CT-3 Review: Is CT-3 a Real Web3 Storage Platform and Earning Opportunity or a Ponzi Scheme?

Scam Radar Exposes CT-3 This CT-3 review examines every available piece of public information about the project behind ct-3.io and ct-3.ltd. After studying the whitepaper, compensation plan, company records, team profiles, math behind the returns, and independent risk reports, one conclusion stands out clearly.

CT-3 presents itself as a decentralised Web3 storage solution. In reality, it operates as a centralised, recruitment-driven investment scheme with mathematically impossible returns.

Table of Contents

Part 1: What CT-3 Claims to Offer

The public-facing site (ct-3.ltd) describes a genuine-sounding decentralised storage service:

- Files are encrypted and split across global nodes (IPFS-based)

- Pay only for the storage you actually use

- Current price: $0.015 per GB (cheaper than AWS, Google Cloud, or Azure)

- Eco-friendly, anonymous, highly reliable

The whitepaper adds technical depth: dual-token system ($CT3GB utility token + $CT3 governance/investment token), Proof-of-Replication, Proof-of-Availability, NFT access keys, and a roadmap that promises full decentralisation by 2027+.

All of this looks professional at first glance.

The problem appears once you go behind the login wall (invite-only dashboard). There, the real product is not storage. It is a fixed-return investment plan with daily profit payments and a 10-level referral commission structure.

Part 2: Ownership and Team Who Actually Runs CT-3?

Legal entity: Cuillin Technology Limited

UK Company Number: 14453567

Incorporated: October 31, 2022

Registered office: 167–169 Great Portland Street, London (a virtual office address used by thousands of unrelated companies)

Sole listed director: Alexander Mills (British, born October 1986) – no other directorships, no public history in blockchain or storage projects.

Marketing materials and some LinkedIn posts claim the following leadership team:

- Monique Amaral – Chief Financial Officer LinkedIn: https://www.linkedin.com/in/monique-amaral-215173239/

- Leandro Gomes – Chief Technology Officer / Head of Partnerships LinkedIn: https://www.linkedin.com/in/leandro-gomes-903211202/

- Rodrigo Pereira – Chief Marketing Officer LinkedIn: https://www.linkedin.com/in/rodrigo-pereira-5b786099/

These profiles exist, but none of the three publicly list CT-3 or Cuillin Technology Limited in their current experience (as of November 2025). The whitepaper itself admits a portion of the team remains pseudonymous “to avoid jurisdictional targeting.”

Translation: the people who control the wallets and can disappear with the funds do not want to be identified.

Part 3: The Real Compensation Plan Detailed Breakdown

The investment side (hidden from public view) works like this:

Minimum deposit: $100 in USDT, BTC, or BNB

Lock-up periods: 60 to 360 days

Daily profit: 0.45–0.976% depending on rank and term length

Profit Calculator (Level 1 Investor, $100 Deposit)

Term | Base ROI | Period Bonus | Level Bonus | Total Profit | Total Return | Approx. Daily Rate |

60 days | 27.06% | 0.00% | 3.00% | 30.06% | $130.06 | 0.501% |

120 days | 54.12% | 0.60% | 6.00% | 60.72% | $160.72 | 0.506% |

180 days | 81.18% | 1.80% | 9.00% | 91.98% | $191.98 | 0.510% |

240 days | 108.24% | 3.60% | 12.00% | 123.84% | $223.84 | 0.516% |

300 days | 135.30% | 6.00% | 15.00% | 156.30% | $256.30 | 0.521% |

360 days | 162.36% | 9.00% | 18.00% | 189.36% | $289.36 | 0.526% |

Higher ranks (up to Level 10) add up to +0.50% daily → top promoters can reach ~351% profit in 360 days.

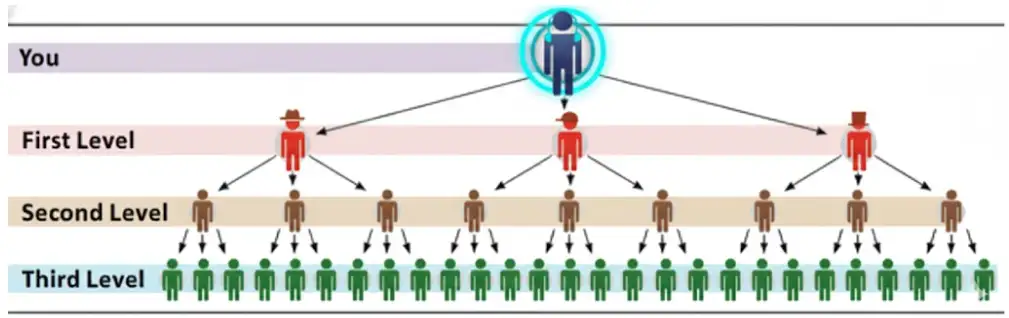

10-Level Referral Commissions (Unilevel)

Level | Commission per Deposit |

Level 1 | 6% |

Levels 2–4 | 3% each |

Levels 5–7 | 2% each |

Levels 8–10 | 1% each |

Total | Up to 24% |

On every $100 deposit, up to $24 is immediately paid to uplines. Only $76 stays in the system.

3.1 Why These Returns Are Mathematically Impossible

Take the most common plan (360 days, Level 1):

- Investor receives: $289.36

- Uplines receive: up to $24

- Total payout obligation: $313.36

- Capital actually available: $76

Required internal performance on the $76: +312% in one year just to break even.

For a Level 10 promoter: required performance exceeds +525%.

Now compare to the storage revenue (from their own whitepaper example):

20 GB stored for 30 days = $0.0017 revenue

To pay one Level 1 investor their $0.526 daily profit requires ≈ $0.526 ÷ $0.0017, ≈ 309 real storage customers per investor per day.

That is not happening. The storage side is negligible window dressing.

3.2 Required Growth to Keep Paying Everyone (Ponzi Mathematics)

Generation | Required New Deposits (to pay the previous generation) | Multiple of Initial Deposits |

Gen 1 | 1.89× | 1.89× |

Gen 2 | 3.57× | 3.57× |

Gen 3 | 6.75× | 6.75× |

Gen 4 | 12.76× | 12.76× |

Gen 10 | 322× | $322 billion for $1M start |

Part 4: Legitimate Investments vs CT-3 Promises

Investment Type | Realistic Annual Return (2025) | CT-3 Promised (Level 1) |

High-yield savings / CDs | 4.5–5.5% | 189% |

Rental real estate (net) | 8–12% | 189% |

S&P 500 long-term average | 7–10% | 189% |

Legitimate crypto staking | 4–20% (high risk) | 189–351% |

Cloud storage company margin | 10–30% (if profitable) | Must deliver 300–500%+ |

4.1 Independent Risk Assessments

- Scam Detector: 12.6/100 – “Untrustworthy. Risky. Danger.”

- Scamdoc: 25/100 – “Low trust”

- Gridinsoft: 31/100 – “Suspicious Website – Financial trading scam risk”

- ScamAdviser: Low trust, hidden owner, very young domains

- BehindMLM: Full Ponzi classification

- Reddit r/CryptoScams: Multiple threads calling it an unsustainable Ponzi

- Trustpilot: Mixed, mostly solicited 5-star reviews praising “great investment.”

Final Verdict and Recommendation

CT-3 is not a legitimate decentralised storage platform. It is a centralised Ponzi scheme that uses Web3 jargon and a thin storage product to justify impossible fixed returns while relying entirely on new investor money.

The combination of anonymous/pseudonymous control, virtual-office shell company, hidden investment terms, and mathematically unsustainable payouts makes this one of the clearest high-risk schemes active in late 2025.

Do not deposit any money.

If you have already invested, attempt immediate withdrawal of whatever is available and do not send additional “fees” or “taxes.”

Always verify ownership, audit reports, and realistic revenue sources yourself. When returns sound too good to be true, they never are.

DYOR – and stay safe.

CT-3 Review Trust Score

A website’s trust score is an important indicator of its reliability. CT-3 currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the CT-3 or similar platforms.

Positive Highlights

- The SSL certificate is valid.

- We found mostly positive reviews for the site.

- DNSFilter marks the website as safe.

Negative Highlights

- The owner is hiding their identity through a paid WHOIS privacy service.

- The site has very low visitor traffic.

- Many scammers and spammers use the same domain registrar.

- This very new website already has an unusually high number of reviews.

- The domain was registered only recently.

Frequently Asked Questions About CT-3 Review

This section answers key questions about CT-3, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

CT-3 claims to be a Web3 storage platform but mainly runs a fixed-return investment with a multi-level referral plan.

The ROI math and reliance on new deposits make CT-3 function like a Ponzi-style investment scheme.

Anonymous controllers, a virtual office shell company, a hidden investment dashboard, and 189–351% promised yearly returns.

CT-3’s fixed 189%+ yearly returns are far above banks, real estate, or stock indexes and are not realistic.

Like cases in the Everstead Review, CT-3 mixes hidden ownership, aggressive referrals, and unsustainable returns, making it very high risk.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.