Rich Miner Review 2025: Alarming Truth About Rich Miner’s ROI, Risks & Ponzi Red Flags

In this Rich Miner review, Scams Radar explores the platform’s claims as a cloud mining service. Many seek details on Rich Miner cloud mining and its cryptocurrency mining options. We examine ownership, returns, and other factors to help you decide if it’s a safe investment. This analysis uses public data to highlight key concerns.

Table of Contents

Part 1: Quick Summary: What Is Rich Miner?

Rich Miner acts as a cloud mining platform. It promises daily passive income from cryptocurrencies like BTC, ETH, XRP, USDT, SOL, and DOGE. The frontend runs on richdl.com, while richminer.com handles marketing and sales. Founded in 2022, it claims a UK base at 70 High Street, Chislehurst, BR7 5AQ. Features include no hardware needs, green energy use, AI tools for allocation, and strong security.

It boasts FCA licensing, US MSB registration, and HSBC fund management. Yet, these lack proof. Online presence stems from paid press releases on sites like GlobeNewswire and Crypto. News. These carry sponsor notes, not real news. Bottom line: High risks from unreal returns of 36% to 120% monthly, fake mining like XRP, and referral pushes. It mirrors Ponzi traits, per warnings on Binance Square.

1.1 Ownership, Legal Entity & “UK Company” Claims

Domain data & who really owns richdl.com / richminer.com

Domains show redacted owners via privacy tools. Richdl.com dates to 2013, richminer.com to 2020. Registrar is Gname.com Pte. Ltd. No clear owner names or team bios appear on sites. This hides accountability.

Companies House certificate & 70 High Street address

A PDF on the site shows incorporation for RICH FINANCIAL CONSULTING LTD in England and Wales. It lists the Chislehurst address. But this spot hosts many unrelated firms, like a shared office. No direct link ties this entity to platform operations. Directors stay unnamed in public records. Background checks yield no profiles or histories for key people. This setup suggests a shell for looks, not real oversight.

FCA / MSB / HSBC claims vs what’s verifiable

Claims repeat in PR: UK start in 2022, FCA oversight, MSB status, HSBC custody. Searches on the FCA register find no matches for Rich Miner terms. MSB lacks a number to check. HSBC ties seem made up, with no proof. Reviews call these misleading. Without verified leaders or backgrounds, trust falls short.

Part 2: What Rich Miner Actually Promises: Plans, Packages & ROI

Plan Name | Investment | Term | Total Return | Profit | ROI Over Term | Daily ROI |

Sign-in Contract | $15 | 1 day | $15.60 | $0.60 | 4.0% | 4.0% |

New User Experience | $100 | 2 days | $106 | $6 | 6.0% | 3.0% |

Canaan Avalon A15XP | $600 | 8 days | $657.60 | $57.60 | 9.6% | 1.2% |

Bitdeer SealMiner A2 | $1,300 | 13 days | $1,521.39 | $221.39 | 17.0% | 1.31% |

Bitmain Antminer L7 | $3,000 | 17 days | $3,719.10 | $719.10 | 24.0% | 1.41% |

Bitmain Antminer S21 Immersion | $5,600 | 24 days | $7,616.00 | $2,016 | 36.0% | 1.50% |

Bitmain Antminer L9 | $12,000 | 32 days | $18,528.00 | $6,528 | 54.4% | 1.70% |

2.1 Daily, monthly, and annualized returns (with math)

Daily rates ranged from 1.2% to 4%. Monthly equivalents: ~36% to 120%. Annualized, a 1.2% daily rate compounds to about 7,778% (1.012^365 – 1). For $1,000 at 1.2% daily over 365 days, it grows to $77,783. Higher rates explode faster. These ignore market swings, unlike real mining.

Part 3: Why These ROI Numbers Are Economically Impossible Long-Term

Compounding math vs reality

Real mining faces costs like power and hardware. Profits vary, often 5-20% yearly. Fixed high yields need constant new cash, like a Ponzi scheme. Compounding at promised rates turns small sums huge fast, unsustainable without endless growth.

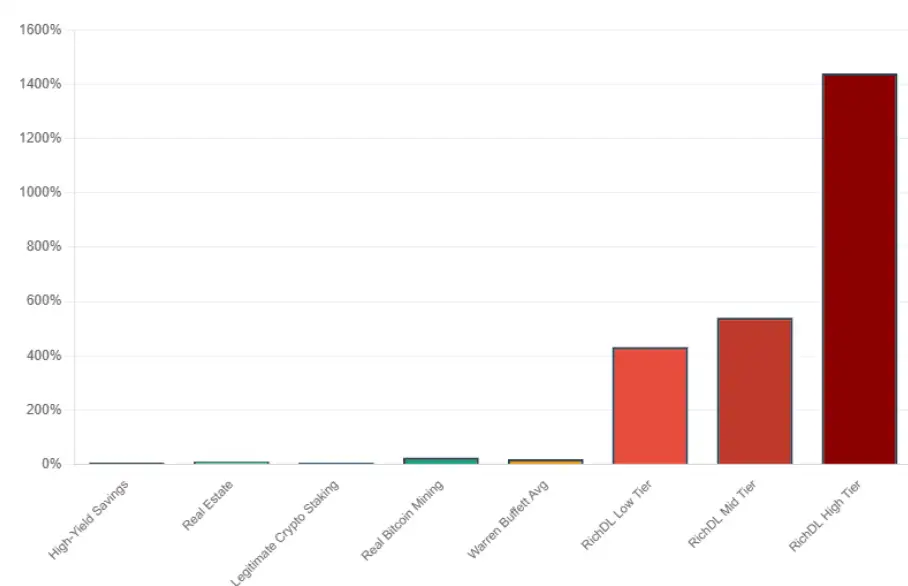

Comparisons: real estate ROI, bank deposits, ETH staking & real mining

- Bank savings: 1-5% yearly, safe.

- Real estate: 5-10% yearly net, tangible.

- ETH staking: 3-6% yearly, variable.

- Real mining: 5-20% yearly, risky.

Rich Miner dwarfs these. Bar chart data shows:

Investment | Annual ROI (%) |

Bank Savings | 4 |

Real Estate | 7 |

ETH Staking | 5 |

Real Mining | 15 |

Rich Miner Low | 432 |

Rich Miner High | 1440 |

3.1 Compensation & Referral Structure (Ponzi-Like Incentives)

Plans favor bigger investments with better rates. Referral program: 3% direct, 1% level 2, 0.5% level 3. This drives recruitment over mining. Rich Miner referral bonuses and affiliate program push sharing links. It fits MLM, where new funds pay old.

Part 4: Traffic, Marketing Footprint & How They Attract Deposits

Heavy PR blitz & sponsored articles

Traffic relies on paid ads, low organic. PR on GlobeNewswire, VRITIMES repeats claims. All sponsored, no independent checks.

Social media accounts & shill networks promoting richdl.com

Accounts like @Richminer2022 post bonuses. Others: @SmartchainNews, @CryptoNewz share articles. Past promotions include similar yields like Bitget, Cbex. Networks tied to get-rich schemes.

4.1 Public Perception: Reviews, Complaints & Independent Warnings

Trustpilot & user experiences

Scores 2.5-3/5. Positives: Easy start, small payouts. Negatives: Blocks on big sums, VIP demands.

Binance Square “Ponzi trap like Cbex” warning

Warns of traps, unsustainable yields like Cbex.

OpenPR / InvestorWarnings and other commentary

Call it Ponzi-like, note impossible mining, unverified rules.

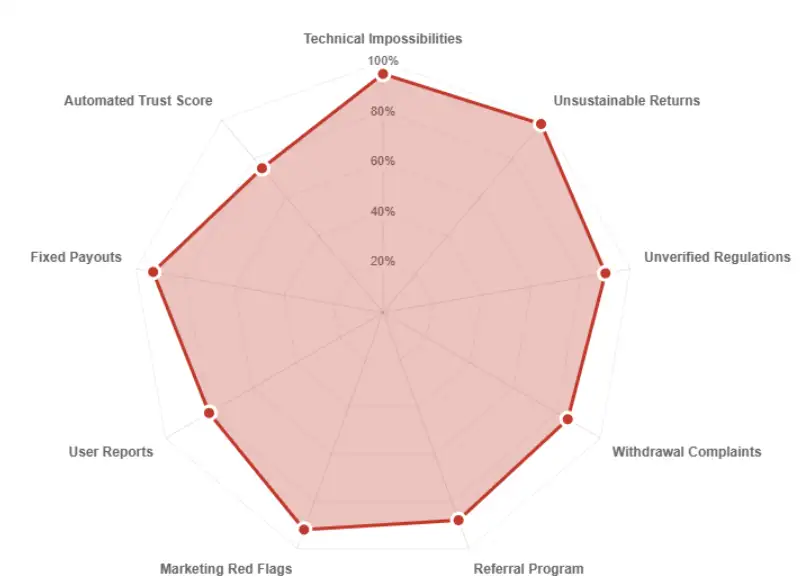

Part 5: DYOR Scanner Reports for Rich Miner

Gridinsoft, ScamDetector, ScamDoc & Scamadviser

Gridinsoft: 80/100 for tech, but flags scam risk. ScamDetector: Suspicious. ScamDoc: 83%, hidden owner. Scamadviser: Low trust.

5.1 Security Claims vs Reality (Tech Stack & “Bank-Level” Marketing)

Claims encryption, no incidents. Uses HTTPS, Cloudflare. But self-reported, no audits. Rich Miner’s security protocols are unproven.

5.2 Content Authenticity: PR, Self-Written Articles & Fake Authority

Content recycled in paid posts. Awards, tech claims unverified. Misleads on mining.

Payment Methods, Customer Support & Technical Performance

Deposits in cryptos, no fiat. Withdrawals are daily but often delayed. Support via email, chat; reviews say slow. App loads fast, JS-based. Rich Miner’s withdrawal process, fees, and charges include hidden terms. Customer support quality varies.

Key Red Flags Investors Should Not Ignore

- Fixed ROIs ignore markets.

- Fake XRP/ETH mining.

- No licenses.

- Withdrawal blocks.

- MLM referrals.

- Sponsored PR.

- Complaints about upsells.

Scenario Analysis & Future Outlook (What Typically Happens Next)

Pays early, then blocks. May collapse in 6-18 months like Cbex. Regulators could shut it.

Recommendations & Safer Alternatives

Avoid deposits. If in, withdraw fast, document. Alternatives: Regulated staking on Binance (5-20% yearly), banks, and real estate.

DYOR Checklist & Tools You Can Use Yourself

Check regulators, WHOIS, and scanners like Gridinsoft. Compare ROIs. Search reviews.

Conclusion

This Rich Miner review shows major concerns in ROI, ownership, and operations. Claims don’t hold up. For safe choices, pick verified platforms. This info aids decisions but isn’t advice. DYOR always; consult experts. Crypto carries risks.

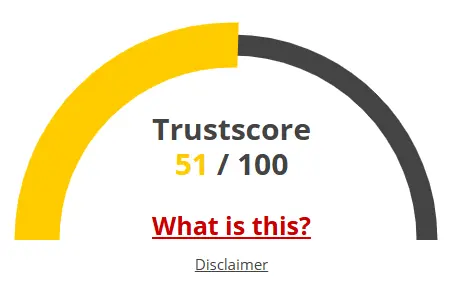

Rich Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. Rich Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Rich Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Rich Miner Review

This section answers key questions about Rich Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Its high ROIs, hidden ownership, and fake mining claims match Ponzi patterns.

Fake mining, blocked withdrawals, unverifiable licenses, and unrealistic returns.

No. Real mining gives 5–20% yearly; Rich Miner promises up to 120% monthly.

Not at all. Its structure and payout model make it unsafe for any investor.

Similar red flags, hidden owners, extreme ROIs, and referral-driven payouts.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.