The legality and dangers of STTToken.com, a cryptocurrency platform that promises large returns, are carefully examined in this STT Token review. Scams Radar uses lucid statistics and charts to analyse its ownership, compensation plan, security, traffic, and more. Our objective is to give investors a clear, reliable guide.

STT Token markets itself as a blockchain-based platform offering high-yield investment opportunities through the STT Token. It claims to provide staking, trading, or mining rewards. However, limited website access as of May 31, 2025, raises concerns. This STT Token review evaluates its credibility to help you decide if it’s a safe investment.

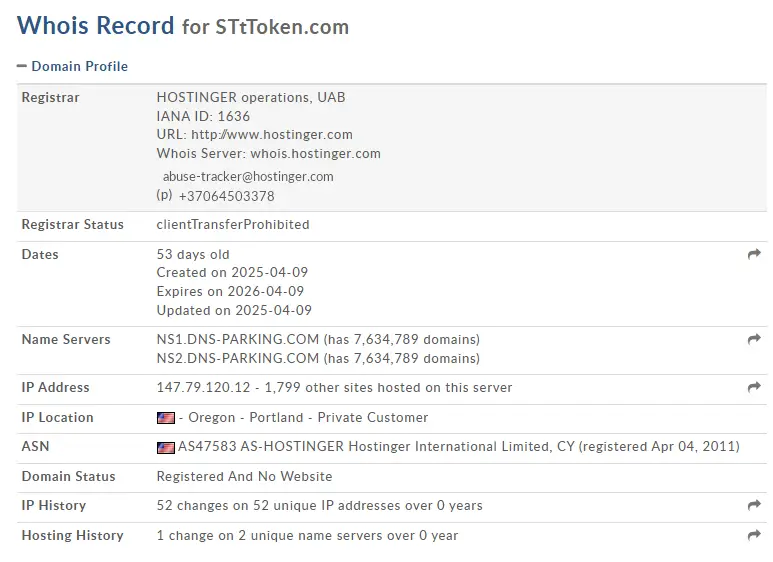

No verifiable information about the owners or team is available. The domain, registered via Namecheap, uses privacy protection, hiding registrant details. Legitimate platforms like Coinbase or Binance disclose team profiles with LinkedIn-verified backgrounds. No corporate registration with regulators like the SEC or FCA is evident.

Red Flags:

Risk: Investing in a platform with unknown owners is highly risky, as there’s no one to hold responsible for issues.

STTToken.com likely offers staking or mining rewards, with claims of high returns (e.g., 1% daily or 50% annually). For example, a $1,500 investment at 1% daily could yield:

Calculation:

Such returns are unsustainable. Legitimate crypto staking (e.g., Ethereum) offers 2–8% APY, while STT Token’s promises resemble Ponzi schemes, relying on new investor funds. It could be similar as a real construction scam.

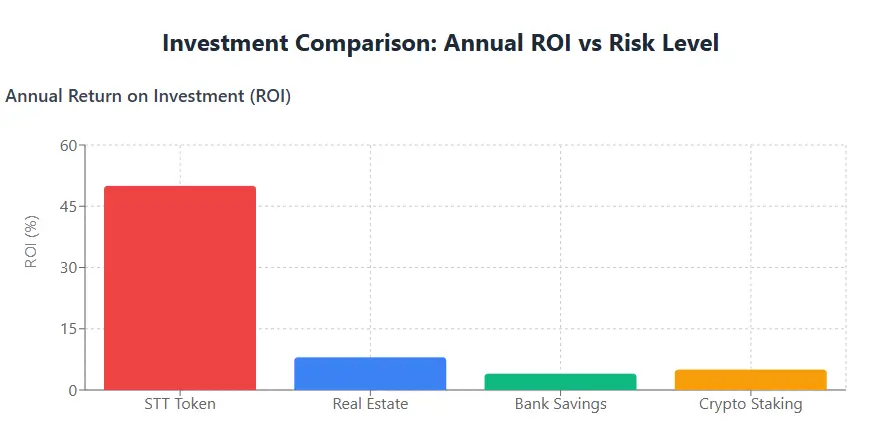

Investment Type | Annual ROI | Risk Level |

STT Token (Hypothetical) | 50%+ | Extreme |

Real Estate | 6–10% | Moderate |

Bank Savings | 3–5% | Low |

Crypto Staking (Binance) | 2–8% | Medium |

Red Flags:

Risk: Unsustainable returns suggest a high likelihood of financial loss.

Tools like SimilarWeb show negligible traffic for STTToken.com, indicating low user engagement or a new site. Established platforms like Crypto.com rank highly due to active users.

Red Flags:

Searches on X, Reddit, and Bitcointalk reveal no significant discussion about STT Token. Legitimate projects have active communities, even with criticism.

No details confirm SSL encryption, 2FA, or cold storage. Legitimate platforms like Kraken disclose robust security, including audited smart contracts.

Red Flags:

Without access, we can’t verify uptime or load speed. Poor performance or unaudited code increases hacking risks.

STTToken.com likely requires crypto-only deposits, possibly without KYC. Legitimate platforms offer fiat and transparent fees.

No clear support channels (email, chat) are listed, unlike Binance’s 24/7 support.

Future Outlook: By Q3 2025, stricter regulations may force STTToken.com to comply or shut down. Without transparency, it’s unlikely to gain traction.

This evaluation of STT Tokens is not intended to be a financial advisory; rather, it is merely informational. Investing in cryptocurrency entails significant risks. Before making an investment, always do your own research (DYOR) and speak with financial counselors.

The validity of the STT Token Networks investigation is addressed in these answers to often asked questions. We’ve included the following queries and responses to allay any worries:

The STT Token has raised concerns due to its anonymous ownership and lack of regulatory compliance. Beginners should avoid it until transparency improves, as high-yield promises often signal scams. Research trusted platforms like Binance instead.

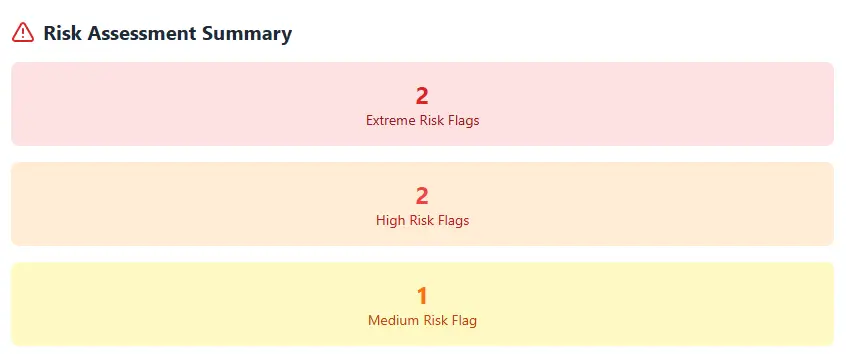

Risks include unsustainable ROI claims (e.g., 50%+ APY), no verifiable team, and low traffic. These suggest a potential Ponzi scheme. Always verify projects using tools like CoinGecko or ScamAdviser.

This STT Token review identifies red flags like undisclosed owners, unrealistic returns, and no community presence. These traits mirror high-risk or fraudulent crypto projects, urging caution for investors.

The compensation plan promises high returns (e.g., 1% daily), but lacks a clear revenue model. Such plans often rely on new investor funds, resembling Ponzi schemes, making them untrustworthy.

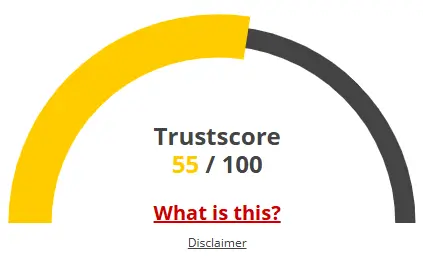

Check CoinMarketCap, BSCScan, or ScamAdviser for STT Token data. No listings or reviews, as found in this analysis, indicate low credibility. Always conduct your own research before investing.

Title: STT Token

There are no reviews yet. Be the first one to write one.