Grow BNB Review: Is This Platform Reliable?

In this Grow BNB review, Scams Radar examines the platform’s claims and risks. Many people search for ways to grow their BNB holdings. But caution is key. We combine facts from various sources. Our goal is to help you decide.

Table of Contents

Part 1: Understanding the Grow BNB Platform

Grow BNB operates on the BNB Smart Chain. It uses a native token called GBNB. The site promises daily returns that range from 0.75% to 1.25%. Plans tied to deposit size. It markets as sustainable DeFi. It adds green blockchain themes. But the details lack proof.

The platform requires a wallet connection early. This blocks easy browsing. Recent checks show the site empty. No content loads. This raises concerns. It may be down or abandoned.

1.1 Ownership and Team Background

No clear owners appear. The site lists no founders. No developers or advisors show up. WHOIS data hides behind privacy tools. Standard lookups give no names. No addresses or contacts emerge.

Legit platforms share team info. For example, Binance lists leaders. Uniswap does too. Here, anonymity rules. This limits accountability. If issues arise, no one to contact. Rug pull risks grow high.

No LinkedIn profiles link to the project. No public bios exist. This opacity is common in risky schemes. Investors have no recourse.

Part 2: Detailed Compensation Plan

Plan Name | Investment Range | Daily ROI | Maturity | Annual Equivalent |

Wheat Harvester | 0.05 – 4 BNB | 0.75% | Until 2x capital | ~1,429% APR |

Exotic Fruit | 4 – 20 BNB | 1.00% | Until 2x capital | ~3,678% APR |

Superfood | 20 – 50 BNB | 1.25% | Until 2x capital | ~9,215% APR |

A 5% fee plus gas applies to withdrawals. Returns cap at double capital.

Referrals add income. It’s a 20-level system.

- Level 1: 8%

- Level 2: 7%

- Level 3: 6%

- Drops to 0.25% at Level 20

Unlock levels need direct referrals. Seed income spans 25 levels. Earn 0.2% to 10% from downline pulls.

Tokenomics break down like this:

- 40% for rewards

- 20% development

- 15% marketing

- 10% liquidity

- 10% referrals and seeds

- 5% reserves

This setup is centralized. Manual control raises manipulation fears. Earnings rely on new users. Not on real value.

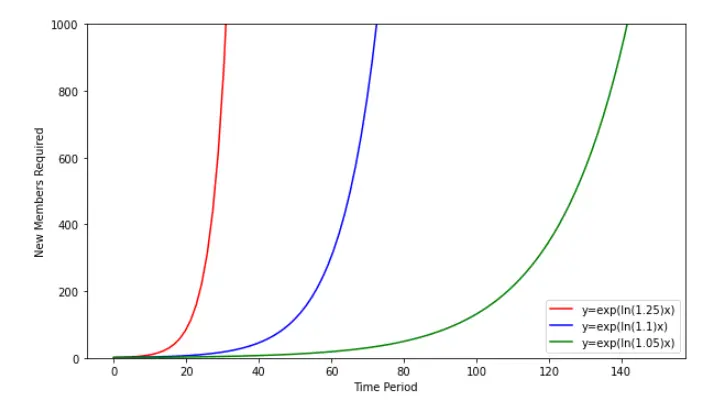

2.1 Why Returns Are Unsustainable: Math Proof

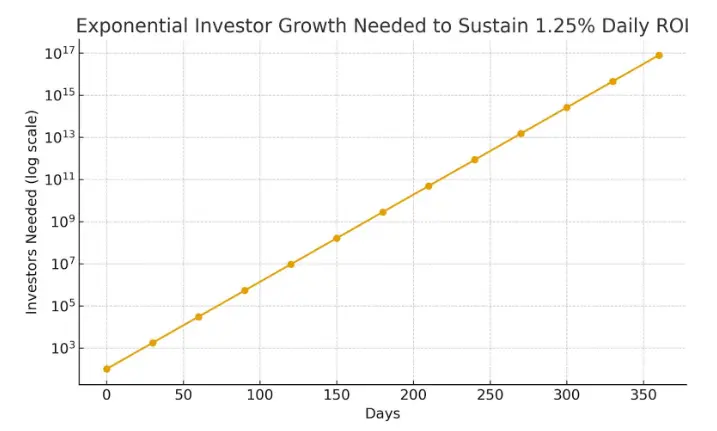

Daily ROIs compound high. See this chart of 1.25% daily over a year.

Notable compound interest growth at 1.25% daily, leading to unrealistic APY.

Formula: APR = [(1 + rate/100)^365 – 1] × 100. Yields thousands percent.

Sustain needs endless inflows. Model: 100 start investors. 10% daily growth is required.

Data shows explosion: After 365 days, 1.17e+17 investors needed. Impossible.

See this graph of Ponzi growth.

Exponential investor growth is needed to sustain a Ponzi scheme.

Real yields differ.

- Banks: 4-5% APY, insured.

- Real estate: 8-12% annual.

- Crypto staking: 5-15% APY.

Grow BNB dwarfs these. Signal issues.

Part 3: Traffic and Public Views

Traffic data stays low. Tools like SimilarWeb show no results. This points to a few visits. Established sites get millions.

Public mentions are rare. Searches hit unrelated sites. Growyourbnb.com aids Airbnb hosts. It has 5-star Trustpilot scores. But Grow BNB has no positive reviews on Trustpilot. Reddit and forums lack threads. Silence suggests avoidance.

On X, “growbnb.us” yields few hits. Recent posts talk GBNB token. Issues with treasury noted. Low engagement shows.

3.1 Security and Technical Aspects

Smart contract address: 0x48d…4355 on BscScan. Claims immutable status. But no audits from Certik or PeckShield.

SSL exists. But it’s basic. No KYC or insurance. Wallet connect upfront risks drain.

Performance is simple. Loads fast. But gating hinders checks. Unverified code adds exploit odds.

Content uses buzzwords. Sustainable DeFi lacks evidence. No carbon proofs. Generic feel mirrors Ponzi templates.

Payments use BNB only. No fiat. This skips rules. But adds volatility.

Support limits to Telegram. No email or phone. This shows poor focus.

Red Flags and Comparisons

- Unreal ROIs need referrals.

- No audits or transparency.

- Green claims without proof.

- Multi-level like Forsage, BitConnect.

- Site now empty.

DYOR tools: ScamAdviser has low trust for similar domains. VirusTotal has no scans. Obscurity hints at evasion.

Social promotions: @GoldbnbGold, @Gold_BNB_ push GBNB. Past focus on other tokens like $BNB. Low shilling suggests hype fade.

Like past scams: BNBMatrix rug pulled. Forsage faced crackdowns.

Future Outlook

Short term: Some payouts may draw FOMO. Midterm: Slow inflows cause delays. Long term: Likely rug or vanish. Post-2025 rules target such DeFi. GBNB may zero out. Trends favor audited projects.

What to Do Next

Avoid deposits. Risks: total loss. If in, withdraw fast. Revoke via Revoke. cash. Report to r/CryptoScams.

Safer paths: Stake on Binance. Use real estate ETFs. Grow your BNB via legit tools.

Final Thoughts on Grow BNB

This Grow BNB review highlights key risks. No owners. Unreal returns. Ponzi traits. Site down adds doubt. Do deep checks. Consult experts. Markets change fast. DYOR always. Invest what you can lose. This info aids safe choices.

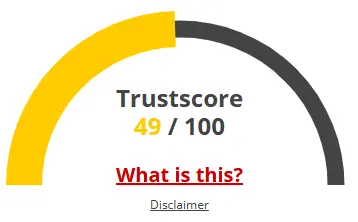

Grow BNB Review Trust Score

A website’s trust score is an important indicator of its reliability. Grow BNB currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Grow BNB or similar platforms.

Positive Highlights

- Valid SSL certificate found.

- DNSFilter marks the site as safe.

Negative Highlights

- Low website traffic

- Uses registrar linked to scams

- Mostly negative reviews found

- Flagged by iQ Abuse Scan for phishing

- Newly registered domain

- Unusually high number of early reviews

Frequently Asked Questions About Grow BNB Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

The smallest coin size for Grow BNB participation is 0.05 BNB, which qualifies users for the basic “Wheat Harvester” plan.

Larger coin sizes automatically place users in higher-tier plans with greater daily ROI rates, but these inflated percentages make the project unsustainable.

Yes. The top-tier “Superfood” plan accepts up to 50 BNB, after which additional deposits are capped or split across wallets.

Grow BNB doesn’t allow plan upgrades directly; users must create new deposits with higher coin sizes to move into new ROI tiers.

Unlike audited tokens highlighted in the Everstead Review, Grow BNB’s coin size system directly dictates ROI instead of depending on real yield generation, making it riskier.

Other Infromation:

Website: growbnb.us

Reviews:

There are no reviews yet. Be the first one to write one.