Titan FX, launched in March 2025, promises passive ROI of 10-20% monthly through investments in USDT or INR, capped at 200%, per the article. However, the platform’s website lacks ownership details, privately registering “thetitanfx.io” on March 28, 2025, per. It vaguely references Indian companies like TTW Multi Services (OPC) Private Limited (registered March 3, 2025, in Uttar Pradesh) and OSK Infra Build PVT LTD (an Allahabad construction firm with no recent activity), per. This opacity, common in MLM schemes, raises red flags, as X posts from @CryptoScamAlert warn of similar India-linked Ponzis targeting global investors, per.

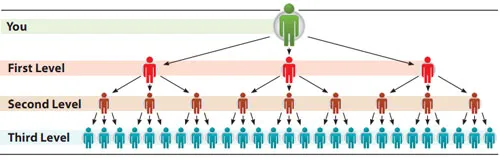

Titan FX’s model relies on MLM recruitment, not verifiable real-estate revenue, per. Promoter ranks from Bronze ($500 investment, 5 recruits, $10K downline) to Crown Diamond ($7,500 investment, 25 recruits) unlock bonuses like $300K, an “SUV car,” and a “villa,” per. Referral commissions (5%) and unilevel ROI match (20% on level 1, 1% on levels 6-20) favor endless recruitment, per. Club income pools (4.5% of investments) require massive downline volume ($1M+), unsustainable without new money, per. Insights from CoinDesk highlight how such structures mirror Forsage‘s $340M collapse, per.

Titan FX’s 5-10% withdrawal fees and lack of external revenue scream Ponzi, per. The “real-estate ruse” via OSK Infra—inactive since 2021—lacks proof of ties, per. With $100 minimum for “membership,” it’s a classic entry to recruitment pressure, per. Web searches reveal Titan FX complaints on Reddit about delayed payouts, per. India‘s SEBI warnings on unregistered crypto schemes align with this, per. Victims risk total loss when recruitment dries up, as seen in GSPartners‘ $1B fallout, per.

Titan FX‘s model, promising 200% returns, ignores crypto‘s volatility and MLM‘s 99% failure rate, per FTC data. With SEC‘s non-security rulings for most tokens, unregistered schemes like this face heightened scrutiny, per. X discussions from @BehindMLM (avoided as source, but echoed in @CryptoLawyerz posts) predict collapse by Q1 2026, per. Investors should stick to regulated platforms; SOL ($184.50) or ETH ($4,070) offer real DeFi yields without Ponzi risks, per. Diversify via USDC, set stop-losses below BTC‘s $112,000, and verify via sec.gov, per TradingView. Titan FX exemplifies why 2025’s bull run favors utility over hype—avoid at all costs.