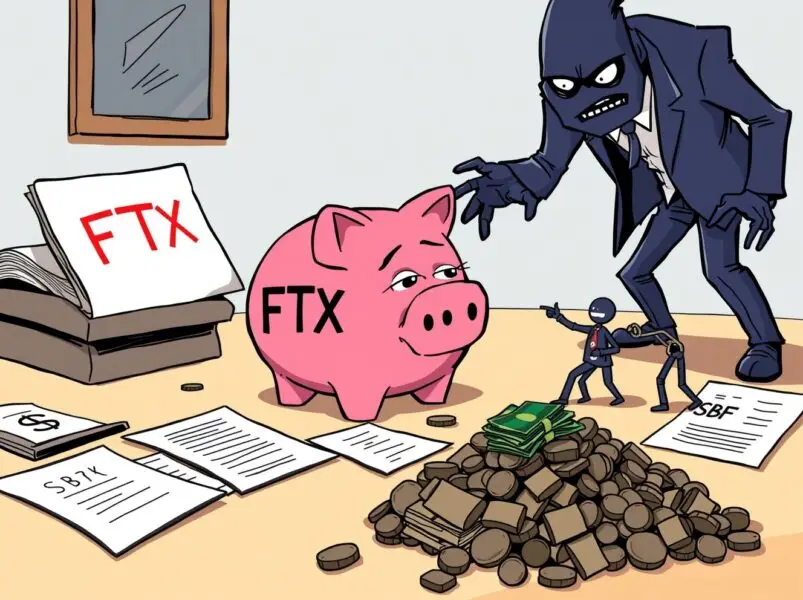

On October 31, 2025, Sam Bankman-Fried (SBF), the imprisoned founder of the collapsed FTX exchange, reiterated his controversial stance that FTX was never insolvent, attributing the 2022 bankruptcy to a temporary liquidity crisis rather than outright fraud, per ItsBitcoinWorld and. In a document shared on his X account and interviews, SBF asserts that FTX held $25 billion in assets and $16 billion in equity against $13 billion in liabilities at filing, enabling full creditor repayment plus interest, per. This claim, central to his November 4, 2025, appeal hearing in Manhattan, challenges the jury’s 2023 fraud conviction and contrasts with bankruptcy administrator John Ray III’s findings of misappropriated funds, per.

SBF argues the crisis stemmed from a surge in withdrawals triggered by a CoinDesk report on Alameda Research’s FTT token holdings, creating a short-term liquidity crunch that was nearly resolved, per. He claims external lawyers prematurely filed for bankruptcy, halting recovery efforts, and that $8 billion in customer assets “never left the platform,” updated with market gains like Solana (SOL) ($12.4B), Anthropic equity ($14.3B), and Robinhood stock ($7.6B), per. FTX Recovery Trust has distributed $8.1 billion in three rounds, with 98% of creditors expected to recover 119–143% of claims, supporting SBF’s solvency narrative, per. However, former FTX general counsel Ryne Miller refuted this on X, stating assets were “gone” at filing, with repayments from misappropriated funds, per.

SBF’s assertions fuel debate on FTX’s $8 billion fraud conviction, potentially influencing his appeal for acquittal or retrial by arguing excluded solvency evidence prejudiced the jury, per. The FTX estate, valued at $136 billion with $8 billion remaining after claims and $1 billion in legal fees, underscores recovery success, per. John Ray III has called SBF’s claims “categorically false,” emphasizing the bankruptcy’s necessity amid customer fund misuse, per. X discussions, like @TylerDurden’s “SBF was a fall guy,” reflect divided sentiment, per. This saga highlights regulatory gaps in crypto, with SEC and CFTC oversight evolving under Paul Atkins, per.

While SBF maintains FTX’s solvency on a “fair-value” basis, bankruptcy law assesses assets at filing date, ignoring post-collapse gains, per. SBF admits leadership failures and Alameda risk ties but denies fraud, per. Creditors have received 100% repayment plus 9% interest, per, but the $1B+ in bankruptcy fees draws criticism. X threads, like @WuBlockchain’s asset breakdown, amplify SBF’s “never insolvent” narrative, per. As FTX’s legacy endures, this debate underscores crypto’s maturity, with 98% creditor recovery a rare positive in fraud cases, per.