AiETF Token Review: A Close Look at the Project, Compensation Plan, and Investor Risks

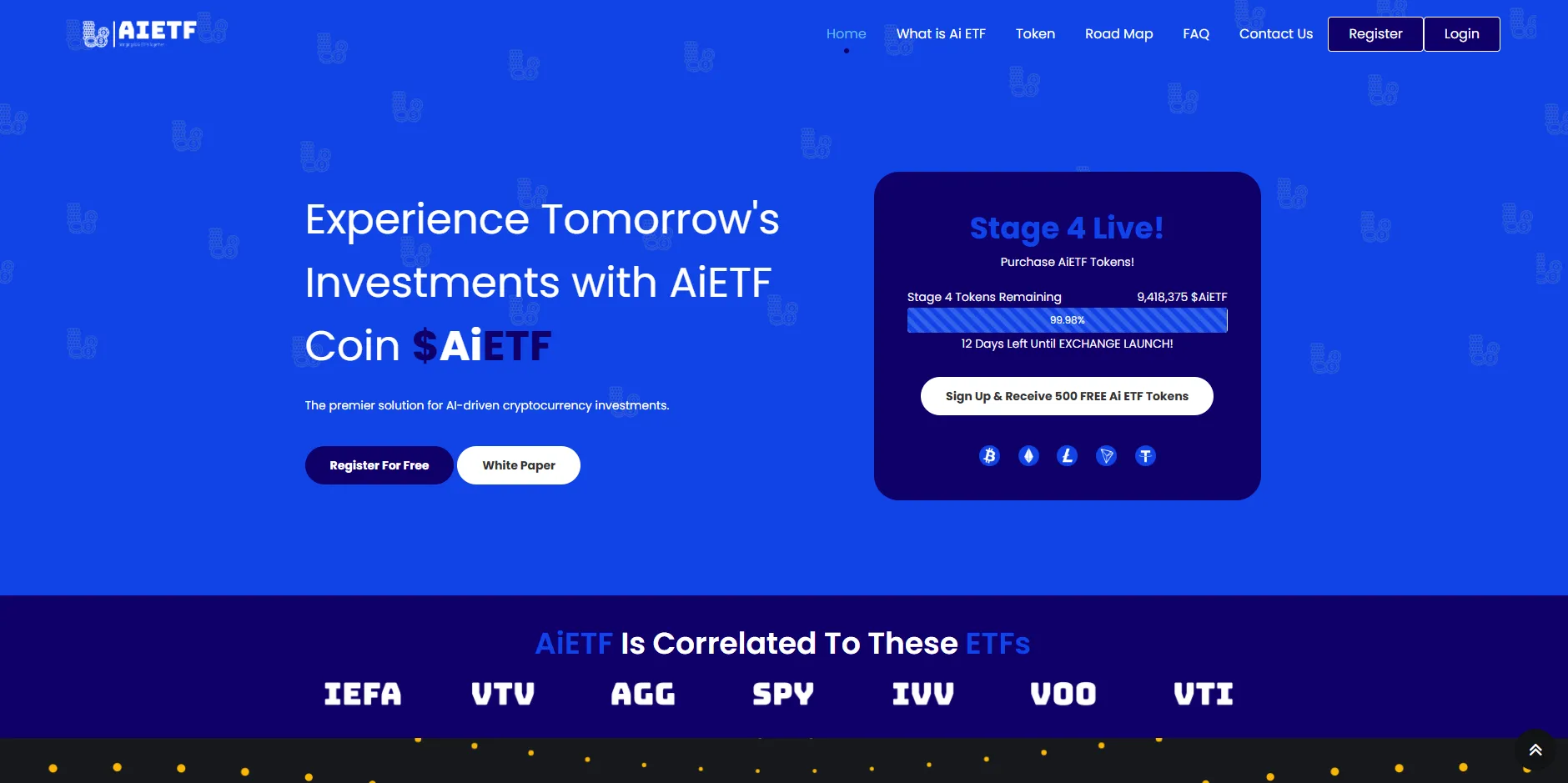

In this AiETF Token review for 2026, Scams Radar examines the cryptocurrency project behind aietftoken.com. Many people are actively searching for clear and reliable information about the AiETF Token, including its presale, compensation structure, and overall legitimacy. This Scams Radar analysis brings together publicly available data, user feedback, and basic mathematical evaluation to present a clear and unbiased picture. The goal is to help everyday investors understand exactly what they are dealing with before committing any money.

Table of Contents

Part 1:Ownership and Team Transparency

One of the first questions any investor should ask is: Who runs the project?

AiETF Token provides almost no information about its founders, executives, or development team. There are no names, LinkedIn profiles, biographies, or past project records listed on the website. The only address given is 400 Convention Street, Baton Rouge, Louisiana, a multi-tenant office building with no visible connection to the project.

The domain was registered on July 11, 2024, through NameCheap with complete privacy protection enabled. This hides the real owner’s identity. While privacy protection is legal, established cryptocurrency projects usually share team details to build trust. The complete absence of identifiable people is a serious concern for accountability.

1.1 Compensation Plan and Referral Structure

The project uses a referral-based reward system that pays in AiETF tokens. Public descriptions from the official Telegram channel and third-party analyses describe it as a two-level unilevel plan.

Here are the main rewards:

- Signup bonus: New users receive 500–5,000 free tokens (numbers vary across promotions).

- Level 1 referral (direct recruits): 5,000 tokens per person referred.

- Level 2 referral (recruits of your recruits): 2,500 tokens per person.

- Purchase matching: 100% token match on purchases made by Level 1 and Level 2 referrals.

Additional presale bonuses range from 50% to 75% extra tokens, depending on the stage, with earlier stages offering higher percentages.

This structure encourages recruitment. Growth depends on bringing in new buyers rather than on actual product use or external revenue. Rewards are paid only in project-issued tokens, not cash from profitable trading or ETF investments.

Part 2: Tokenomics and Presale Stages

The total token supply is repeatedly stated as 200 billion tokens. The presale is divided into multiple stages with rising prices and decreasing bonuses.

Stage | Time Frame | Price per Token | Bonus | Tokens Allocated |

PreLaunch | Aug–Sep 2024 | $0.0000001 | 75% | 50 billion |

Pre-Sale 1 | Oct–Nov 2024 | $0.000001 | 65% | 40 billion |

Pre-Sale 2 | Nov–Dec 2024 | $0.00001 | 60% | 30 billion |

Pre-Sale 3 | Jan–Feb 2025 | $0.0001 | 55% | 20 billion |

Main ICO | Feb–Nov 2025 | $0.00001 | 50% | 60 billion |

Note the pricing inconsistency: the Main ICO price drops below Pre-Sale 3, which does not follow standard presale logic.

Telegram posts have mentioned expected launch prices from $3.98 to over $100. At a 200 billion supply, those prices would imply market caps of $600 billion to $20 trillion, larger than Bitcoin and most global stock markets combined.

Part 3: Why the Promised Returns Don’t Add Up

The marketing focuses on high bonuses and future price growth rather than guaranteed daily percentages. Still, the implied returns are extreme.

Example with a $100 early investment:

- At a $0.0000001 price with 75% bonus → approximately 1.75 billion tokens received.

- If the price ever reached $0.0001 → position worth $175,000 (1,749x return).

Realistic comparison of annual returns:

Investment Type | Typical Annual Return (2024–2026 data) |

High-yield savings accounts | 4–5% |

U.S. Treasury bonds | 4–5% |

Real estate (rental + growth) | 8–12% |

S&P 500 index funds | 8–12% (historical average) |

Ethereum staking | 3–5% |

Solana staking | 6–8% |

Higher-risk DeFi yields | 10–20% (with significant risk) |

AiETF’s implied returns are orders of magnitude higher while claiming correlation with regulated ETFs that deliver only single-digit to low-teen annual gains.

Public Feedback and Trust Scores

Trustpilot shows around 22 reviews with an average of below 2 stars out of 5. Common complaints include:

- Delayed or missing token deliveries

- Login problems after accumulating tokens

- Unresponsive support

- Repeated launch delays

Independent scam-checking sites rate the domain poorly:

- ScamAdviser: Low trust

- Scam-Detector: 53.5/100

- ScamMinder: 10/100

- Gridinsoft: Flagged as cryptocurrency risk

Traffic estimates suggest very low daily visitors, far below what a major presale would usually attract.

Security and Technical Concerns

The site uses a valid SSL certificate, but that is standard today. There are no published smart contract audits from recognized firms, no working whitepaper link, and no clear official contract address on major explorers. Multiple unrelated “AIETF” tokens exist on different chains, creating confusion.

The project promotes mandatory KYC and future Visa cards, yet provides no details about issuing partners or data protection measures.

Summary of Key Risks

- Anonymous ownership and team

- Heavy reliance on recruitment rewards

- Mathematically unrealistic price and market-cap targets

- Inconsistent pricing and roadmap details

- Repeated launch delays

- Low trust scores and negative user feedback

- No independent audits or transparent on-chain data

Final Thoughts

AiETF Token shows many characteristics common to high-risk cryptocurrency presales. The lack of identifiable owners, a recruitment-driven compensation plan, and extreme implied returns raise substantial concerns. While some early participants report receiving bonus tokens, the overall structure depends on continuous new investment rather than sustainable value creation.

Investors should approach with extreme caution. Established assets like Bitcoin, Ethereum, or regulated index funds offer far more transparency and historically realistic returns. Always verify claims independently and never invest money you cannot afford to lose.

AiETF Token Review Trust Score

A website’s trust score is an important indicator of its reliability. AiETF Token currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the AiETF Token or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions AiETF Token Review

This section answers key questions about the AiETF Token, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

AiETF Token claims to offer AI-based crypto investment returns but lacks transparent proof.

AiETF Token appears high-risk due to unclear ownership and unrealistic ROI claims.

It claims AI trading, but no verifiable revenue model is publicly available.

No, the promised returns exceed realistic crypto and ETF benchmarks.

Both show similar red flags like vague income sources and aggressive promotion.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.