On October 7, 2025, the Netherlands Authority for the Financial Markets (AFM) issued a fraud warning against BitHarvest, labeling it a suspected boiler room—a type of online investment scam promising high returns through aggressive sales tactics, per. The alert targets cryptex-vip.com and cryptex.to, where BitHarvest offers unlicensed DeFi staking services, allowing users to deposit crypto assets for promised rewards, per. This follows the AFM’s first warning in July 2025, focusing on cryptex-vip.com, per. Offering unregistered securities violates German financial law, constituting securities fraud under the German Securities Trading Act, per.

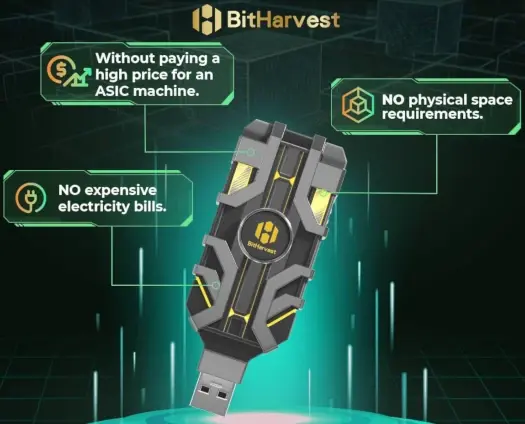

BitHarvest, based in Malaysia, operates as an MLM crypto Ponzi scheme centered on a dubious “USB thumb drive” that allegedly boosts crypto mining efficiency by up to 300%, per. Fronted by “CEO Logan Lee”—a fabricated identity played by Singaporean Steve Ng, a Prudential insurance advisor and poker player—the scheme ties to Malaysian national Jaz Pee (aka Wei Haw Pee), per. Ng’s dual role raises red flags, as he promotes the scam while advising clients on legitimate investments, per. The Ponzi lures affiliates with recruitment bonuses, promising $250–$700 daily returns on $50,000 investments, but relies on new inflows to pay earlier participants, per.

California’s Department of Financial Protection and Innovation (DFPI) issued a desist and refrain order on August 20, 2024, against BitHarvest Ltd, Logan Lee, Lenni Herlin, and promoter Jan Gregory Cerato for selling unregistered securities like BitBoosters, per. Russia’s Central Bank (CBR) flagged it as a financial pyramid in February 2025, citing MLM recruitment over actual mining, per. Austria’s FMA warned in April 2025, per. As of September 2025, the site sees 322,000 monthly visits, primarily from the U.S. (43%) and Italy (34%), with declining traffic in Australia and France, shifting to Cote d’Ivoire and Hungary, per. X posts label it a “scam” and “pyramid scheme,” with users reporting withdrawal issues and fake dashboards.

BitHarvest’s ruse, including Texas mining farm claims, exploits crypto hype but shows classic Ponzi signs: unrealistic returns, fake executives, and regulatory bans, per. Investors should report to AFM at afm.nl and avoid deposits, per. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,070) remain stable, per CoinMarketCap, but such scams erode DeFi trust. Diversify into USDC or ETH with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for alerts. BitHarvest’s collapse could mirror Forsage’s $340M losses, urging vigilance in 2025.

Zeus Funding exemplifies investment fraud, promising unregistered passive returns without evidence of regulatory compliance, per. $1B+ in alleged GSPartners losses (related scheme) highlight Ponzi risks, per. Investors should report to SEC (sec.gov) or local regulators and avoid Telegram-based schemes. Bitcoin (BTC) ($113,234) and Ethereum (ETH) ($4,100) remain stable; diversify into USDC with stop-losses below BTC’s $112,000, per TradingView. Follow @TheBlock__ on X for scam alerts. Zeus Funding’s collapse seems inevitable as recruitment dries up, per.