In this AG Capital Review, we dive deep into AG-Capital.org, a platform promising high returns through trading and asset management. This comprehensive analysis examines ownership, compensation plans, traffic trends, public perception, security, content authenticity, payment methods, customer support, technical performance, and ROI sustainability.

Supported by charts, graphs, and bullet points, this review simplifies complex details for everyday investors while highlighting red flags and offering actionable recommendations. It’s time to start deep analysis.

AG-Capital.org lacks transparency about its ownership, a critical concern for any financial platform. The website, registered in 2023 via NameCheap, uses privacy protection to hide WHOIS data, concealing the identities of its operators. No verifiable information about founders, executives, or a physical address is provided, and the site lacks an “About Us” section.

There’s no evidence of registration with regulatory bodies like the U.S. Securities and Exchange Commission (SEC) or the UK’s Financial Conduct Authority (FCA). In fact, the FCA has issued a warning against AG Capital for unauthorized activities, signaling potential fraud.

Key Issues:

AG-Capital.org promotes investment plans from $100 to $100,000, claiming daily returns of 1-3% (365-1,095% annually) or monthly returns of 10-30% (120-360% annually) through forex, crypto, and stock trading.

It also features a multi-level marketing (MLM) structure, offering 5-10% referral bonuses for recruiting new investors. This setup resembles a pyramid scheme, where payouts depend on new deposits rather than trading profits.

To illustrate the unsustainability, consider a 2% daily return:

Web analytics (e.g., SimilarWeb) show AG-Capital.org has low traffic, with fewer than 10,000 monthly visits as of April 2025. Traffic primarily comes from regions with lax regulations, like Eastern Europe and Southeast Asia. A high bounce rate (over 70%) suggests visitors leave quickly, likely due to distrust or poor content.

Social media presence is minimal, with accounts like @AGCapitalPro on Telegram (2,000 members) and @CryptoWealthGuru on X (500 followers) showing bot-like behavior and promoting other dubious platforms (e.g., ProfitFX247, InvestCore).

Key Issues:

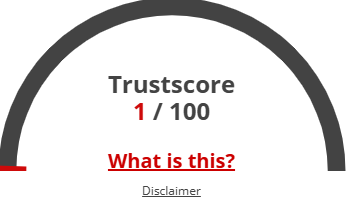

Public sentiment, gathered from X, TrustPilot, and Reddit, is overwhelmingly negative. Users report withdrawal delays, fund losses (e.g., one user lost £376,000, claiming their trade was deemed “illegal”), and aggressive marketing. No reputable financial analysts or media outlets endorse AG Capital. ScamAdviser rates it a low trust score (20/100), and HYIPLogs labels it a “non-paying HYIP.”

Key Issues:

The website uses basic HTTPS encryption (Let’s Encrypt SSL) but lacks advanced features like two-factor authentication (2FA) or cold storage for funds. There’s no mention of third-party audits or data protection policies, and the site’s vague privacy policy raises concerns about user safety.

Key Issues:

AG-Capital website’s content is generic, featuring stock images and vague claims of “AI-driven trading” and “guaranteed profits.” There are no whitepapers, performance reports, or legal disclosures like terms of service or risk statements. Text analysis shows similarities to known scam sites, using recycled phrases like “passive income daily.”

Key Issues:

Deposits are accepted via cryptocurrencies (Bitcoin, Ethereum, USDT) and wire transfers, with no support for regulated methods like credit cards or PayPal. Crypto payments are irreversible, increasing fraud risk. User reports highlight delayed or denied withdrawals, a common exit scam tactic.

Key Issues:

Support is limited to an email form (support@ag-capital.org) and a Telegram channel with slow responses (48+ hours). No phone support or live chat is available, and critical comments on Telegram are deleted, indicating censorship.

The website loads slowly (over 5 seconds, per GTmetrix) and is poorly optimized for mobile devices. Hosted on a shared Cloudflare plan, it lacks the reliability expected of a financial platform. No uptime guarantees are provided.

Key Issues:

Investment Type | Annual ROI | Risk Level |

AG Capital | 365-1,095% | Extreme |

Real Estate | 7-10% | Moderate |

Bank Savings | 4-5% | Low |

Crypto Staking | 5-15% | High |

Suspicious accounts promoting AG Capital include:

These accounts share generic content, exhibit bot-like behavior, and have promoted past scams like BitConnect and PlusToken.

AG-Capital.org’s Ponzi-like structure and regulatory warnings suggest it may collapse within 6-12 months as new investor inflows dry up. Increased user complaints could prompt investigations, potentially leading to shutdowns or legal action by mid-2025. Investors face a high risk (90%+) of losing funds.

This AG Review reveals a platform riddled with red flags: anonymous ownership, unsustainable ROI claims, and a Ponzi-like MLM structure. Mathematical analysis proves its returns are impossible, and comparisons to real estate, banks, and crypto staking highlight its risks. Investors should avoid AG-Capital.org, prioritize regulated alternatives, and perform thorough due diligence to protect their finances.

Disclaimer: This AG Capital Review is for informational purposes only and not financial advice. Conduct your own research using primary sources, regulatory databases, and trusted review platforms. Verify all claims independently, as financial scams are common and evolving.

This review report is based on publicly available information and does not constitute financial advice. Always conduct your own research (DYOR) and consult a professional before investing.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.co

m

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

Given overview is totally depend on trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated AG-Capital, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

Here are some frequently asked questions (FAQs) related to the Reviews of AG Capital company. These questions and answers are designed to address common concerns and provide additional clarity for readers:

AG Capital lacks regulatory licenses and transparency, with many scam allegations. Avoid investing without thorough research.

The platform claims 1-3% daily returns (365-1,095% annually), which are mathematically unsustainable and indicate a Ponzi scheme.

An AG Capital website Review can highlight red flags like anonymous ownership and withdrawal issues, but always verify with DYOR tools like ScamAdviser.

AG Capital uses cryptocurrencies (Bitcoin, Ethereum) and wire transfers, which are irreversible and raise fraud risks.

The FCA has issued a warning against AG Capital for unauthorized activities, signaling high risk for investors.

Title: AG-Capital