RapidBitex Review: Is This Crypto Platform Safe for Investors in 2025?

The RapidBitex crypto exchange (rapidbitex.com) claims to offer high returns through AI-driven trading and token investments. Launched in 2025, it promises fast profits and advanced trading tools for beginners and experienced investors alike.

However, our detailed RapidBitex review on Scams Radar reveals serious concerns about its legitimacy. We examine ownership, compensation plans, security, and user experience using clear data, charts, and comparisons to help investors make informed decisions. Always perform your own research (DYOR) before investing.

Table of Contents

Ownership: Who Runs RapidBitex?

The platform lacks clear ownership details. The domain, registered on May 12, 2025, uses privacy protection to hide registrant information, a tactic often seen in scams. WHOIS data points to Hong Kong and China, with no verifiable executives listed. The site claims a San Francisco headquarters, but records show the address belongs to a Planet Fitness gym. Fake personas like “Walter Cross,” a stock photo model, are used to portray founders. Legitimate exchanges like Binance or Coinbase disclose their leadership and comply with regulations. This anonymity raises major concerns about RapidBitex’s transparency.

Ownership Red Flags

- Hidden Registrant: WHOIS data conceals owner identity.

- Fake Address: Claims a U.S. base at a gym location.

- Stock Photos: Uses fabricated executive profiles.

Compensation Plan: Unrealistic Promises

RapidBitex promises 200% to 1000% returns over 14 months via AI trading and proprietary WINH tokens. Investors deposit USDT, but payouts come in WINH, a token with no external market value. Early withdrawals face a 50% penalty, and regular withdrawals incur a 10% “charity” fee. The plan relies on recruiting new investors, a hallmark of Ponzi schemes. Legitimate platforms like Kraken provide clear risk disclosures, unlike RapidBitex’s vague claims.

Feature | Details |

Investment | USDT deposits, locked for 14 months |

Returns | 200%–1000% promised, paid in WINH token |

Fees | 50% early withdrawal penalty, 10% “charity” fee on regular withdrawals |

Structure | Three-level unilevel commission based on recruitment |

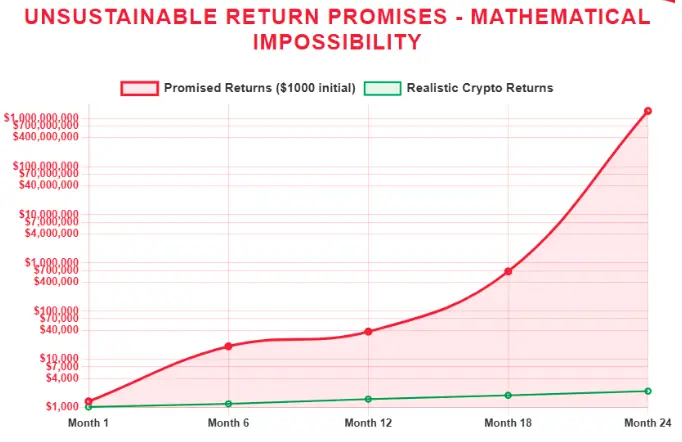

ROI Math: Why It’s Unsustainable

Let’s calculate a 200% return over 14 months on a $1,000 investment:

- Formula: ( A = P (1 + r)^n ), where ( P = $1,000 ), ( r = 8.2%/month ), ( n = 14 )

- Result: ( A = 1000 \times (1.082)^{14} \approx $3,000 )

- Annualized ROI: ~156%/year

For 1000% returns:

- Monthly Rate: ~18.7%

- Result: ( A = 1000 \times (1.187)^{14} \approx $11,000 )

- Annualized ROI: ~680%/year

These returns far exceed legitimate benchmarks:

- Real Estate: 6–10%/year

- Bank Savings: 3–5%/year

- Crypto Staking (Coinbase): 4–12%/year

Security and Technical Performance

RapidBitex claims SSL encryption and two-factor authentication but offers no proof of third-party audits like SOC 2. Its SSL is a basic Domain Validated (DV) certificate, easily obtained by anonymous entities. The site, hosted on Cloudflare, shows persistent loading issues, with a “Loading resources” screen indicating poor functionality. Subdomains like coin5manager.aisms.info host support apps, a red flag for scams. Legitimate platforms ensure robust, audited security and reliable performance.

Security Red Flags

- No Audits: Lacks SOC 2 or ISO 27001 certifications.

- Basic SSL: DV certificate offers minimal verification.

- Loading Issues: Suggests incomplete development.

Payment Methods and Customer Support

Deposits are limited to USDT, with no fiat options, unlike regulated exchanges like Gemini. Withdrawals are complex, with high fees and delays reported. Customer support is a generic contact form on an off-domain site, lacking live chat or phone options. Legitimate platforms offer transparent, multi-channel support.

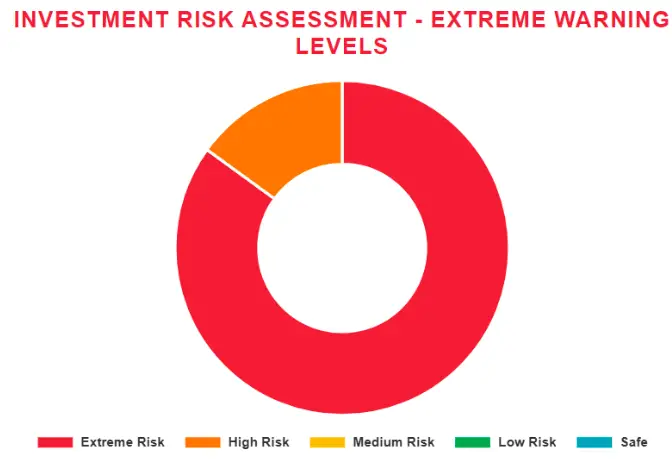

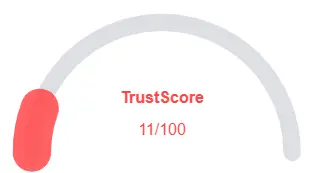

Public Perception and Traffic

RapidBitex has low traffic, estimated at under 10,000 monthly visits, compared to Binance’s 100 million. It’s absent from CoinMarketCap and CoinGecko. Scamadviser gives it a 31/100 trust score, citing hidden ownership and malware risks. No organic discussions exist on Reddit or X, and promotions often use fake Telegram accounts tied to past scams like BitsAlmax and DarvisClub.

Social Media Promotions

Promoters linked to RapidBitex also pushed:

- BitsAlmax (collapsed 2022)

- DarvisClub (collapsed 2022)

- WinchesterHS (collapsed 2022)

RapidBitex Review Conclusion

This RapidBitex review highlights serious risks: anonymous ownership, unrealistic 200–1000% returns, and poor functionality. Compared to Binance’s 4–12% APY or real estate’s 6–10%, RapidBitex’s model is unsustainable, resembling a Ponzi scheme. Investors should avoid it, use regulated platforms, and verify claims with tools like CoinGecko. Always conduct your own research (DYOR) and consult financial advisors to protect your funds in the volatile crypto market. For further comparison, check out our QbitAI Review.

Disclaimer: This analysis, based on data as of September 4, 2025, is for informational purposes only. Cryptocurrency investments carry high risks. Verify all information independently and never invest more than you can afford to lose.

RapidBitex Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 RapidBitex currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with RapidBitex similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New archive

- New archive

Frequently Asked Questions About RapidBitex Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

RapidBitex raises red flags regarding ownership transparency and unsustainable ROI claims. Investors should exercise caution.

Risks include high promised returns, unclear management, limited regulatory oversight, and potential security vulnerabilities.

Compared to established exchanges, RapidBitex lacks verified credibility, strong security measures, and transparent user reviews.

Investing carries significant risk. Verify claims, start with minimal amounts, and always perform your own research (DYOR).

Information on support channels is limited, and responses from users suggest delays or unresponsiveness.

Other Infromation:

Website: rapidbitex.com

Reviews:

There are no reviews yet. Be the first one to write one.