Jacques Marais, a notorious South African fraudster linked to illegal cash gifting schemes, has relaunched his Infinity Grid MLM gifting Ponzi in September 2025, following multiple collapses since 2022, per. Initially succeeding The Prosperity Grid, Infinity Grid imploded repeatedly, rebooting as “Infinity Grid Traditional” in 2024 before Marais vanished, only to resurface in August 2025 blaming developers, per. The latest iteration requires participants to pay $5 in cryptocurrency by September 26 to “flush the grids” and join “AI positions,” undisclosed funding sources that promise phantom gifting payments, per. This cycle of reboots has left victims desperate, with Marais now recruiting them into LevAI, a LaCore Enterprises MLM opportunity, per.

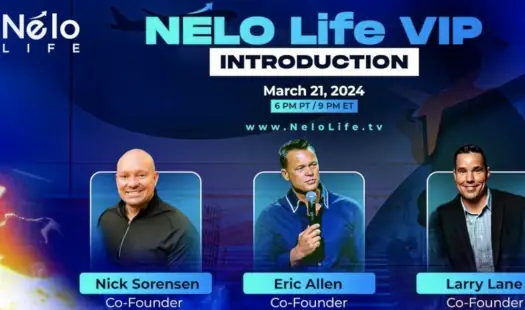

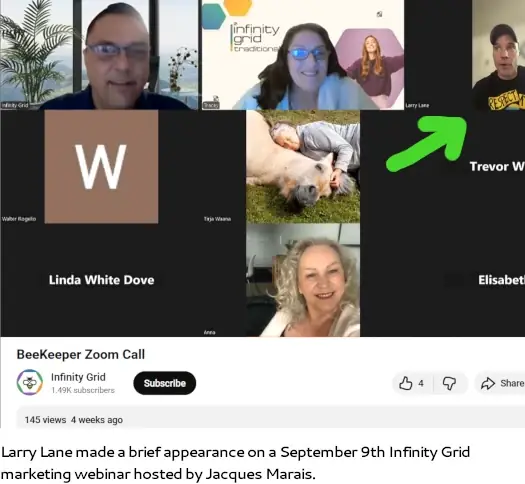

Marais was recruited into LevAI by Larry Lane, a veteran MLM promoter with a history of collapsed schemes, including Rippln (2013), B-Epic, TranzactCard, Beurax, and VidMe, per. Lane, co-founder of Nelo Life until March 2024, briefly appeared on Marais’ September 9 webinar to hype AI features, per. LevAI, launched in September 2025, is Lane’s latest LaCore venture, following his 2022 role as co-CEO of VIP Global Stars, per. X posts from @MLMWatchdog warn that LevAI recycles Infinity Grid victims, with low website traffic (2,900 monthly visits, mostly Belarus 56%, U.S. 29%) indicating limited traction, per SimilarWeb.

Infinity Grid’s “AI reboot” terminates prior positions, forcing repurchases and extracting fees, while LevAI recruitment exploits desperate victims, per. Gifting schemes like these collapse when recruitment dries up, with Marais’ undisclosed “AI position” funding likely from recycled commissions or stolen funds, per. South African authorities have issued warnings on Marais’ schemes, but global enforcement lags, per. SEC scrutiny under 18 U.S.C. § 981 for fraud could escalate if U.S. victims emerge, per Coinlaw.io. Investors face total loss risks, with no consumer redress in sight.

Infinity Grid and LevAI highlight MLM Ponzi dangers, with victims urged to report to FTC at reportfraud.ftc.gov or SEC at sec.gov, per. Avoid schemes promising quick returns; verify via BBB or FINRA. Monitor Bitcoin (BTC) ($113,234) for safe havens, with support at $112,000, per TradingView. Diversify into USDC or ETH ($4,070) with stop-losses. Follow @TheBlock__ on X for regulatory alerts. As crypto matures in 2025, due diligence prevents funneling into endless reboots, per.