On November 25, 2025, My Daily Choice (MDC), a leading network marketing company founded in 2014 by Josh Zwagil, announced a merger with Immunotec, a health and wellness firm known for its glutathione supplement Immunocal, per Business for Home and Direct Selling News. The deal integrates MDC’s 20+ brands and 1M+ global members into Immunotec’s ecosystem, with Zwagil joining as an ImmunotecPro. However, an email to MDC promoters revealed that earned commissions are being withheld until they activate Immunotec accounts, placing them in Zwagil’s downline, per Jesse Singh’s report. This tactic has drawn accusations of unethical practices, potentially breaching promoter contracts.

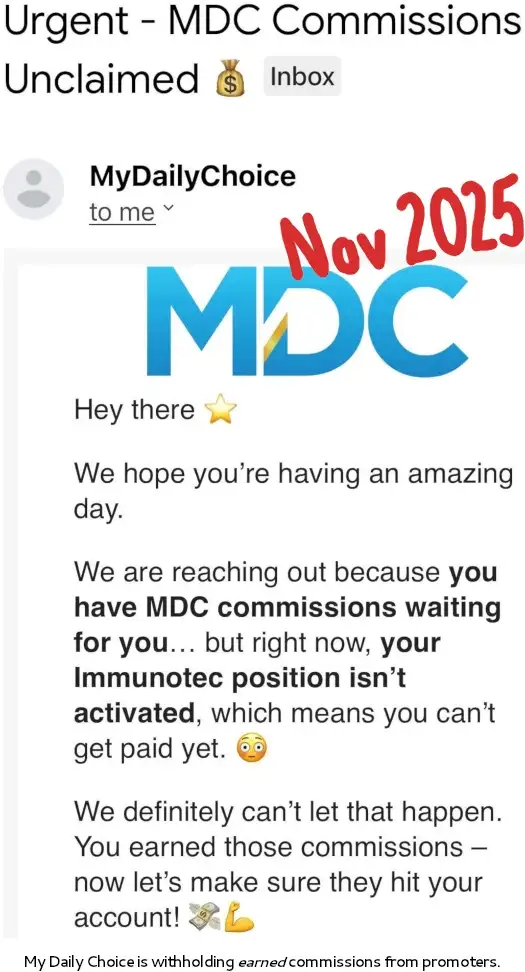

The email explicitly states: “We are reaching out because you have MDC commissions waiting for you… but right now your Immunotec position isn’t activated yet, which means you can’t get paid yet,” urging promoters to create Immunotec profiles, per. Critics argue this forces enrollment in a new MLM for Zwagil’s financial gain, exploiting MDC’s 89,188 promoters amid a 2024 data breach exposing personal info, per. Legal experts suggest it could violate MLM compensation agreements, opening doors to breach of contract lawsuits. Zwagil’s shift follows MDC’s declining traffic (38,700 monthly visits in October 2025), per, while Immunotec touts the merger as a “new era” with $600M+ in MDC sales.

Immunotec CEO Mauricio Domenzain framed the partnership as leveraging MDC’s “high-velocity field leadership” for global growth, per Direct Selling News. However, withholding commissions risks alienating the field, echoing past MLM controversies like Herbalife’s recruitment focus, per. X posts from @realjessesingh amplify the issue, warning of “commissions hostage” tactics, per [post:15]. MDC’s compensation plan, emphasizing product sales over recruitment, contrasts with this merger’s apparent downline push, mydailychoice.com. Promoter uncertainty lingers, as merger details remain undisclosed.

This merger could doom Immunotec’s momentum by eroding trust, per. Promoters should review contracts for payout clauses and consult lawyers on withheld earnings, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, but MLM volatility highlights diversification needs, per CoinMarketCap. Track updates via businessforhome.org, and MLM Ranks set financial boundaries. Follow @TheBlock__ on X for MLM trends. While the merger promises “exponential growth,” unresolved payment issues may lead to legal fallout in 2026.

Zhimin’s conviction, with £5B seized, underscores global crackdowns on crypto fraud, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, per CoinMarketCap, but the case highlights Ponzi risks amid the SEC’s Paul Atkins era. Investors should verify via sec.gov and avoid MLM schemes. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for updates. This saga may spur stricter FATF rules.