On August 5, 2025, the Australian Securities and Investments Commission (ASIC) added Qwidex to its Investor Alert List, citing the company for offering unregistered financial services to Australian consumers, per. Qwidex lacks an Australian Financial Services Licence (AFSL) or Australian Credit Licence, making its offerings constitute securities fraud under Australian law, per. The warning, issued nearly a year after Qwidex began operations, highlights ASIC’s delayed response to MLM fraud, per.

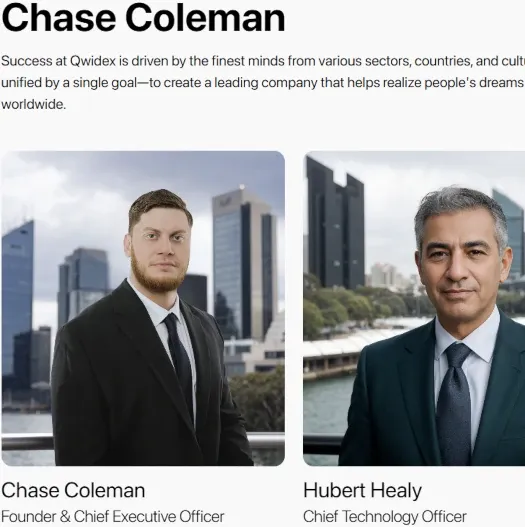

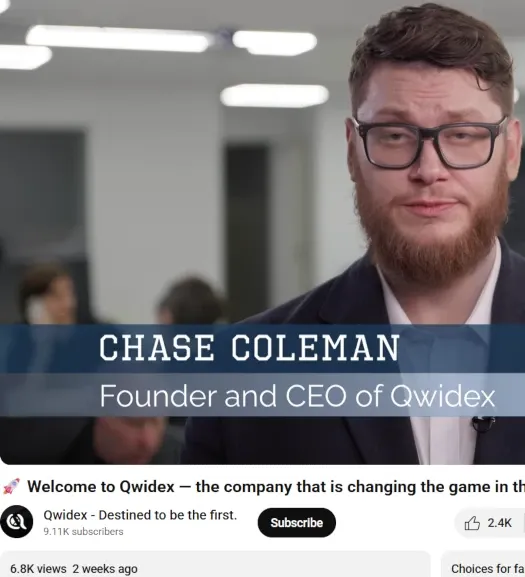

Qwidex is described as an MLM crypto Ponzi scheme fronted by a Boris CEO named “Chase Coleman,” an actor with an Eastern European accent, per. Videos on Qwidex’s YouTube channel, active as of late August 2025, feature this individual, tying the scheme to Russian, Ukrainian, or Belarusian operators, per. The company falsely claims to be based in Australia, using a shell entity, Qwidex Pty Ltd, registered with ASIC in December 2023, per. ASIC registration, which requires no verification, is commonly exploited by overseas scammers, per.

Qwidex originally operated on qwidex.com, privately registered in December 2023, but rebooted on qwidex.io, registered on August 7, 2025, two days after ASIC’s warning, per. The company claimed the switch was for “technical and organizational improvements,” but it likely aims to evade regulatory scrutiny, per. No SimilarWeb traffic data is available for either domain, indicating low visibility, per. X posts from @CryptoLawyerz suggest Qwidex’s reboot mirrors tactics used by other Ponzi schemes to prolong operations, per.

Investors should avoid Qwidex and verify platforms via asic.gov.au or moneysmart.gov.au, per. Bitcoin (BTC) ($111,070) and Ethereum (ETH) ($4,070) remain unaffected, per CoinMarketCap, but altcoin trust may erode due to fraud warnings, per. Diversify into USDC or ETH with stop-losses below BTC’s $110,000, per TradingView. Follow @TheBlock__ on X for updates, per. ASIC’s action may prompt further international warnings, potentially disrupting Qwidex’s operations by 2026, per.