%-5,517%.

Math proves this unsustainable. For 1% daily on $1,000:

- Month 1: $1,348

- Year 1: $36,118

- Year 3: Over $47 million

No real revenue scales this way without endless new money, a Ponzi scheme.

2.2 Comparisons to Safe Options

Option | Annual ROI | Risk | Notes |

Banks | 1-5% | Low | FDIC-insured |

Real Estate | 5-10% | Medium | Tangible assets |

Regulated Exchanges (e.g., Binance) | 5-20% APY | Medium | Verifiable staking |

All inX | 73-365%+ | High | Unproven claims |

All inX trading fees aren’t transparent. All inX fees and commissions are explained vaguely. Cross-border trading on the All inX platform appeals, but lacks depth. All inX trading depth and volume analysis shows low activity.

All inX crypto card vs other crypto debit cards: No rollout yet, unlike proven ones.

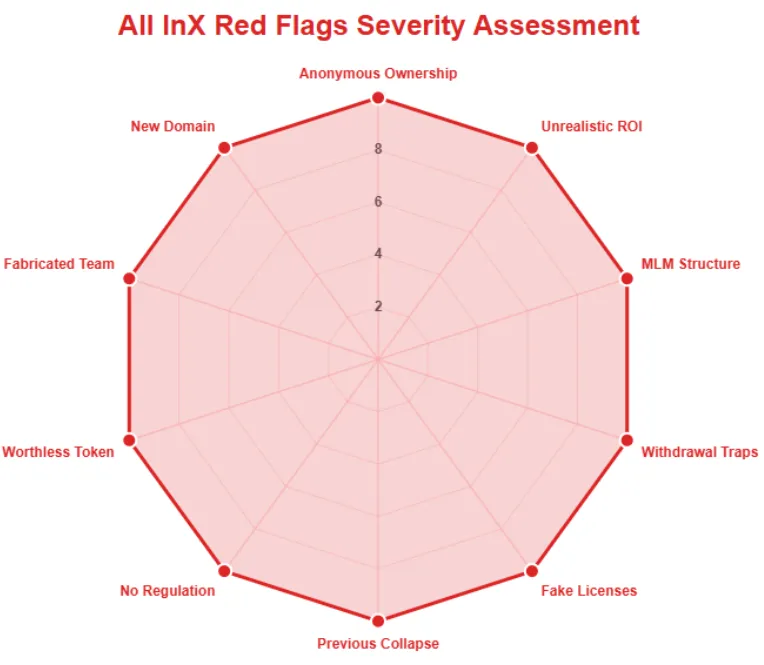

Red Flags and Public Views

Multiple issues stand out:

- New domain from July 2025, quick relaunch after collapse.

- No FCA or SEC licenses despite All inX regulatory compliance in different countries claims.

- Low trust scores from ScamAdviser and others.

- Withdrawal traps: Users report “tax” fees.

- Confusion with older projects like ALLINX Finance.

Public perception is poor. BehindMLM calls it a rebooted Ponzi. CryptoScamsReviews notes fee scams. All inX trading platform user reviews are scarce and negative. All inX support and customer service contacts seem generic, with slow responses.

All inX security features for digital asset protection include HTTPS, but no audits or insurance details. All inX onboarding and KYC procedures are basic, yet unverified.

Future Outlook and Predictions

With an MLM focus, expect a short life. Recruitment may slow by early 2026, leading to freezes. If transparent, it could survive. But trends point to risks amid market shifts.

All inX mobile app download and usage exists on Google Play, but ratings are absent. All inX API access for trading data is claimed, yet untested.

Conclusion: Weigh the Facts in Your All inX Review

This All inX review highlights high risks from opaque ownership, unsustainable payouts, and red flags. While features like All inX asset tokenization sound innovative, evidence suggests caution. Always DYOR, consult experts, and stick to regulated paths. Invest only what you can lose. For safer trades, explore verified exchanges. Now visit Vault27 Review.

All inX ReviewTrust Score

A website’s trust score is an important indicator of its reliability. All inX currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with All inX or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About All inX Review

This section answers key questions about All inX , providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

All inX shows red flags like hidden owners and unrealistic ROIs, suggesting Ponzi-style risks.

It offers up to 86% commissions, focusing on recruitment over real trading profits.

Unlike Binance or Coinbase, it lacks audits, transparency, and verified liquidity.

No. Promised 1% daily returns (365%+ yearly) are mathematically impossible long-term.

Both show unclear ownership and high-risk ROI claims, but All inX leans heavily on an MLM structure.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.