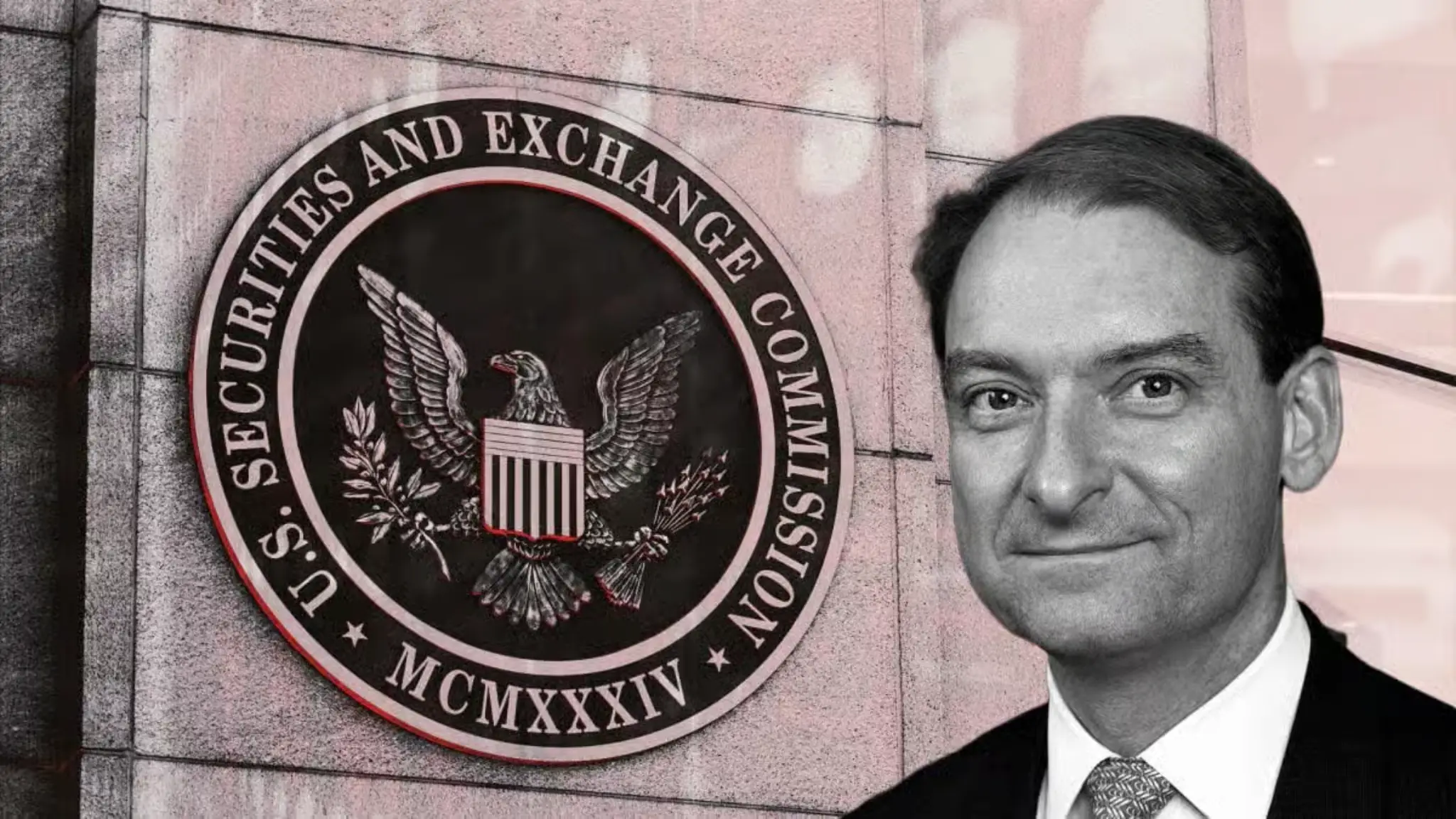

On February 11, 2026, SEC Chair Paul Atkins faced intense scrutiny from Democratic lawmakers during a House Financial Services Committee hearing over the agency’s decision to pause its case against Tron founder Justin Sun and drop its lawsuit against Binance, per The Block. Rep. Stephen Lynch (D-Mass.) demanded explanations for the lack of enforcement, stating, “The reputational damage that the SEC is suffering right now is unbelievable,” per. Overall, SEC enforcement actions fell 30% in 2025, with crypto-related cases dropping 60%, according to Cornerstone Research, signaling a major shift under Atkins’ leadership since April 2025.

The SEC requested a stay in the Justin Sun case in February 2025 to explore a settlement, after charging him in 2023 with unregistered securities sales and market manipulation. Sun has since invested millions in Trump-linked crypto ventures, raising conflict concerns, per. The Binance lawsuit, filed in 2023 for unlicensed services and misrepresented controls, was dropped in May 2025 under Atkins, following Changpeng Zhao’s 2023 guilty plea and $4B DOJ settlement, with Trump later pardoning Zhao. A World Liberty Financial stablecoin is reportedly used for a $2B Abu Dhabi investment in Binance.

Lawmakers, including Rep. Sean Casten (D-Ill.) and Rep. Sylvia Garcia (D-Texas), pressed Atkins on Trump’s crypto ties, estimated at $1.4B from ventures like World Liberty Financial and a 20% stake in American Bitcoin, per. Garcia asked if Trump or associates influenced enforcement decisions; Atkins replied, “No.” The hearing highlighted fears that Trump’s industry connections undermine SEC independence, contrasting with Gary Gensler’s aggressive stance.

Atkins defended a “robust enforcement effort” while unveiling plans for an innovation exemption, a time-limited, transparent “sandbox” for crypto products with strong investor protections. Collaboration with CFTC Chair Michael Selig aims for joint rules, potentially codifying Atkins’ crypto taxonomy, per. Investors should monitor SEC filings on sec.gov and CFTC updates at cftc.gov. BTC ($113,234) and ETH ($4,070) remain stable, according to CoinMarketCap, but clarity could drive BTC to $150,000, per Techopedia. Follow @TheBlock__ on X for updates. Atkins’ approach may foster innovation but risks perceived leniency amid Trump ties.